Have Sports Bettors Shifted To Stocks During Shutdowns?

A prominent talking point during the current Covid-19 crisis is how DraftKings – a company that is all about sports – has made such a success out of a flotation which came when there was almost no sport available.

Originally valued at $3.3bn when it merged with SBTech at the tail end of last year, the company’s shares rose 10% on the day of listing to leave the company valued at over $6bn and they have been on a tear ever since.

Now worth nearly $40 a share, DraftKings has a market cap of around $12bn, which is some valuation for a company that recorded earnings of $111m in the first quarter, and a loss of nearly $76m.

This miraculous success story has left the analysts – and many insiders in the global betting and gaming sector – looking for answers to the question: Why the DraftKings float has been met with such evident enthusiasm?

This leads us back to the issue of the lack of sport.

Crisis, What Crisis?

While the global pandemic has wrought destruction of a previously unimagined scale upon huge swathes of the economy, some sectors have been doing very nicely.

The stock market has been on the very definition of a roller-coaster ride – and one where the suspicion remains that we have yet to come to the end – but stock trading sites such as E-Trade, TD Ameritrade, Charles Schwab and Interactive Brokers have enjoyed record new account sign-ups.

Even more impressive are the numbers from their zero-trading cost competitor Robinhood which in early May announced a liquidity event via a series F funding round that values the company at $8.3bn.

In a blog post announcing the news, Robinhood said it had added three million funded accounts since the turn of the year. Crucially, perhaps, the company said that half of these were “first-time investors.” Or should we say sports-bettors?

Coincidence of Timing

Various articles and blogs have made the connection between the boom in day-trading and the lack of anything in the way of sports-betting opportunities apart from Belarusian soccer and Swedish table tennis.

Look no further than Barstool Sports – whose founder Dave Portnoy has said that “for a gambler, investing has a ton of similarities” – shift in focus from sports picks to stock picks, with Portnoy adopting the moniker “Davey Day Trader.”

“It tells a nice story,” says Will Hershey from Roundhill Investments which itself has capitalized on the enthusiasm for US sports-betting among investors by launching BETZ, a sports betting and gaming ETF. “Sports-bettors based by their nature are looking for something to speculate on.”

If this is true, then these internet-wandering gamblers appear to have found their métier with mobile phone-based stock trading.

A website that tracks stocks popular among Robinhood traders called Robintrack shows the extent to which the userbase has been betting on a stock market recovery among some of the most bombed-out stocks.

Among the top 20 most popular stocks as of earlier this week are such high-profile casualties of the crisis as airline stocks American Airlines and Delta and United, cruise lines Carnival Cruises and Norwegian Cruise Line, and Disney. Further down the list lies Hertz which, as of last Tuesday, has filed for Chapter 11 bankruptcy but which, according to Robintrack, has over 150,000 users holding the stock.

Robinhood’s users clearly like a punt.

Crazy Times, Crazy Prices

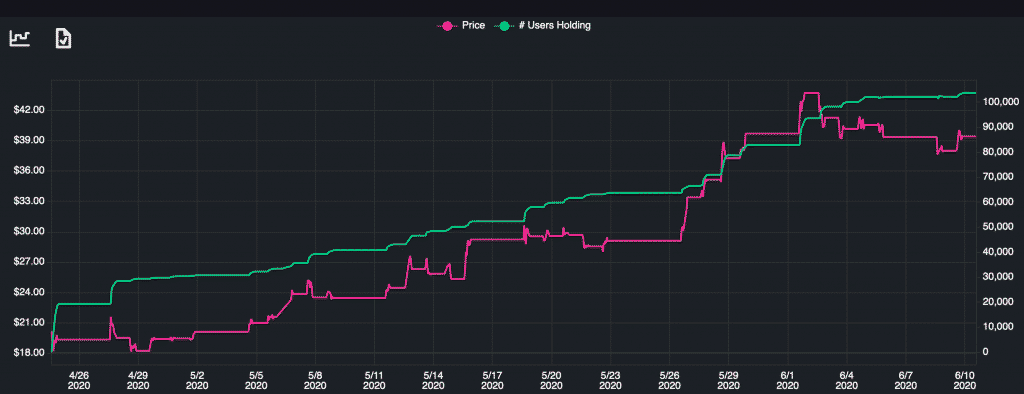

And then slightly further down the leaderboard at 67 as of earlier this week sits DraftKings. According to the data, over 100,000 Robinhood users hold the stock and while we cannot know the number of shares represented by these users, that still represents a substantial retail interest.

Chart: Robinhood users holding DraftKings vs share price performance

“Can 100,000 investors move a share price? Absolutely, yes they can,” says Peter Sleep, senior investment manager at London-based wealth management group 7IM

“It’s weight of money after all. Maybe 20% of the US equity market is retail investors and if they move together, yes it can have that effect.”

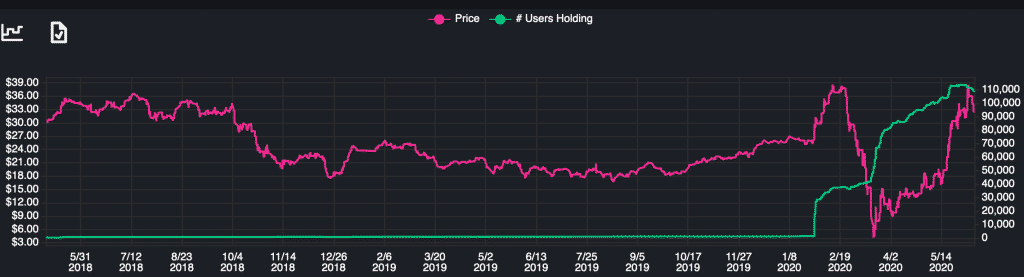

As for DraftKings, so with Penn National, home now to Portnoy’s Barstool. Penn is more popular among Robinhood users than DraftKings with fully 110,000 of them holding stock.

Indeed, with Penn it is not hard to trace the interest of the Robinhood users to Portnoy’s famous clarion call to buy Penn stock in January after Barstool was bought out.

Chart: Penn National users holding DraftKings vs share price performance

Feeding Frenzy

“This is reminiscent of the crypto frenzy and the dotcom boom,” says Peter Sleep, senior investment manager at London-based wealth management group 7IM.

“This sort of thing is not uncommon. People talk about things on message boards and they wade in. It is very much like favorite backers in sport except that the momentum can work in your favor – provided you are not the last one in.”

Here lies the rub.

Both DraftKings and Robinhood have reasons for hoping the symbiotic thread recently strung between the two will continue once the lockdown is lifted and big-time sport returns.

The latter because it wants to keep adding accounts, not see them disappear once big-time sports betting returns. But for DraftKings also, while they will surely welcome back their audience with open arms, the company will also be hoping they don’t cash in their profits from their recent share-buying.

Check out our list of sports betting stocks to consider purchasing.

Scott Longley has been a journalist since the early noughties covering personal finance, sport and the gambling industry. He has worked for a number of publications including Investor’s Week, Bloomberg Money, Football First, EGR and GamblingCompliance.com. He now writes for online and print titles across a wide range of sectors.