Analyzing The Flutter-TSG Merger

The merger of The Stars Group and Flutter, two of the largest online gambling sites in the world, sent shockwaves throughout the industry last week. The following is the first in a three-part series exploring different aspects of the deal.

The size and scope of the merger are hard to ignore and not surprisingly, making headlines inside and outside the gambling industry. But what does the deal mean for the two companies and the industry writ large? That’s harder to quantify.

Here is our big-picture analysis of the TSG-Flutter deal, as well as how it will impact the sports betting and online gambling spaces.

Consolidation on Steroids

The mega-merger (provided it’s approved) creates the largest online gaming company in the world. But that’s been said several times over the past few years. The TSG-Flutter merger is just the latest trump card played in the game of consolidation the industry is currently playing.

In fact, neither company has finished crossing the t’s and dotting the i’s of their last blockbuster merger, and here they are, about to merge.

In 2015, it was a $5 billion deal that brought Paddy Power and Betfair together to form what would later become known as Flutter, after the company picked up FanDuel in May 2018.

In April 2018, The Stars Group and Sky Gaming merged in what was, at the time, a similarly sized blockbuster $4.7 billion deal.

What’s driving the consolidation trend? A big factor is the continued regulation of online gambling across the globe. The regional legalization and regulation trend is increasing the cost of doing business, which plays into the hands of larger, multinational companies.

Bottom line: expect the consolidation train to keep rolling down the tracks, and don’t be surprised if these deals keep getting bigger in scale, including the merging of retail and online gambling companies.

Is the Sum Greater Than the Parts?

The big question for TSG and Flutter is whether the companies are better positioned as individual entities, a consolidated business, or a mixture of the two?

The case for redundant product options

In some markets, the Flutter and TSG brands are strong in one or more online gambling verticals (poker, sports betting, and casino).

Even though it amounts to competing against yourself, it needs to give serious consideration to operating redundant products in markets where strengths overlap. If not, the new company runs the risk of duplicate customers shifting to a competitor as a second or third option.

By maintaining multiple brands, TSG-Flutter could focus brands on specific market segments. One brand could advertise to recreational customers while another brand focuses on the more serious gambler.

The case for complete integration

Full integration will be a long, expensive process. However, it will eliminate redundancies (read as saving money) and streamline the overall corporate strategy.

However, that would greatly reduce cross-sell opportunities in multiple markets where one of the companies possess a strong poker brand but lags in other areas like casino or sports betting.

The case for a bit of both

The solution seems obvious, full integration in some markets and duplicate offerings in others.

Of course, that’s easier said than done.

Not only would the new company have to identify which markets require which approach, but it would also have to execute multiple, likely conflicting strategies.

As Eilers & Krejcik noted in its Flash Report on the merger, “Platform, technology and management integration will be a key risk factor for the combined entity… There is also the question of dual platforms in the US, with FanDuel believed to be working on its own solution alongside TSG.”

All Eyes on the US Market

The companies pointed to the US as a key market for future growth.

“The opening up of the US sports betting market is perhaps the most exciting development in the industry since the advent of online betting,” Flutter CEO Peter Jackson said on a conference call with analysts following the deal’s announcement.

And TSG-Flutter is well-positioned to be a major force in the US.

From FOX Bet to FanDuel, and from PokerStars to ADW horseracing at TVG, the new company will bring together some of the strongest online gambling brands in the nascent US market.

Perhaps more importantly, the merger provides unparalleled market access due to the myriad of deals the two companies have signed. That should be the key to unlocking the US market, at least over the next few years.

TSG Fills the One Hole in Flutter’s Resume

Speaking of PokerStars, online poker is Flutter’s weakness. The merger solves that problem in a major way, opening up cross-selling opportunities in markets across the globe.

As 888 Head of Commercial Development, Yaniv Sherman recently told Betting USA, poker and sports betting create proven cross-sell opportunities.

The combination of PokerStars and one of the dominant sports betting brands the company possesses (Sky Bet, Betfair, Paddy Power, and FanDuel) will give it a leg up on many competitors.

Next, we’ll examine the sports betting implications of the deal.

Flutter+TSG=Sports Betting Strength

Market Access

The US market is a misnomer. The US is actually a collection of smaller state markets, each with its own licensing and regulatory requirements. In most cases, legal sports betting runs through existing land-based casinos or gaming operators.

What does that mean? In most states, online gaming companies will be shut out of the market unless they enter into partnership agreements with land-based operators.

The more markets a company has access to, the more opportunities it will have in the US. The combination of Flutter and TSG already has deals in place that provide market access to some two dozen states.

A number of those states are already live or soon will be, including:

- New York Sports Betting

- New Jersey Sports Betting

- Pennsylvania Sports Betting

- Indiana Sports Betting

- Iowa Sports Betting

- Mississippi Sports Betting

- Illinois Sports Betting

Flutter-TSG also has access to highly prized states that are prime candidates to legalize sports betting, including:

The Benefit of Having Multiple Strong Sports Betting Brands

The legal market is barely a year old (not counting Nevada), but US sports betting operators have quickly learned it’s hard to please everyone. Go after the big bettors and sharps and risk alienating casual bettors. Focus on the casual bettor, and you run the risk of losing the sharps. At the end of the day, no single site is going to corner the US market.

But what if a company, like the combined Flutter-TSG, possesses more than one site?

That gives them multiple options. Like Landry’s Inc., which owns multiple restaurant chains, you could offer a fine-dining choice like Morton’s and a more casual dining option like Rainforest Café.

For Flutter-TSG, FOX Bet could be a casual-bettor-friendly option, while FanDuel caters to experienced bettors.

That could be a huge advantage in the nascent US market. Unlike the more mature legal markets around the globe, the US customer base is largely untapped. The ability to offer seasoned sports bettors and newbies well-known (FOX Bet and FanDuel) but differentiated brands is an asset exclusive to Flutter-TSG.

With modern tech, the company can easily identify when bettors begin to shift between the two categories, and it can change the way it markets to these players. It might mean a shift from FOX Bet to FanDuel, but it’s keeping that player from exploring other options.

Cross-Selling Is the Name of the Game

The FOX Bet, FanDuel, and other Flutter-TSG-associated brands will also benefit from cross-selling. Not only will they boast two of the best sports betting brands in the US market, but those brands will be attached to top online poker, horse racing (TVG), daily fantasy sports, and casino products.

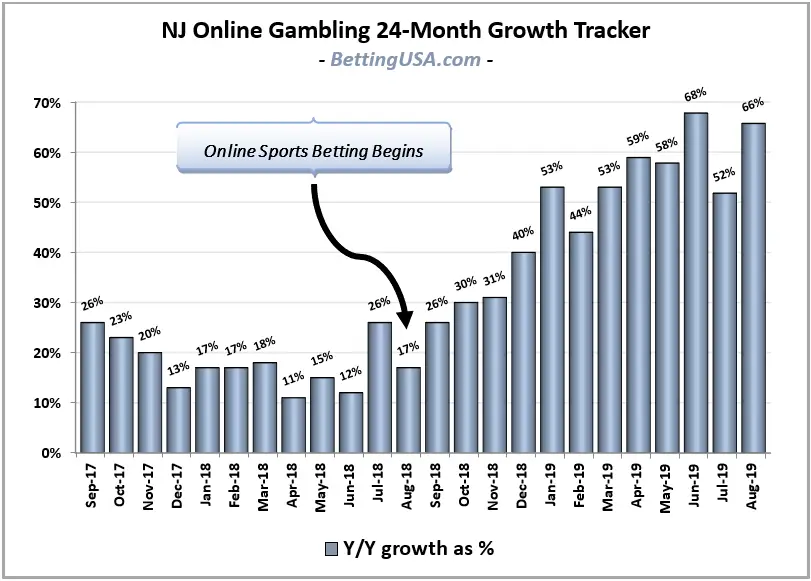

Whether it’s PokerStars, TVG, FanDuel, or Betfair, Flutter-TSG should be able to leverage cross-selling opportunities to and from sports betting. And if New Jersey is any indication, cross-selling is the difference between a solid product and a supercharged product.

Since the launch of online sports betting in the Garden State, the state’s five-year-old online casino industry has routinely seen year-over-year revenue growth of 50% or more.

Legalizing online sports betting or online casinos is nice, but a state won’t realize the full potential of either unless they are both available.

Bottom Line

The Flutter-TSG merger creates a company that will have every conceivable advantage in the US:

- Unparalleled market access

- Well-known brands it can leverage to different customers

- The ability to cross-sell to leading online poker and casino products

To sum it up, Flutter-TSG has set itself up for success in the US.

And finally, here’s how the deal will impact online casinos and poker sites.

Are Online Casino and Online Poker Flutter’s Secret Weapon?

The Official End of the Bad Actor Debate?

The merger places another layer between the current version of PokerStars and its pre-Black Friday roots. As such, the tie-up (should) eliminate any lingering suitability concerns regarding PokerStars.

That subject is already irrelevant in most states, but it’s still an impediment in select places. Post-merger, I can’t even imagine it gets brought up in California – but that state has proven me wrong many times.

Is a Flutter-TSG Online Casino Coming to a State Near You?

As detailed in Part 2 of this series, existing partnerships provide Flutter-TSG access to a number of US sports betting markets and, by extension, online poker and casino markets.

Both companies are already active in New Jersey, and TSG is expected to launch online casino and poker in Pennsylvania in the coming weeks.

TSG also has access to West Virginia thanks to its deal with Eldorado Resorts. West Virginia legalized online casino and poker in March, but the state isn’t expected to launch until 2020.

Online casinos and poker aren’t as widespread as sports betting, and in the near term, only a couple of states are candidates for expansion, and neither is a great candidate. The good news is the combined Flutter-TSG is ready to go in the two key locales.

Michigan Still a Candidate

Michigan is one of the leading candidates to legalize online casino and poker games, although online casino and poker have fallen out of favor this year.

That said, PokerStars has been one of the key figures pushing the debate forward in Michigan. The company hasn’t announced an official online casino or online poker partnership in the Wolverine State, but based on its level of activism, it’s hard to imagine an agreement isn’t already in place.

New York

Through a partnership with the Akwesasne Mohawk Casino Resort, PokerStars could bring its online poker platform to the Empire State. But before you get too excited, realize it’s contingent on the New York legislature getting its act together and passing the online poker legislation that’s been kicking around Albany for several years.

Planning for the Future

Michigan isn’t the only place where sports betting is overshadowing online poker and casinos. Even though it brings in more revenue than sports betting in New Jersey, online casinos and poker have been placed on the backburner across the country. Lawmakers have decided to use whatever political capital they have to pass sports betting legislation.

That said, if the frantic rate of sports betting legalization has taught us anything, it’s that market access, and already having pieces positioned on the chessboard goes a long way.

Because of the pace of legalization, sports betting operators and suppliers were quick to partner with licensees at almost any cost. Fear of being shut out or left behind in the US market has led to plenty of ill-conceived deals that companies would almost certainly like to roll back in hindsight – I won’t single any out here.

It’s too late for sports betting, but it’s not too late for online casinos and poker. Flutter-TSG is in an excellent position to start preparing for a future US online gambling space that includes sports betting, poker, and casino games.

Let’s Talk a Little More About Cross-Selling

I touched on the cross-sell opportunities the new company brings to the table in Part 2, but those opportunities are turbo-charged in a combined Flutter-TSG company. There are a couple of reasons why.

First, premier products across the spectrum will likely lead to stronger lobbying campaigns for comprehensive online gambling bills, and not just sports betting.

Second, the larger the company gets (and the more deals it has in place with land-based operators), the more clout it will have in statehouses.

It’s easy to envision the company, alongside its land-based partners, extolling the revenue benefits of cross-selling and the need for consumer protection across all online gambling products in state capitols.

Bottom Line

As it is with sports betting, Flutter-TSG is well-positioned to be a preeminent online casino and poker provider in the US.

Furthermore, the larger the company gets, and as it aligns with more land-based interests, there will be less bickering over specifics in online gambling bills. And that could speed up online poker and casino efforts in several states.