Sports Betting Analysts: Can Barstool Sportsbook Deliver?

The launch of the Barstool Sports betting app didn’t disappoint. Based on the early metrics, the app seems to have lived up to the hype during its debut.

But Barstool is Barstool, which means the reactions have ranged from criticism to cheerleading to the ever-present schadenfreude that accompanies the brand. Some people are trumpeting the numbers; others are finding flaws. In some cases, it’s simply a bias towards the brand.

But for some, it’s just a truthful, “I don’t know,” as traditional gambling analysts are still struggling to wrap their heads around what exactly they’re seeing from the newest entry into the US online sports betting market. The truth is, we’re all seeing something that we’ve never seen before and aren’t sure how to react to it or what it means.

There’s Only One Barstool, and That’s OK

In the 1980s, Steve Wynn began a process that would eventually flip Las Vegas on its head – a focus on entertainment and amenities over gambling. To many, it seemed like a hair-brained idea, and with no model to point to, analysts were essentially playing a guessing game. In much the same way, the ushering in of resort fees, paid parking, and gambling with high house edges confounded industry stalwarts.

I chose this analogy for a specific reason. Not every Las Vegas casino uses this model, nor has it caught on in every casino market worldwide. It works where it works, and it only works if you’re committed to it. There are plenty of ways to operate a successful casino.

Similarly, if Barstool succeeds, other sportsbooks shouldn’t necessarily try to follow suit. Sky Bet’s model worked, but imitators have primarily fallen flat. That doesn’t mean these other companies aren’t successful. They’re just not successful in deploying Sky Bet’s model. There’s no shame in that.

I suspect the same thing will happen with Barstool. Assuming the company’s approach works, others will try to copy it, but without the lived experiences, it won’t be as authentic.

Right now, it feels like everyone is trying to fit Barstool into a traditional sports betting box, and looking at the company through the lens of, “this isn’t how the current crop of successful sportsbooks have done things,” without considering that it isn’t a bug; it’s a feature.

Barstool’s Reach Extends Beyond “Stoolies”

In terms of the company’s reach, Matt Primeaux brought up an excellent point on Twitter:

My only critique of Matt’s categories would be to add a fourth.

Essentially, there are Stoolies, sports enthusiasts that consume some Barstool content, people who see Barstool content in their timeline, and people who aren’t into sports and are mostly unaware of Barstool.

The first group is described as Barstool’s bread and butter. Barstool is already reaching the second group to some extent. And the last group is low value.

It’s the third group that is the most interesting. I don’t think most people understand how broad that third category is, or the extent of Barstool’s social media presence and the glut of content it produces.

As I noted recently, the two big draws at Barstool are Dan “Big Cat” Katz and Dave Portnoy. They possess 1.1 and 1.8 million Twitter followers, respectively.

Barstool’s Twitter follower count stands at 2.5 million. On Facebook the site has 3.9 million likes. On Instagram its follower count is 8.8 million. Then, there are the individual personalities who specialize in baseball, golf, college football, hockey, poker, esports, and everything in between.

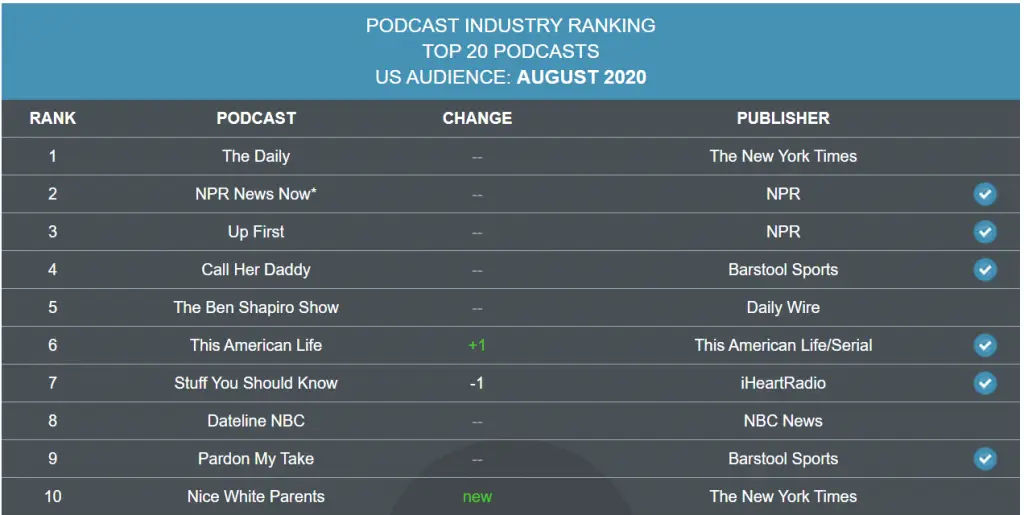

Two of its podcasts were in the Top 10 in August, alongside the New York Times and NPR. Think about that for a second, Barstool’s top podcasts have the same reach as Ben Shapiro or Dateline NBC.

The breadth of content they produce is quite extraordinary. I have Facebook friends that aren’t into sports that share Portnoy’s pizza reviews, clips from the Chicks in the Office and Call Her Daddy podcasts, and the Donnie Does travel series. Barstool has its own Sirius XM channel and a social media team that puts out unique, Barstool-branded content that tends to go viral.

To Matt’s point, Barstool can certainly activate stoolies, has access to sports enthusiasts that already consume some Barstool content, and has a pipeline to non-sports bettors through its lifestyle content and social media reach.

The big question is, can Barstool leverage its reach and social media presence and turn that third segment that Matt refers to as “impressions” into sports bettors?

As Chris Grove asked, does Barstool have growth potential beyond the early adopters, AKA Stoolies?