Prediction markets let you trade on the outcomes of real-world events in a vast range of categories, ranging from sports and elections to weather and economic indicators.

In short, you buy and sell “yes” or “no” contracts on questions like “Will the Cowboys win on Sunday” and “Will Candidate X win the next US Presidential Election.”

Critically, prediction markets are regulated by the Commodity Futures Trading Commission (CFTC) as financial services and are available nationwide.

Quick Start Guide: The Basics

Where to Trade

Several CFTC-registered prediction markets operate in the US:

-Kalshi

-Crypto.com

-Polymarket

-PredictIt

-Robinhood

How It Works

-Market asks a question:

-“Will X happen by next month?”

-You buy Yes or No contracts

-Each pays $1 if correct, $0 if not.

-Example: You buy Yes at 62¢ and receive $1 if correct (profit: 38¢ per contract)

Is It Legal?

Yes. Major prediction markets operate in all 50 states

-Regulated by the CFTC

-Some states have challenged legality of sports and election-related questions

-Learn more below

Major Prediction Market Apps

Play $5 Get $75 In Fantasy EntriesUnderdog Predict Promo Code: BETUSA

Prediction Event Contracts is a derivatives product offered by Crypto.com | Derivatives North America (CDNA), an exchange regulated by the Commodity Futures Trading Commission (CFTC). Trading CDNA Prediction Event Contracts involves risk and may not be appropriate for all. By trading you risk losing your cost to enter any transaction, including fees. You should carefully consider whether trading on CDNA is appropriate for you in light of your investment experience and financial resources. Any trading decisions you make are solely your responsibility and at your own risk.

Play $5 Get $75 In Fantasy EntriesUnderdog Predict Promo Code: BETUSA

Prediction Event Contracts is a derivatives product offered by Crypto.com | Derivatives North America (CDNA), an exchange regulated by the Commodity Futures Trading Commission (CFTC). Trading CDNA Prediction Event Contracts involves risk and may not be appropriate for all. By trading you risk losing your cost to enter any transaction, including fees. You should carefully consider whether trading on CDNA is appropriate for you in light of your investment experience and financial resources. Any trading decisions you make are solely your responsibility and at your own risk.

Several prominent prediction market apps operate in the United States today and are regulated by the Commodity Futures Trading Commission (CFTC). Each has a distinct focus, fee structure, deposit methods, and caters to different types of traders.

Kalshi

- Legal Status: CFTC Designated Contract Market (DCM)

- Best For: Hedging and vast market diversity

- Funding Methods: Bank transfer, card, wire, and crypto (converted to USD)

- Fees: Formula-based fee (see review)

- Primary Markets: Sports, Politics, Economics, Weather, Science

- Review: Kalshi Review

Polymarket

- Legal Status: Relaunching in the US via acquired CFTC approval

- Best For: High-volume political, sports, and crypto markets

- Funding Methods: To be announced

- Fees: 1 basis point (0.01%) on completed market buy/sell orders

- Primary Markets: Politics, Sports, Crypto, Pop Culture

- Review: Polymarket Review

Crypto.com

- Legal Status: CFTC DCM

- Best For: Sports-focused, simple interface

- Funding Methods: ACH, wire, crypto (converted to USD)

- Fees: $0.02 to open a position, $0.02 to close early

- Primary Markets: Sports, Politics, Economics

- Review: Crypto.com Review

PredictIt

- Legal Status: CFTC DCM

- Best For: Politics-focused, granular election markets

- Funding Methods: Credit card, PayNearMe

- Fees: 10% on profits, 5% on withdrawals

- Primary Markets: Politics (US elections, policy)

- Review: PredictIt Review

Robinhood

- Legal Status: Operates via Kalshi

- Best For: Low fees, existing Robinhood customers

- Funding Methods: Bank transfer, debit card

- Fees: $0.01 per contract bought/sold

- Primary Markets: Sports, Politics, Economics, Weather, Science

- Review: Robinhood Review

Fanatics Markets

- Legal Status: Operates via Crypto.com

- Best For: Existing Fanatics Sportsbook customers, casual fans

- Funding Methods: Debit card, Apple Pay, bank transfer, wire transfer

- Fees: Formulaic fee schedule but never more than $0.02 per contract (see review for details)

- Primary Markets: Sports, Politics, Culture, Weather, Economy

- Review: Fanatics Markets Review

DraftKings Predictions

- Legal Status: CFTC-registered platform

- Best For: Existing DraftKings users, sports fans

- Funding Methods: Debit card, bank transfer, Apple Pay, wire transfer

- Fees: $0.01 per contract bought or sold

- Primary Markets: Sports, Economy

- Review: DraftKings Predictions Review

All Prediction Market App Reviews

What Is A Prediction Market?

In simple terms, a prediction market is an exchange where users trade “yes” or “no” event contracts on the outcomes of future events.

Each market poses a straightforward, verifiable question about an upcoming outcome, such as, “Will inflation exceed 5% this quarter?” or “Will Movie X win the Best Picture Oscar?”

On most prediction markets, “Yes” and “No” contracts trade at prices ranging from $0.01 to $0.99. The contracts that correctly predict the outcome pay $1, while those that get it wrong expire worthless.

A note on definitions: The terms “prediction market” and “market” can refer to the trading platform itself (e.g., “Kalshi is a regulated prediction market”) or to a specific tradable question on that platform (e.g., “The market on the next Fed interest rate decision is very active today”).

The Underlying Concept

Prediction markets are the real-world implementation of the “wisdom of crowds” theory. The theory posits that large groups of people, each with their own information and analysis, can collectively produce forecasts that are more accurate than those of any individual expert.

Each participant has a financial incentive to be correct, which encourages truth-seeking and diligent research. Prediction markets aggregate disparate information, ranging from public news and statistical models to niche expertise, into a single, real-time data point: the contract price.

As a result, prediction markets are an effective forecasting tool for observers, with a history of accurately predicting events ranging from presidential elections to company sales results.

Caveat: Emotionally charged markets, liquidity issues, and widespread hedging can significantly impact any individual market’s forecasting accuracy.

For users, prediction markets provide opportunities to leverage domain expertise for financial gain and to hedge against unwanted outcomes.

How Event Contracts Work

Event contracts are every prediction market’s basic trading unit.

Each contract represents a measurable “yes” or “no” outcome. For every “Yes” contract that exists, there is a corresponding “No” contract.

If the outcome does happen:

- “Yes” contracts pay $1 each

- “No” contracts pay $0 each

If the outcome does not happen:

- “No” contracts pay $1 each

- “Yes” contracts pay $0 each

While the market is live and before the outcome is known, users trade contracts at prices ranging from $0.01 to $0.99.

Generally, the price represents the market’s current, collective assessment of the probability that the event will happen.

For example, if a “Yes” contract is trading at $0.45, the market is signaling a collective belief of a 45% probability of that outcome occurring.

That said, the above caveat applies: emotion, illiquid markets, and large hedges can distort prices away from the market’s actual collective probability sentiment.

When the event resolves and the outcome is known, each contract pays $1 if true and $0 if false.

You can also exit your position early at any time by selling your shares. This means you can take profits early if things are going your way or cut your losses if you change your mind.

Simple Prediction Market Example

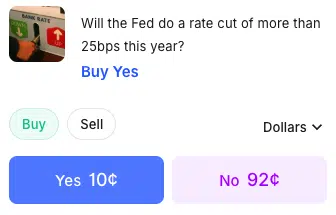

Here’s a snapshot from a real federal funds rate market:

Here, we can see that:

- You can buy “yes” contracts for $0.10 each

- You can buy “no” contracts for $0.92 each

Imagine you buy 100 “yes” contracts for $0.10 each (spending a total of $10) and hold them until expiry. One of two outcomes will happen:

- The Federal Reserve cuts rates by more than 25bps: Your 100 “yes” contracts expire at $1 each for a total payout of $100. You net a $90 profit.

- The Federal Reserve does not cut interest rates: Your 100 “yes” contracts expire worthless. You lose the $10 you initially spent on those contracts.

Common Prediction Market Formats

Every individual “share” is a binary yes/no contract, but prediction market questions can take one of three formats:

- Yes or No: The standard format used for events with two mutually exclusive outcomes. Example: “Will X happen by Y date?”

- Range: Based on where a number lands in a range, with individual yes/no contracts for each range. Example: “Will the high temperature in NYC reach 82-83°, 84-85°, or 86°+ today?”

- Multiple Choice: Events with multiple potential outcomes, like elections with multiple candidates. Structured like range markets: yes/no contracts for each option.

The Mechanics: How Prediction Markets Work

Prediction markets operate on many of the same principles as established financial markets, such as the New York Stock Exchange, to facilitate fair, efficient, and orderly trading.

Unlike an online sportsbook, where you’re betting against the house, in a prediction market, you’re trading with other users in an open order book system.

The platform itself just matches buyers and sellers and enforces the rules; it doesn’t take sides on the bet.

Trade Execution

When you decide to “bet” on an outcome, you can buy “Yes” contracts if you think it will happen or “No” contracts if you think it won’t.

There are two primary types of orders you can place:

- Market Order: An order to buy or sell immediately at the best available price.

- Limit Order: An order to buy or sell only at a specific price or better.

Market orders offer the advantages of quick execution. If you need to move into or out of a position quickly, market orders are the way to go. However, you have less control over price, and limited liquidity at the current price can result in your order being partially filled at worse prices.

Limit orders allow you to name your price, but there is no guarantee that the order will be filled if the market never moves to that price.

The Order Book

Exchanges match buy and sell orders using a central order book. The order book primarily works in the background, automatically matching buy and sell orders and displaying the current price at which you can buy or sell contracts.

The order book lists all:

- Outstanding bid orders (ranked by the price buyers are willing to pay)

- Outstanding ask orders (ranked by the price sellers are asking)

The highest bid and lowest ask define the current market price for “Yes” or “No” shares.

Whenever you place a market order, you’ll be matched with the best available counter-order in the book. For example, if someone is offering to sell “Yes” at $0.40 and you place a buy order, you’ll receive that $0.40 price.

If you place a limit order (for example, bidding thirty cents for “Yes”), your order will sit in the order book until the market moves or a seller agrees to your price.

Prediction markets handle order matching automatically, so casual users simply see the current price and trade with a click.

However, you can view the full order book to see the depth of bids and asks at various prices (this can give a sense of liquidity and what other traders are thinking).

Prediction Markets Liquidity

Liquidity is paramount in prediction markets.

A market with high liquidity has many buyers and sellers actively placing orders, resulting in a “deep” order book.

Liquidity is critical for several reasons:

- Tighter Spreads: High liquidity leads to more competition between buyers and sellers, which narrows the bid-ask spread. This directly reduces the transaction costs for traders.

- Faster Execution: With more orders on the book, it is more likely that a new order will find a match quickly at or near the current market price.

- Price Stability: In a liquid market, large orders are less likely to cause drastic price swings, resulting in more reliable and less volatile price discovery.

Conversely, an illiquid market is characterized by a “thin” order book with few orders and wide bid-ask spreads. Additionally, individual trades have a greater impact on current contract prices.

Attempting to trade in illiquid markets can be costly and difficult. For this reason, new traders should focus on the most popular markets, such as major elections or championship sporting events, where liquidity is typically highest.

Contract Resolution

Every market listed on an exchange has an expiration date and settlement rules. Each market’s rules outline how long trading remains open and the method used to determine the official result.

For example, a market asking whether gas prices will exceed $X this month may have rules stating that it closes at 11:59 PM ET on the 31st and specifying which source it will use to determine the official result.

After the prediction market resolves the event, it converts all contracts into $1 or $0 and automatically credits the winners’ accounts.

Prediction Market Categories

Prediction markets cover an ever-growing array of topics. If an event is in the future and its outcome is verifiable, there’s probably a market for it, or there soon will be.

Politics

Political markets are among the most popular and liquid on any platform. They allow traders to take positions on a wide range of political outcomes, from high-profile national elections to the intricacies of the legislative process.

See our political prediction markets and Presidential Election markets guides for comprehensive explainers, tips, and FAQs.

Examples:

- Who will win the next US Presidential Election?

- Will the government shut down by October 1st?

- Which party will control the Senate after the midterms?

- Will a specific Supreme Court nominee be confirmed?

Sports

Sports markets offer a direct, federally regulated alternative to traditional online sportsbooks, except available nationwide.

These markets initially focused on long-term futures, such as championship winners, but have expanded to include single-game outcomes, point spreads, and even parlays.

See our sports prediction markets guide for a detailed discussion, legal considerations, tips, and FAQs.

Examples:

- Will the Kansas City Chiefs win the Super Bowl?

- Will the Los Angeles Lakers win tonight’s game?

- Will Player X rush for over 80.5 yards?

Economics & Finance

Economic and financial markets allow traders to take positions on key indicators that drive the global economy.

Economic prediction markets are particularly useful for hedging, allowing businesses and individuals to protect themselves against adverse economic events like inflation or interest rate hikes.

Corporate markets also allow trading on specific company outcomes, such as quarterly earnings reports or product launch dates.

Examples:

- Will the monthly CPI inflation rate be above 3.5%?

- Will the Federal Reserve cut interest rates at its next meeting?

- Will Tesla’s Q3 earnings per share beat analyst expectations?

- Will the US enter a recession this year?

Pop Culture & Entertainment

These markets cater to public interest in cultural events, allowing people to trade on their knowledge of the entertainment industry. They cover major awards shows, box office performances, and other significant cultural topics.

Examples of culture prediction markets:

- Will ‘Film X’ win the Oscar for Best Picture?

- Will Taylor Swift release a new album by December 31st?

- Will the next major superhero movie gross over $100 million in its domestic opening weekend?

Science & Weather

This category includes markets on verifiable scientific achievements and specific, measurable weather events.

Weather betting prediction markets can serve as a form of parametric insurance, allowing individuals and businesses in affected areas to hedge against the financial impact of natural disasters and disease outbreaks.

Examples:

- Will a category 2+ hurricane make landfall on the Gulf Coast this year?

- Will July be the hottest month on record globally?

- Will OpenAI announce the release of its next model by the end of the year?

Business & Corporate

These markets allow traders to take positions on measurable outcomes related to individual companies. They typically focus on key performance indicators and milestones that can impact a company’s stock price or public perception.

Examples:

- Will a company’s quarterly earnings per share beat analyst expectations

- Will a specific product receive regulatory approval by a certain date?

- Will a company announce a new product launch by the end of the quarter?

Cryptocurrency Predictions

Crypto prediction markets focus on the outcomes and price movements of digital assets. They cater to traders with specific knowledge of the crypto industry and blockchain technology. Polymarket is the leader in cryptocurrency prediction markets.

Examples:

- Will the price of a specific cryptocurrency reach a certain level by a set date?

- Will a particular network development or upgrade occur on schedule?

- Which blockchain will have the highest trading volume in a given month?

Esports Markets

Esports markets allow users to trade on the outcomes of professional, competitive video gaming events. These markets function similarly to traditional sports markets, with contracts on tournament winners and individual match outcomes. Esports prediction markets are one of Kalshi’s strength areas.

Examples:

- Will a specific team win a major Esports championship?

- Which player will be named the MVP of a tournament?

- Will a team win their next scheduled match?

Mention Markets

Mentions prediction markets, sometimes listed as a subcategory under under politics or current events, focus on whether a public figure will mention a particular word, phrase, or topic during a scheduled public address. These markets allow traders to speculate on the messaging and focus of upcoming high-profile speeches, debates, or announcements.

Examples:

- Will the Federal Reserve Chair use the word “transitory” during a press conference?

- Will a specific political topic be mentioned during a presidential debate?

- Will a company’s CEO mention a new product line during an earnings call?

Technology & AI

Technology markets cover verifiable achievements and milestones in the tech sector, including advances in artificial intelligence. These contracts allow traders to take positions on specific product releases or scientific developments from major tech companies.

Examples:

- Will OpenAI announce the release of its next-generation AI model by the end of the year?

- Will a specific tech company receive a patent for a new innovation by a certain date?

Public Health

Health-related markets concentrate on verifiable public health events, such as disease outbreaks. These markets can also serve as a form of parametric insurance, allowing businesses or individuals in affected areas to hedge against the potential financial impact of a widespread health event.

Examples:

- Will a global health organization declare a specific virus a public health emergency by a certain date?

- Will the CDC report a certain number of flu cases during the peak of the season?

Are Prediction Markets Gambling?

No. Prediction markets are not just gambling, both legally and conceptually.

Legally speaking, prediction markets operate under the federal Commodity Futures Trading Commission (CFTC), not under state-level gambling regulators. That’s why prediction markets are available nationwide.

Conceptually, prediction markets are much more than simple gambling.

For some traders, especially those with a background in sports betting, the appeal lies in speculation. They may enjoy the challenge or rush of “betting” on future events.

For others, today’s prediction markets represent the democratization of a hedging tool once limited to institutional investors. Consider these scenarios:

- A small business owner in Florida whose revenue depends on tourism can buy “Yes” contracts on a hurricane making landfall. If the hurricane hits and their business suffers, the payout from the contracts can help offset their losses. This functions as a form of accessible, event-specific insurance.

- A homebuyer with a variable-rate mortgage is exposed to the risk of rising interest rates. They can buy “Yes” contracts on the Federal Reserve raising rates. If rates rise and their mortgage payment increases, the profit from their contracts can help mitigate the new expense.

- An investor whose portfolio is heavily weighted in tech stocks can hedge against a market downturn by buying “Yes” contracts on the US entering a recession.

Are Prediction Market Sites Legal?

Prediction markets are legal and available nationwide, but their standing is a subject of ongoing debate.

The core of the issue is a jurisdictional dispute: are prediction platforms financial markets under exclusive federal oversight, or do they constitute online betting, making them subject to state gambling laws?

Federal vs. State Regulation: The Core Distinction

The primary reason prediction markets operate in all fifty states is their classification under federal law:

- Federal Oversight: Prediction markets are regulated by the Commodity Futures Trading Commission (CFTC), the same federal body that oversees commodity futures and options markets. The CFTC classifies event contracts as a type of financial derivative, not as a wager.

- State Authority: In contrast, online sports betting is regulated on a state-by-state basis by local gaming commissions that create rules specifically for sports wagering.

In matters of interstate commerce, federal law typically preempts state law, which is the legal basis CFTC-regulated markets use to operate nationwide.

A key 2023 federal court case involving Kalshi and the CFTC’s subsequent decision in May 2025 to drop its appeal helped solidify the legal standing for election-related contracts.

The Legal Debate & State-Level Challenges

Despite federal approval, prediction markets face persistent challenges from state regulators. The central legal question is whether event contracts are truly financial instruments under the exclusive jurisdiction of the CFTC or a form of gambling subject to state law.

Regulators in numerous states have sent cease-and-desist letters to operators, contending that prediction markets constitute illegal online sports betting. Although most challenges focus on sports-related contracts, some have also explicitly targeted markets based on election outcomes.

In response, operators like Kalshi have filed lawsuits in federal court against state regulators. They have won critical preliminary injunctions, which have allowed them to continue operating in certain states while the cases proceed.

Understanding the Regulatory Landscape

Some prediction market platforms operate under specific federal approvals or no-action letters, while others operate without formal authorization and are therefore unregulated.

- What “Regulated” Means: A regulated platform, such as a CFTC-registered Designated Contract Market (DCM), operates under direct federal oversight. These exchanges must follow compliance rules and publish detailed rulebooks for each market.

- What “Unregulated” Means: Some platforms operate without formal US authorization, which could expose users to legal, financial, and consumer protection risks.

For now, CFTC-registered prediction markets remain available nationwide, thanks in large part to favorable court rulings and a strong legal defense from operators.

However, the jurisdictional debate is far from settled, and the legal landscape could still change as various challenges play out. Unregulated prediction markets face additional legal risks should state-level authorities target them for enforcement action.