Sports Betting Market Matchup: Pennsylvania Vs New Jersey

Success is an ambiguous term, and nowhere is that more evident than in the context of sports betting. This column attempts to better define success in the US sports betting industry, which, as you’ll soon see, is easier said than done, as success is in the eyes of the beholder.

I recently had the privilege to moderate a panel on sports betting in the US at the National Council of Problem Gambling’s 34th annual conference. During the discussion, Spectrum Gaming Group’s Joe Weinert brought up an important but often overlooked point: Success in the US market is dependent on the point of view.

As Weinert explained, it’s difficult to grade different models in place in the US. Operators and the industry are looking at metrics like handle and gross gaming revenue, but states are focused on tax revenue.

I suspect the conflict between these two points of view will grow as:

- More states, including some of the most heavily populated, consider passing sports betting legislation.

- Additional evidence of the efficacy of the different models becomes available as markets mature.

The State vs. The Sports Betting Industry

At the macro level, the industry would point to New Jersey as its success case, but states would point to Pennsylvania.

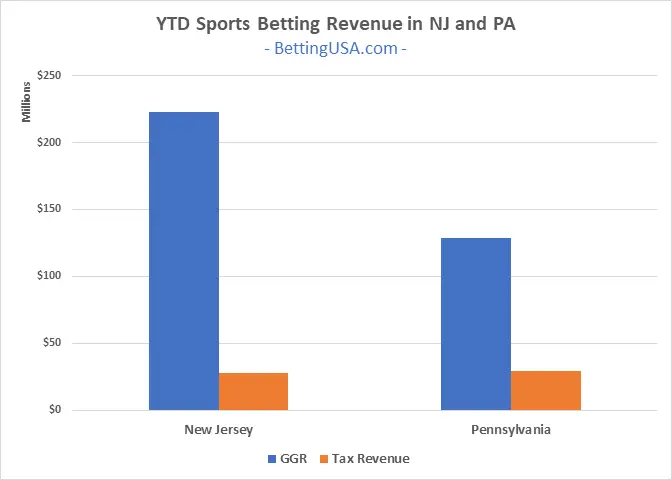

As the chart below shows, New Jersey is on track to produce twice as much GGR as Pennsylvania, yet the two industries send a similar amount of tax revenue to the state. Not to mention the $100 million Pennsylvania has collected in upfront licensing fees compared to less than $1 million in New Jersey.

And bear in mind, the two industries are in different stages of development – The Pennsylvania online sports betting industry launched in May 2019, while New Jersey mobile sports betting apps went live in August 2018.

The critical difference between the two states is tax rates. New Jersey taxes retail sports betting revenue at 8.5% and online sports betting revenue at 13%. Pennsylvania levies a 36% tax on sports betting. Throw in the $10 million licensing fees, and it’s easy to see why Pennsylvania is the superior model for states. However, there’s a third component to consider.

What About Sports Bettors?

The third group that will come into play is the consumer. While states are primarily interested in tax revenue, they have to balance that against the burdens they impose on operators carefully. The reason being, those burdens will get passed on to the consumer.

A consumer-unfriendly market will keep some bettors in offshore markets. In other instances, it will merely dissuade people from betting in the first place. And other bettors will be left with a bad taste in their mouth, which could send them to offshore sites or cause them to revert to non-bettors.

The bettor’s perspective is a thumb on the scale for the industry, as the bettor’s perspective closely aligns with the operators – fewer burdens on the operator tends to lead to a more consumer-friendly industry.

Finding the Sweet Spot

It will be interesting to see if the US can settle on a sweet spot that provides significant revenue to the state without overburdening operators to the point they have to punish their customers.

And these debates will be consequential. Big states like California, Texas, Florida, Ohio, and New York (mobile) are still non-sports betting states. The 120 million population in those five states represent a third of the US population.

The question is, where is the sweet spot? My guess is it’s much closer to Pennsylvania than New Jersey. That said, operators may begin to look at the US differently if entry barriers are set that high.

My opinion: States should maximize the upfront licensing fee (an opportunity a number of states have missed) while reducing the ongoing tax burden, thereby diminishing the state’s rooting interest in the industry’s success.