How Big Can US Esports Betting Get? Would You Believe $6B

There was a palpable level of excitement when a fund from ETF provider ARK made its debut investment in betting and gaming last week via a small-ish slug of DraftKings stock. The news helped send the DraftKings share price up 9% on Tuesday.

The investment had been well trailed. In January, a note issued by ARK had signaled its interest in the “burgeoning” sports-betting market.

Illustrating the potential, ARK published a chart showing that traditional sports betting in the US could be worth up to $18bn by 2025. That number is in itself, at the top end of most estimates. It also showed that fantasy sports would be worth $13bn, which may help explain the recent M&A in that space.

But alongside these two bullish calls, there was also an estimate for esports betting that suggested it might be worth up to $6bn by 2025.

There’s Always a But…

Even in the hyped-up world of sports-betting right now, that is a big number. “The figure seems high and indicates a higher wager volume than other reports projected for the global esports handle,” suggests Moritz Maurer, founder and chief executive at GRID Esports in Berlin.

For some comparison of what that figure represents, we can look at what we know of esports-betting performance in the UK.

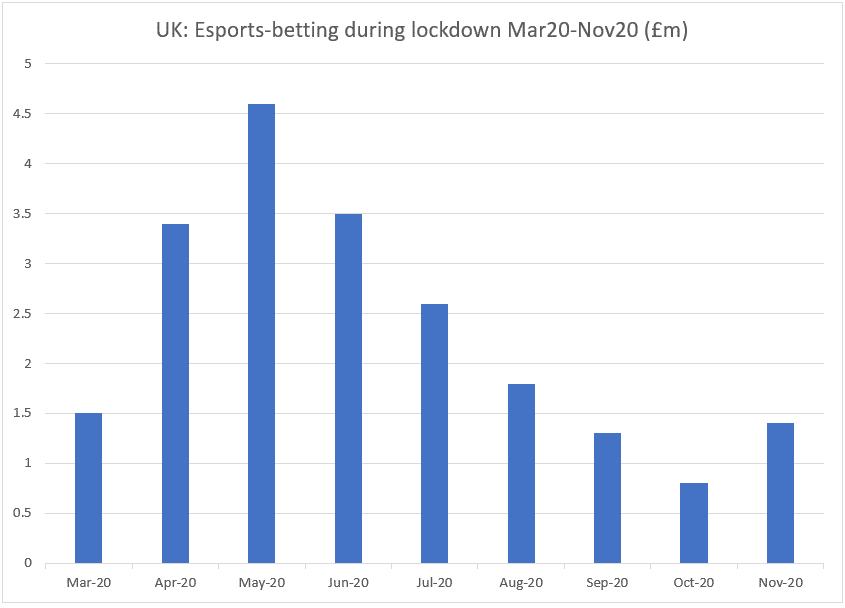

Worried about the possibility of an explosion of potentially harmful online gaming activity during the lockdown, the UK Gambling Commission began publishing month-by-month data from operators representing 80% of the UK market in March 2020.

Usefully, this data broke the market down by product type, including both traditional sports-betting and esports-betting. As this graph shows, the latter activity went through something of a (small) rollercoaster as interest in esports waxed and waned during and after the first UK national lockdown.

Even accepting the qualification that this is only 80% of the market, it would be fair to say that annualized gross gaming yield (GGY) revenues of circa £27m for 2020 are still small in UK terms. By way of reference, traditional sports-betting in the months from that same 80% of the total market between March and November was £1.6bn in GGY and would have been well over £2bn for the year despite the sporting year having been so heavily disrupted.

The High Line

No wonder there is some skepticism over the $6bn in revenue for the US by 2025. Steven Salz, founder and CEO of endemic esports betting operator Rivalry, suggests the $6bn figure for the US in just four years sounds “extremely bullish and unrealistic.”

“I do think from a year-on-year growth perspective, esports betting will shortly begin to exceed all other sports, as it does in other markets internationally,” he adds. “But to think logically for a second, $6B in revenue at, say, a market 7.5% VIG would imply $8obn in turnover in the US alone.”

And yet. Marco Blume, trading director for Pinnacle, a leader among traditional bookmakers in esports betting, says of the $6bn estimate: “It’s high for sure but not out of the realm of possibilities.”

As Salz suggests, at present, estimates for global regulated esports-betting turnover hover around the $5bn mark. Using a rule of thumb and doubling that figure to $10bn and if compound annual growth hit 50%, then that $80bn level could be hit by 2025. But that would be a global figure, not just the US, and would include all the grey markets.

A huge factor in what level of revenue esports-betting might reach comes down to regulation and whether esports is even included in future sports-betting laws and regulations. Maurer says that should esports be included within licensing frameworks, then the potential “relative to traditional sports is certainly there.”

“Esports betting is growing massively in other regulated territories, and the demographic dynamics understandably add to the confidence level of the market in the continued, steep growth trajectory of the space,” he suggests.

Salz, unsurprisingly, agrees on the potential, even if the specific target figures might be on the optimistic side. “To think the US alone could do a number equal to that or greater seems like a stretch,” said Salz. “We are super bullish, of course, and I think the growth rate will stun people, but total dollars wagered to get to $6B in revenue in the US alone feels closer to 2030 than 2025.”

Scott Longley has been a journalist since the early noughties covering personal finance, sport and the gambling industry. He has worked for a number of publications including Investor’s Week, Bloomberg Money, Football First, EGR and GamblingCompliance.com. He now writes for online and print titles across a wide range of sectors.