PredictIt Review And Promo Code

PredictIt is a legal US political exchange betting site that allows you to put your money where your mouth is when it comes to politics. Are you a policy wonk or do you think you have a knack for predicting the outcomes of upcoming elections? If so, PredictIt is where you can go to test your knowledge and win money when your predictions come true.

Read our PredictIt review to learn how the popular prediction site works, including where and how it’s legal.

- Only legal political betting site in the US

- Make money with your political predictions

Update: PredictIt Ceasing Operations: In August 2022, PredictIt announced it would be ceasing operations beginning February 15th, 2023 because the Commodity Futures Trading Commission (CFTC) had withdrawn its no-action letter that allowed PredictIt to offer wagering contracts on political events. BettingUSA will leave this review up for posterity, but it will no longer provide updates unless PredictIt manages to return to the US.

Pros

Only legal political betting site in the USMake money with your political predictionsCons

No welcome bonuses or promotions10% fee applied to winning trades5% fee applied to withdrawalsPredictIt Promo Code And Bonuses

PredictIt does not currently offer any welcome bonuses to new customers.

A search on Google for PredictIt promo codes returns many websites claiming to list coupon codes, but none of them work. In fact, there isn’t even anywhere to insert a promo code when registering or depositing.

It is unlikely PredictIt will begin offering bonuses or other promotions anytime soon. PredictIt is a research project, not a commercial operator. As a result, it does not compete with traditional sports betting sites for new users and lacks a significant marketing budget.

Bettors interested in high value sports betting bonuses must look elsewhere. However, keep in mind that commercial sports betting sites do not offer political betting.

PredictIt Basics

We’ll cover the nuts on bolts of how it works shortly, but the overarching idea behind PredictIt is to buy and sell binary options in an attempt to predict the outcomes of political events such as presidential and gubernatorial elections, the next speaker of the house, whether or not someone will face criminal charges related to a scandal and so on.

The values of these contracts rise and fall in line with market expectations in such a way that prices have at times proven more accurate than polls when it comes to predicting the future. It turns out money is a real motivator when it comes to shaking off bias and making cold, emotionless predictions.

Victoria University of Wellington launched PredictIt in 2014 after receiving a no-action letter from the US Commodity Futures Trading Commission (CFTC). Essentially, the CFTC granted its blessing of approval for PredictIt to operate “for academic research purposes only” rather than as a commercial enterprise.

That PredictIt is allowed to operate at all in the United States is a win for political betting fans, but its academic nature leads to some limitations that limit the full the site’s full potential.

For one, PredictIt limits all traders to a maximum investment of $850 into any single position. No matter how confident you may be in an outcome, the most you can throw down onto any one prediction is $850.

PredictIt also enforces an upper limit of 5,000 traders in any particular market, which can cause liquidity problems if a large number of traders buy into a prediction market and then just sit on those positions without trading. Even so, PredictIt does manage to generate significant volume. The Futures Industry Association, for example, reported that trading volume touched 13.7 million on the day of the 2016 US election.

The CFTC also requires PredictIt to “prominently disclose that the proposed market is unregulated, experimental, and being operated for academic purposes.” In other words, PredictIt is not a highly regulated betting site and buyers should beware.

Caveats aside, PredictIt is an interesting betting site that has so far proven safe and well-run. New markets are added frequently, and trading volume is usually more than sufficient for the major markets – especially those dealing with national politics.

How PredictIt It Works

To put it simply, PredictIt allows customers to trade “yes” and “no” shares on the outcomes of future political events at prices ranging from $0.01 to $0.99 per share. If the outcome takes place, the yes shares are redeemed for $1 and the no shares expire worthless. If the predicted outcome does not take place, the no shares are redeemed for $1 and the yes shares expire worthless.

For example, consider a basic Presidential election market in which the question being asked is whether or not the Republican nominee will win. Anyone who likes the Republican’s chances will buy yes shares on that outcome in anticipation of redeeming those shares at $1.00 a piece later. Anyone who think the Republican is likely to lose the election would buy no shares in anticipation of redeeming those for $1.00 a piece later.

Prevailing market sentiment pushes and pulls prices between $0.01 and $0.99 while the market is still live. For example, if sentiment turns against the Republican candidate, prices of yes shares will drop as people try to sell off those shares. Meanwhile, “no” share prices would rise as people buy into those hoping to cash in on them when the Republican loses the election.

You can buy and sell shares at any time or hold them to expiration if you’re confident your predicted outcome will come true. Thus, you can buy a bunch of no shares for, say, $0.30 each and later sell them at $0.55 to exit the position and lock in a profit. Likewise, you can sell off your shares if the market moves against you to cut your losses – as long as someone else is willing to buy the shares you’re selling.

Buying and Selling PredictIt Shares

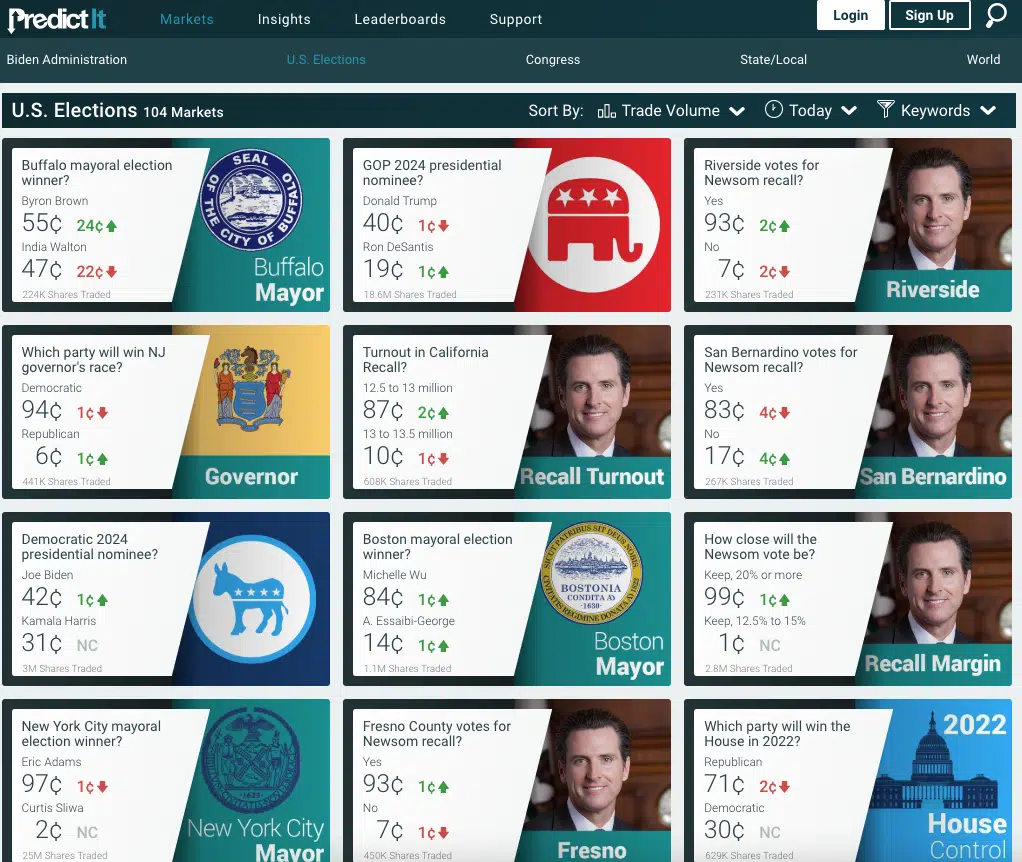

Buying and selling shares on PredictIt will be familiar to anyone with experience in financial markets or binary options. You can buy shares by first selecting the prediction market you want from a page that looks like this:

Select the market you want to move on to the next page, which is where you’ll buy and sell shares for each market. This page shows trading volume and current prices for yes and no shares for each prediction.

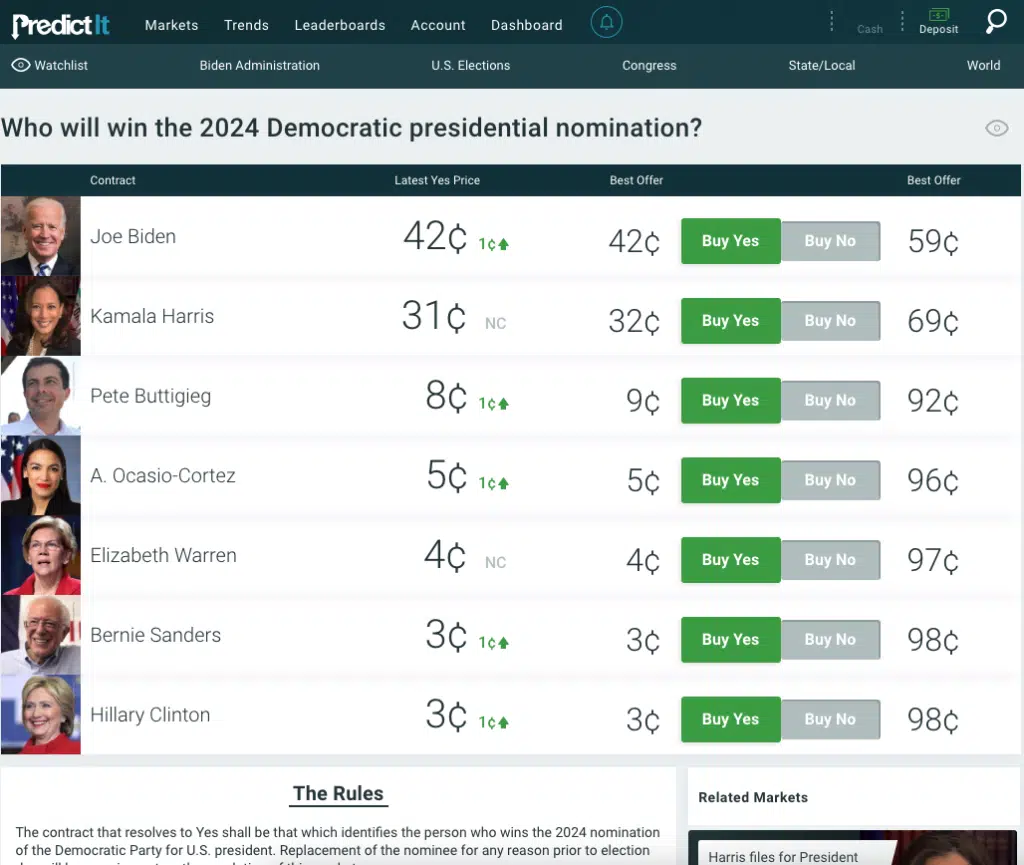

The following screenshot shows the current prices for shares on who will win the 2024 Democratic presidential nomination. Joe Biden and Kamala Harris lead the pack, as indicated by their prices. The higher the price, the likelier the outcome – at least according to prevailing market prices.

As a result, someone who buys Biden or Harris shares stands to win less than someone who buys shares in long shot candidates because the winning position will mature at $1.00. Market participants can get into positions on long shot candidates at much lower prices to earn more if they are correct, but their odds of winning are also lower.

Additionally, traders can buy positions FOR or AGAINST each candidate. Above, note that the current price on Joe Biden winning the 2024 nomination is $0.42 per share. Traders can also buy shares AGAINST Biden winning at $0.59 per share.

The process of buying and selling shares is where strategy comes into play. Something to keep in mind is that you don’t necessarily have to be 100% confident in your prediction coming true – you can instead look at shares as undervalued or overvalued.

For example, let’s say you estimate Joe Biden has a 50-50 shot of being the 2024 Democratic nominee. Even though you’re undecided in your actual prediction, you could confidently buy YES shares on Joe Biden because they are underpriced at just $0.42, which roughly equates to the market giving him a 42% chance.

Those familiar with the nature of political media can also buy shares with the intention of making a quick hit-and-run move. If you suspect the news cycle will run a scandalous story on one candidate or another, you can buy NO shares on that candidate and then sell when the news hits and gives NO shares a bump.

Expert Opinion: Is PredictIt Legit?

PredictIt would earn a glowing review if it wasn’t for the high cost of business imposed on traders. All winning trades, whether you sell early for a profit or hold a position until it expires at $1, are assessed a 10% fee on net profit. Additionally, withdrawals are assessed a 5% fee on the amount of withdrawal.

These two fees, combined with the occasional widespread in illiquid prediction markets, add up to a significant cost that’s hard to beat. Just to break even on an individual trade will require you to close your position for more than a 10% profit – and that’s before taking into account the 5% withdrawal fee.

PredictIt is a fun way to test your political wit and possibly earn good money at times, but the limited positions sizes, limited liquidity, and high fees make it difficult to consider this a serious trading platform.