The bank transfer is a fast and easy way to fund an online betting account in the United States. Bank transfer betting deposits are free, instant, and widely accepted. Additionally, customers can withdraw their winnings via bank transfer when they’re done betting.

Best eCheck Betting Sites

Bet $5 Get $150 If It WinsFanDuel Promo Code: Not Needed

Gambling Problem? Call 1-800-GAMBLER or visit RG-Help.com. Call 1-888-789-7777 or visit ccpg.org/chat (CT). Hope is here. GamblingHelpLineMA.org or call (800) 327-5050 for 24/7 support (MA). Visit www.mdgamblinghelp.org (MD). Call 1-877-8HOPE-NY or text HOPENY (467369) (NY). 21+ (18+ D.C.) and present in select states (for KS, in affiliation with KS Star Casino). First online real money wager only. $5 first deposit required. Bonus issued as nonwithdrawable bonus bets which expire 7 days after receipt. Restrictions apply. See terms at sportsbook.fanduel.com.

Bet $5 Get $150 If It WinsFanDuel Promo Code: Not Needed

Gambling Problem? Call 1-800-GAMBLER or visit RG-Help.com. Call 1-888-789-7777 or visit ccpg.org/chat (CT). Hope is here. GamblingHelpLineMA.org or call (800) 327-5050 for 24/7 support (MA). Visit www.mdgamblinghelp.org (MD). Call 1-877-8HOPE-NY or text HOPENY (467369) (NY). 21+ (18+ D.C.) and present in select states (for KS, in affiliation with KS Star Casino). First online real money wager only. $5 first deposit required. Bonus issued as nonwithdrawable bonus bets which expire 7 days after receipt. Restrictions apply. See terms at sportsbook.fanduel.com.

Up to $1000 in Bonus BetsFanatics Sportsbook Promo Code: Not Needed

Must be 21+. GAMBLING PROBLEM? Call 1-800-GAMBLER

(CO/DC/IL/KS/KY/LA/MD/OH/MI/NC/NJ/PA/TN/VA/VT/WV/WY), (800)-327-5050 or http://gamblinghelplinema.org (MA), Call (877-8-HOPENY) or text HOPENY (467369) (NY), 1-800-NEXT-STEP or text NEXTSTEP to 53342 (AZ), (888) 789-7777 or http://ccpg.org (CT), or 1-800-BETS-OFF (IA), or 1-800-9-WITH-IT (IN), or www.mdgamblinghelp.org (MD), or morethanagame.nc.gov (NC), or 1800gambler.net (WV). $1,000 No Sweat Bets offer for customers in AZ, CO, CT, DC, IA, IL, IN, KS, KY, LA, MA, MD, MI, NC, NJ, OH, PA, TN, VT, VA, WV, or WY only. Must apply this promotion in your bet slip and place a $1+ cash wager with odds of -500 or longer each day for 10 straight days. Your 10 days begin the day you establish your account. Wager must settle as a loss to qualify for Bonus Bets. Bonus Bets will equal the amount of the losing wager(s) (up to $100 in Bonus Bets per day) and expire 7 days from issuance. This offer is not available in IL, NY, & NC. Terms apply- see Fanatics Sportsbook app.

Up to $1000 in Bonus BetsFanatics Sportsbook Promo Code: Not Needed

Must be 21+. GAMBLING PROBLEM? Call 1-800-GAMBLER

(CO/DC/IL/KS/KY/LA/MD/OH/MI/NC/NJ/PA/TN/VA/VT/WV/WY), (800)-327-5050 or http://gamblinghelplinema.org (MA), Call (877-8-HOPENY) or text HOPENY (467369) (NY), 1-800-NEXT-STEP or text NEXTSTEP to 53342 (AZ), (888) 789-7777 or http://ccpg.org (CT), or 1-800-BETS-OFF (IA), or 1-800-9-WITH-IT (IN), or www.mdgamblinghelp.org (MD), or morethanagame.nc.gov (NC), or 1800gambler.net (WV). $1,000 No Sweat Bets offer for customers in AZ, CO, CT, DC, IA, IL, IN, KS, KY, LA, MA, MD, MI, NC, NJ, OH, PA, TN, VT, VA, WV, or WY only. Must apply this promotion in your bet slip and place a $1+ cash wager with odds of -500 or longer each day for 10 straight days. Your 10 days begin the day you establish your account. Wager must settle as a loss to qualify for Bonus Bets. Bonus Bets will equal the amount of the losing wager(s) (up to $100 in Bonus Bets per day) and expire 7 days from issuance. This offer is not available in IL, NY, & NC. Terms apply- see Fanatics Sportsbook app.

$1000 Bonus BetCaesars Sportsbook Promo Code: BUSA1000

Must be 21 or older and physically present in AZ, CO, IL, IN, IA, KS, KY, LA, ME, MD, MA, MI, NJ, NY, NC, OH, PA, TN, VA, WV, or WY. New users only. Must register using eligible promo code. First bet after registration must qualify. Max. Bonus Bet: $1,000. Bonus Bet expires 14 days after receipt. Void where prohibited. See Caesars.com/promos for full terms. Know When To Stop Before You Start®. Gambling Problem? CO, IL, KY, MD, MI, NJ, OH, TN, VA, WV, WY, KS (Affiliated with Kansas Crossing Casino), LA (Licensed through Horseshoe Bossier City and Harrah’s New Orleans), ME (Licensed through the Mi’kmaq Nation, Penobscot Nation, and Houlton Band of Maliseet Indians, federally recognized tribes located in the State of Maine), NC (Licensed through Tribal Casino Gaming Enterprise), PA (Affiliated with Harrah’s Philadelphia): If you or someone you know has a gambling problem, crisis counseling and referral services can be accessed by calling 1-800-GAMBLER (1-800-426-2537) or MD: visit mdgamblinghelp.org or WV: visit 1800gambler.net; AZ: Call 1-800-NEXT-STEP; IN: Call 1-800-9-WITH-IT; IA: Call 1-800-BETSOFF. ©2024, Caesars Entertainment

Gambling Problem? Call 1-800-GAMBLER

MA: CALL 1-800-327-5050 or visit gamblinghelplinema.org

NY: Call 877-8-HOPENY or text HOPENY (467369)

$1000 Bonus BetCaesars Sportsbook Promo Code: BUSA1000

Must be 21 or older and physically present in AZ, CO, IL, IN, IA, KS, KY, LA, ME, MD, MA, MI, NJ, NY, NC, OH, PA, TN, VA, WV, or WY. New users only. Must register using eligible promo code. First bet after registration must qualify. Max. Bonus Bet: $1,000. Bonus Bet expires 14 days after receipt. Void where prohibited. See Caesars.com/promos for full terms. Know When To Stop Before You Start®. Gambling Problem? CO, IL, KY, MD, MI, NJ, OH, TN, VA, WV, WY, KS (Affiliated with Kansas Crossing Casino), LA (Licensed through Horseshoe Bossier City and Harrah’s New Orleans), ME (Licensed through the Mi’kmaq Nation, Penobscot Nation, and Houlton Band of Maliseet Indians, federally recognized tribes located in the State of Maine), NC (Licensed through Tribal Casino Gaming Enterprise), PA (Affiliated with Harrah’s Philadelphia): If you or someone you know has a gambling problem, crisis counseling and referral services can be accessed by calling 1-800-GAMBLER (1-800-426-2537) or MD: visit mdgamblinghelp.org or WV: visit 1800gambler.net; AZ: Call 1-800-NEXT-STEP; IN: Call 1-800-9-WITH-IT; IA: Call 1-800-BETSOFF. ©2024, Caesars Entertainment

Gambling Problem? Call 1-800-GAMBLER

MA: CALL 1-800-327-5050 or visit gamblinghelplinema.org

NY: Call 877-8-HOPENY or text HOPENY (467369)

$1500 In Bonus BetsBetMGM Bonus Code: BUSABONUS

Gambling problem? Call 1-800-GAMBLER (available in the US). Call 877-8-HOPENY or text HOPENY (467369) (NY). Call 1-800-327-5050 (MA). 21+ only. Please gamble responsibly. Call 1-800-NEXT-STEP (AZ), 1-800-BETS-OFF (IA), 1-800- 981-0023 (PR). First bet offer for new customers only. Subject to eligibility requirements. Bonus bets are non-withdrawable. In partnership with Kansas Crossing Casino and Hotel. See BetMGM.com for terms. US $1500 promotional offer not available in New York, Nevada, Ontario, or Puerto Rico.

$1500 In Bonus BetsBetMGM Bonus Code: BUSABONUS

Gambling problem? Call 1-800-GAMBLER (available in the US). Call 877-8-HOPENY or text HOPENY (467369) (NY). Call 1-800-327-5050 (MA). 21+ only. Please gamble responsibly. Call 1-800-NEXT-STEP (AZ), 1-800-BETS-OFF (IA), 1-800- 981-0023 (PR). First bet offer for new customers only. Subject to eligibility requirements. Bonus bets are non-withdrawable. In partnership with Kansas Crossing Casino and Hotel. See BetMGM.com for terms. US $1500 promotional offer not available in New York, Nevada, Ontario, or Puerto Rico.

Bet $5 Get $150 Win Or LoseBet365 Bonus Code: BETUSAGAMBLING PROBLEM? CALL OR TEXT 1-800-GAMBLER (AZ, CO, IL, IN, KY, LA, NC, NJ, OH, PA, VA), 1-800-BETS OFF (IA) or 1-800-889-9789 (TN). 21+ only (18+ in KY). Must be present in AZ/CO/IA/IL/IN/KY/LA (select parishes)/NC/NJ/OH/PA/TN/VA. New Customer Offer Bet $5 and Get $150 in Bonus Bets at bet365. *Subject to meeting qualifying criteria. Minimum wager $5. Minimum odds -500 or greater. $10 minimum deposit. Paid in Bonus Bets. Bonus Bets wager excluded from returns. New customers only. Available in app only, time restrictions and T&Cs apply.

Bet $5 Get $150 Win Or LoseBet365 Bonus Code: BETUSAGAMBLING PROBLEM? CALL OR TEXT 1-800-GAMBLER (AZ, CO, IL, IN, KY, LA, NC, NJ, OH, PA, VA), 1-800-BETS OFF (IA) or 1-800-889-9789 (TN). 21+ only (18+ in KY). Must be present in AZ/CO/IA/IL/IN/KY/LA (select parishes)/NC/NJ/OH/PA/TN/VA. New Customer Offer Bet $5 and Get $150 in Bonus Bets at bet365. *Subject to meeting qualifying criteria. Minimum wager $5. Minimum odds -500 or greater. $10 minimum deposit. Paid in Bonus Bets. Bonus Bets wager excluded from returns. New customers only. Available in app only, time restrictions and T&Cs apply.21+ to Play, T&Cs Apply. Gambling Problem? Call 1-800-GAMBLER

$200 Welcome BonusTwinSpires Offer Code: BET200

Void where prohibited. Terms and conditions apply. Offer for TwinSpires Racing only. See TwinSpires.com for details. Must be 18+ (21+ where applicable). For help with a gambling problem, call 1-800-GAMBLER.

$200 Welcome BonusTwinSpires Offer Code: BET200

Void where prohibited. Terms and conditions apply. Offer for TwinSpires Racing only. See TwinSpires.com for details. Must be 18+ (21+ where applicable). For help with a gambling problem, call 1-800-GAMBLER.

$150 Deposit BonusAmWager Promo Code: BUSA150

Promotional offer valid and continues until further notice.

Open to new AmWager account holders who have not previously opened an AmWager account. Individuals may only have one (1) AmWager account and may only qualify for a signup promotion one (1) time.

The First Deposit Match Bonus promotion applies to the first deposit made; any subsequent deposits will not apply.

The amount of the first deposit will determine the amount of the bonus and bets that must be placed to earn the bonus. For example, to qualify for the maximum bonus of $150 an initial deposit of $150 is required and total bets must equal $150 or more within 30 days of sign up. Cancelled wagers and refunded wagers are not eligible and will not be counted towards the promotion.

The total promotional wagering credits will be credited to the AmWager account in a single deposit within seven (7) business days of meeting the betting requirements for this promotion. Any promotional wagering credits deposited to a player’s account must be wagered and cannot be withdrawn from the account. Any winnings from those wagers are cash and can be withdrawn.

Any portion of the promotional credits unused expires after 30 days.

Account must remain in good standing to be eligible for all promotions. Returned deposits during the promotional period will cancel eligibility to receive promotional wagering credit.

Limit one promotional offer per household.

$150 Deposit BonusAmWager Promo Code: BUSA150

Promotional offer valid and continues until further notice.

Open to new AmWager account holders who have not previously opened an AmWager account. Individuals may only have one (1) AmWager account and may only qualify for a signup promotion one (1) time.

The First Deposit Match Bonus promotion applies to the first deposit made; any subsequent deposits will not apply.

The amount of the first deposit will determine the amount of the bonus and bets that must be placed to earn the bonus. For example, to qualify for the maximum bonus of $150 an initial deposit of $150 is required and total bets must equal $150 or more within 30 days of sign up. Cancelled wagers and refunded wagers are not eligible and will not be counted towards the promotion.

The total promotional wagering credits will be credited to the AmWager account in a single deposit within seven (7) business days of meeting the betting requirements for this promotion. Any promotional wagering credits deposited to a player’s account must be wagered and cannot be withdrawn from the account. Any winnings from those wagers are cash and can be withdrawn.

Any portion of the promotional credits unused expires after 30 days.

Account must remain in good standing to be eligible for all promotions. Returned deposits during the promotional period will cancel eligibility to receive promotional wagering credit.

Limit one promotional offer per household.

21+ to Play, T&Cs Apply. Gambling Problem? Call 1-800-GAMBLER

Play $5, Get $50PrizePicks Promo Code: BUSA

$50 provided as promo funds, only for use on PrizePicks. Promo funds provided under this promotion must be played within 90 days of receipt or shall become null and void at PrizePicks’ discretion. Promo ends 12/31/25. Void where prohibited. If you or someone you know has a gaming problem, get help. Crisis services and responsible gaming counseling can be accessed by calling 1-800-426-2537 or online at www.ncpgambling.org. 18+ in most eligible jurisdictions, but other age and eligibility restrictions may apply. Valid only in jurisdictions where PrizePicks operates. See prizepicks.com/terms for full PrizePicks terms of service.

Play $5, Get $50PrizePicks Promo Code: BUSA

$50 provided as promo funds, only for use on PrizePicks. Promo funds provided under this promotion must be played within 90 days of receipt or shall become null and void at PrizePicks’ discretion. Promo ends 12/31/25. Void where prohibited. If you or someone you know has a gaming problem, get help. Crisis services and responsible gaming counseling can be accessed by calling 1-800-426-2537 or online at www.ncpgambling.org. 18+ in most eligible jurisdictions, but other age and eligibility restrictions may apply. Valid only in jurisdictions where PrizePicks operates. See prizepicks.com/terms for full PrizePicks terms of service.

$250 First Entry RefundBoom Fantasy Promo Code: BUSA

Users must be 18+ years of age to play and deposit (19+ in Nebraska). T&Cs Apply. Gambling Problem? Call 1-800-GAMBLER. All users must have only 1 account. If a user is found to be less than 18 years old, their account will be banned and all their entries will be canceled and refunded. If a user is found to have more than 1 account, they will be subject to a ban at Boom’s discretion.

$250 First Entry RefundBoom Fantasy Promo Code: BUSA

Users must be 18+ years of age to play and deposit (19+ in Nebraska). T&Cs Apply. Gambling Problem? Call 1-800-GAMBLER. All users must have only 1 account. If a user is found to be less than 18 years old, their account will be banned and all their entries will be canceled and refunded. If a user is found to have more than 1 account, they will be subject to a ban at Boom’s discretion.

50% up to $1000Underdog Fantasy Promo Code: BETUSA

18/21+, T&Cs apply. Concerned with your play? Call 1-800-GAMBLER or visit www.ncpgambling.org; AZ: 1-800-NEXT-STEP (1-800-639-8783) or text NEXT-STEP to 53342; NY: Call the 24/7 HOPE line at 1-877-8-HOPENY or Text HOPENY (467369) Learn more about Underdog Contests and how to identify highly experienced players at www.underdogfantasy.com/rules; Learn more about average results at www.underdogfantasy.com/average-results.

50% up to $1000Underdog Fantasy Promo Code: BETUSA

18/21+, T&Cs apply. Concerned with your play? Call 1-800-GAMBLER or visit www.ncpgambling.org; AZ: 1-800-NEXT-STEP (1-800-639-8783) or text NEXT-STEP to 53342; NY: Call the 24/7 HOPE line at 1-877-8-HOPENY or Text HOPENY (467369) Learn more about Underdog Contests and how to identify highly experienced players at www.underdogfantasy.com/rules; Learn more about average results at www.underdogfantasy.com/average-results.

Free Entry + $100 Deposit BonusParlayPlay Promo Code: BUSA

18/21+, T&Cs Apply. Welcome offer is for players who make their first successful deposit to ParlayPlay. Following the deposit, you receive promo entry(s) that matches the deposit amount up to $100. The promo entry can only be used to enter up to 4-pick More/Less contests. If you lose the promo entry, your account balance is not impacted. The deposit promo entry(s) must be used within 7 days of deposit. After 7 days the free entry will expire. If you have concerns about managing your play on ParlayPlay or anywhere else, or if you’re concerned about a family member or friend, the National Council on Problem Gambling offers support through telephone or text. They can be reached confidentially (24-hours a day) at 1-800-522-4700. Or contacted on their website at https://www.ncpgambling.org/ or through chat at ncpgambling.org/chat.

Free Entry + $100 Deposit BonusParlayPlay Promo Code: BUSA

18/21+, T&Cs Apply. Welcome offer is for players who make their first successful deposit to ParlayPlay. Following the deposit, you receive promo entry(s) that matches the deposit amount up to $100. The promo entry can only be used to enter up to 4-pick More/Less contests. If you lose the promo entry, your account balance is not impacted. The deposit promo entry(s) must be used within 7 days of deposit. After 7 days the free entry will expire. If you have concerns about managing your play on ParlayPlay or anywhere else, or if you’re concerned about a family member or friend, the National Council on Problem Gambling offers support through telephone or text. They can be reached confidentially (24-hours a day) at 1-800-522-4700. Or contacted on their website at https://www.ncpgambling.org/ or through chat at ncpgambling.org/chat.

$500 Deposit BonusOwnersBox Referral Code: BUSA

18/21+ to play. Terms & conditions apply. See ownersbox.com for full offer details. If you or somebody you know has a gambling problem, help is available. Call (1-800-GAMBLER).

$500 Deposit BonusOwnersBox Referral Code: BUSA

18/21+ to play. Terms & conditions apply. See ownersbox.com for full offer details. If you or somebody you know has a gambling problem, help is available. Call (1-800-GAMBLER).

21+ to Play, T&Cs Apply. Gambling Problem? Call 1-800-GAMBLER

Online sportsbooks generally accept two types of electronic funds transfers (ETFs). The fastest and easiest is the ACH or eCheck deposit, which takes just a few seconds to complete.

Some betting sites also accept wire transfer deposits, which are better for large transactions but require more effort on the part of the customer. BettingUSA will explain how both types of bank transfer deposits work on this page.

Online Bank Transfer Betting Deposits

Online bank transfers allow customers to move funds directly from their personal bank accounts to their online betting accounts.

Mobile sportsbooks offer instant bank transfers under various names. There are subtle differences between some bank transfer options, but the basic idea is the same. Customers input their bank account and routing numbers, choose an amount to deposit, and instantly receive credit so they can get to betting.

Below are explanations of the most common types of instant bank transfer deposits.

ACH and eCheck Deposits

Anyone with a bank account and use an ACH/eCheck deposit to fund their online betting account within minutes. Sportsbooks credit eCheck deposits to customers’ accounts instantly, so there is no wait, but it may take a few days for the transaction to show up in users’ statements.

Making an ACH betting deposit is easy:

- Visit the sportsbook of your choice to log in or sign up for an account

- Visit the cashier and select ACH/eCheck

- Input your bank account and routing number

- Select an amount to deposit and submit the transaction

The sportsbook may ask for additional information from customers making their first deposits, which is required by state and federal Know Your Customer (KYC) laws. After customers verify their identities and successfully deposit, all future transactions are even faster.

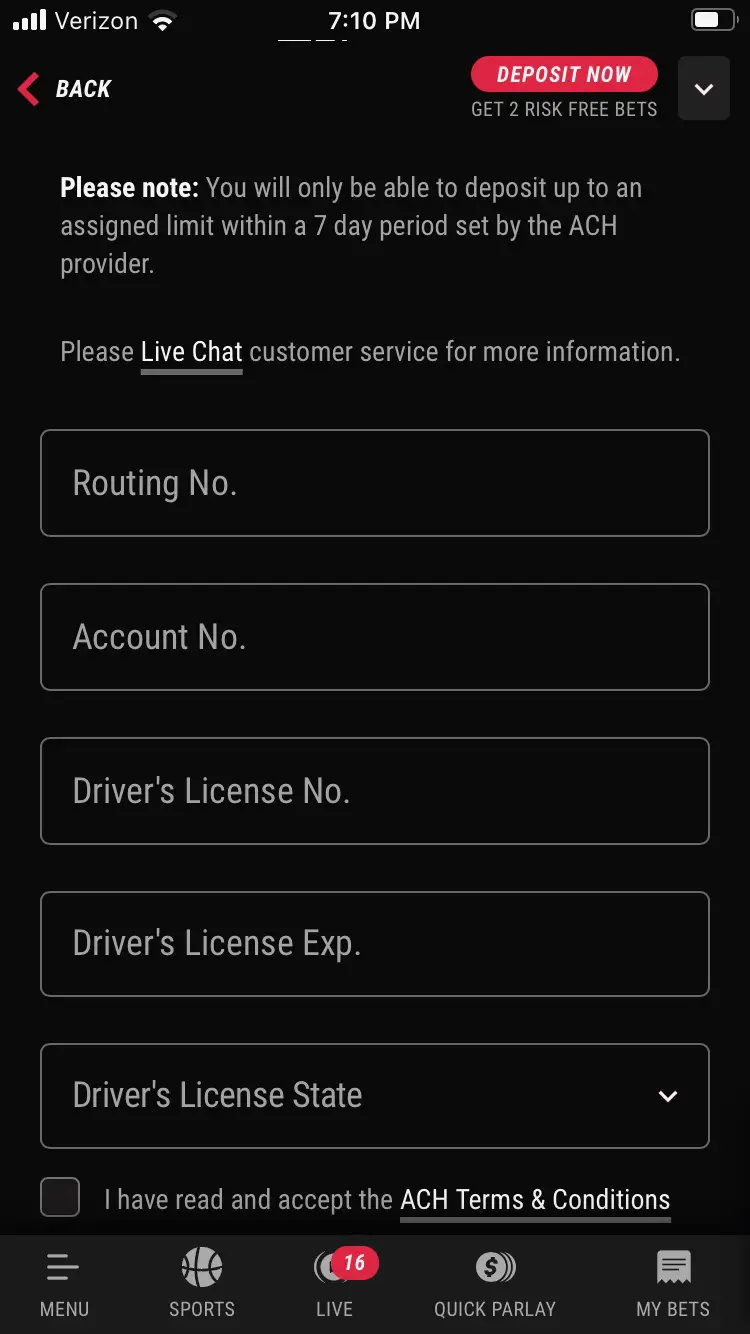

For example, the following screenshot shows the information requested by one sportsbook for a customer’s first deposit:

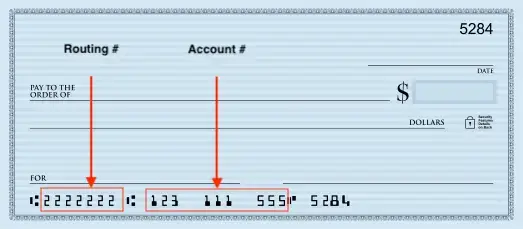

For those who don’t know their bank account and routing numbers, the easiest way to find them is to look at a blank check from their checkbooks. The left-most number on the bottom of the check is the routing number, and the one to the right is the bank account number.

Example:

Online Bill Pay and PayWithMyBank Deposits

Online bill pay and PayWithMyBank are two names for a deposit method similar to but not quite the same as an ACH/eCheck transfer.

Most sportsbooks offer online bill pay deposits as a way for customers to quickly deposit without having to share their checking account and routing numbers.

When customers choose this method, they simply input an amount to deposit, and the sportsbook launches a secure page hosted by their bank. There, customers log in with their existing online banking information to approve the transaction.

The process works like this:

- Visit your preferred sportsbook and log in or sign up for an account

- Select “online bill pay” or “PayWithMyBank”

- Input an amount to deposit

- On the new page that opens, log in with your bank’s online banking credentials

- The sportsbook will instantly credit your betting account with the deposit

There are two advantages to online bill pay. First, customers do not need to find their checking account and routing numbers. They can simply log in using their bank’s online banking feature to approve the deposit.

Second, online bill pay provides additional privacy because customers never share their banking info with their sportsbooks. After users approve the transaction, their bank sends the funds to the sportsbook without sharing their checking account or routing numbers.

The disadvantage is that online bill pay does not work with all banks. Users must choose their bank from a dropdown menu to initiate an online bill pay deposit. If their bank doesn’t appear on the list, they must use a standard ACH deposit or another method.

VIP Preferred Deposits

Many sportsbooks offer ACH and eCheck deposits through VIP Preferred, a cashless gaming platform powered by Global Payments that serves more than 500 land-based casinos, online sportsbooks, and gambling sites in the US.

Some of the more popular betting apps that accept VIP Preferred include:

The first time a bettor deposits with VIP Preferred, they must enroll in the program to establish an account. Once registered, customers can use VIP Preferred ACH transfers to instantly fund their betting accounts and receive quick withdrawals from online sportsbooks that support VIP Preferred.

VIP Preferred’s in-house risk analysis team institutes custom deposit limits for each customer. Bettors may contact VIP Preferred 24/7 to request higher limits.

Benefits of VIP Preferred include fast transactions at many online sportsbooks, free deposits and withdrawals, enhanced privacy because it does not share banking information with betting sites, widespread acceptance, and high successful deposit rates.

EZMoney Deposits

EZMoney is an ACH deposit method popular among horse racing betting sites. Customers can register with EZMoney and make their first deposit within minutes, and future transactions are even faster.

Depositing with EZMoney is a straightforward process: customers input their bank account information, fill out a registration form, and may use it from there on out to make fast online deposits with no fees.

Two legal online racebooks that accept EZMoney include:

EZMoney is free to use and allows customers to deposit up to $1,000 every five days from customers’ checking or savings accounts.

Pros and Cons of eCheck Deposits

Overall, eCheck betting deposits offer numerous updates and few downsides. As long as the customer has a bank account and money to spend, the eCheck is a convenient and free way to bet online.

Echeck Betting FAQ

Below are answers to questions bettors often ask about funding their accounts with ACH transfers. Readers can also contact their sportsbooks’ customer support teams for additional help. Most legal US betting sites employ courteous and knowledgeable support reps.

Wire Transfer Betting Deposits

The wire transfer is not a widely advertised deposit method because it requires additional legwork on the customer’s end. For the most part, betting sites prefer to direct customers to more convenient options to encourage deposits.

Still, wire transfers are an option at most sportsbooks, even if they do not list it as an option inside their cashiers. Bettors who need to make very large deposits can contact their betting sites for more information, but the customer support team may still recommend a different method.

Wire transfers can be useful for high rollers because they support substantial transactions, but customers still need to contact customer service to inquire about deposit limits.

The primary downside to wire transfer deposits is the extra effort they entail. Customers must contact the sportsbook for transfer details and then call or visit their bank to initiate the transfer.

Additionally, most banks charge $20 or more to send wire transfers. Unless it is a large transfer, most customers will find it more efficient to fund their accounts via credit card, debit card, or ACH transfer.