Skrill is an e-wallet payment platform that provides secure deposits and fast withdrawals for licensed betting sites and online sportsbooks in the USA.

Additionally, customers can order prepaid Skrill cards that link to their account balances for cash withdrawals at ATMs and to make purchases anywhere Visa is accepted.

Continue below for a complete list of Skrill betting sites licensed in the USA and a detailed getting started guide. This page explains how Skrill sports betting deposits work, what fees to expect, and much more.

Best Skrill Betting Sites

Bet $5 Get $150 Win Or LoseBet365 Bonus Code: BETUSAGAMBLING PROBLEM? CALL OR TEXT 1-800-GAMBLER (AZ, CO, IL, IN, KY, LA, NC, NJ, OH, PA, VA), 1-800-BETS OFF (IA) or 1-800-889-9789 (TN). 21+ only (18+ in KY). Must be present in AZ/CO/IA/IL/IN/KY/LA (select parishes)/NC/NJ/OH/PA/TN/VA. New Customer Offer Bet $5 and Get $150 in Bonus Bets at bet365. *Subject to meeting qualifying criteria. Minimum wager $5. Minimum odds -500 or greater. $10 minimum deposit. Paid in Bonus Bets. Bonus Bets wager excluded from returns. New customers only. Available in app only, time restrictions and T&Cs apply.

Bet $5 Get $150 Win Or LoseBet365 Bonus Code: BETUSAGAMBLING PROBLEM? CALL OR TEXT 1-800-GAMBLER (AZ, CO, IL, IN, KY, LA, NC, NJ, OH, PA, VA), 1-800-BETS OFF (IA) or 1-800-889-9789 (TN). 21+ only (18+ in KY). Must be present in AZ/CO/IA/IL/IN/KY/LA (select parishes)/NC/NJ/OH/PA/TN/VA. New Customer Offer Bet $5 and Get $150 in Bonus Bets at bet365. *Subject to meeting qualifying criteria. Minimum wager $5. Minimum odds -500 or greater. $10 minimum deposit. Paid in Bonus Bets. Bonus Bets wager excluded from returns. New customers only. Available in app only, time restrictions and T&Cs apply.21+ to Play, T&Cs Apply. Gambling Problem? Call 1-800-GAMBLER

All Betting Sites That Accept Skrill

The number of online sportsbooks that accept Skrill is growing, but acceptance is still very limited compared to other deposit methods. See the table below for a list of licensed Skrill betting sites in each state:

| Heading | 1 |

|---|---|

| Arizona | ESPN Bet |

| Arkansas | Bet Saracen |

| Colorado | ESPN Bet, SBK Sportsbook |

| Illinois | ESPN Bet |

| Indiana | ESPN Bet, SBK Sportsbook |

| Iowa | ESPN Bet |

| Kansas | ESPN Bet |

| Kentucky | ESPN Bet |

| Louisiana | ESPN Bet |

| Maryland | Bet Parx |

| Massachusetts | ESPN Bet |

| Michigan | ESPN Bet, Play Gun Lake Sports |

| New Jersey | Bet365, ESPN Bet, betPARX |

| Ohio | betPARX |

| Pennsylvania | ESPN Bet, betPARX |

| Tennessee | ESPN Bet |

| Virginia | ESPN Bet |

| West Virginia | ESPN Bet |

Additionally, Fliff Social Sportsbook offers real cash prizes in most states and accepts Skrill deposits.

Skrill Online Casinos

Skrill is an accepted payment method at US online casinos and sweepstakes gambling sites in the following states. Licensed Skrill gambling sites only operate in a handful of states, but sweepstakes sites with casino-style games and cash prizes are available in many more.

Skrill gambling deposits offer the advantages of fast transactions and high success rates, which are critical for a positive experience. It’s a straightforward deposit method, but this page will explain how to use Skrill for gambling in more detail.

But first, here’s a list of online casinos that accept Skrill in each state:

| Heading | 1 |

|---|---|

| Michigan | Play Gun Lake |

| New Jersey | Bet365 Casino, betPARX Casino |

| Pennsylvania | betPARX Casino, Jackpot City Casino |

In addition, sweepstakes gambling sites WOW Vegas Casino and Pulsz Social Casino offer casino-style games with cash prizes and accept Skrill in most US states.

How Skrill Works

Skrill resembles PayPal in many ways because it is a US-licensed e-wallet that customers can use to fund their online betting accounts, receive withdrawals, make purchases elsewhere, and store funds online securely.

However, one of the big differences between the two is that Skrill was explicitly designed for the online gambling industry. As the official website states, Skrill is “the digital wallet built for betting.”

The Skrill concept involves a central wallet that acts as a secure staging area for bettors’ bankrolls. Customers can use their Skrill accounts to deposit funds to online sportsbooks without revealing their banking information, receive withdrawals from betting sites, and store their bankrolls in accounts backed by $250,000 in FDIC insurance.

Unlike other sportsbook deposit methods, Skrill offers loyalty rewards such as cash, special online betting offers, and tickets to sports events. Customers also receive prepaid Visa cards that connect to their balances for in-person purchases and cash withdrawals from Skrill betting sites.

However, Skrill has the drawback of higher fees than most deposit methods. It costs nothing to deposit via credit card, debit card, or bank transfer, but Skrill charges a flat $5.50 fee to transfer funds to a personal bank account or $2.50 to withdraw cash at an ATM.

Overall, Skrill is a good-but-not-great deposit method because the fees affect everyone, while the loyalty rewards only benefit some users. Bettors who like the Skrill online gambling concept but not the fees should consider Play+ Card deposits, which offer many of the same features with lower fees and broader acceptance.

Skrill Sports Betting Deposits Explained

Skrill sports betting deposits are straightforward once customers get past the initial setup. Getting started begins with signing up for an account at Skrill.com and loading it via bank transfer, credit card, debit card, Paysafecard, or Paysafecash.

From there, users can transfer money to their online betting accounts without sharing their personal information or banking details.

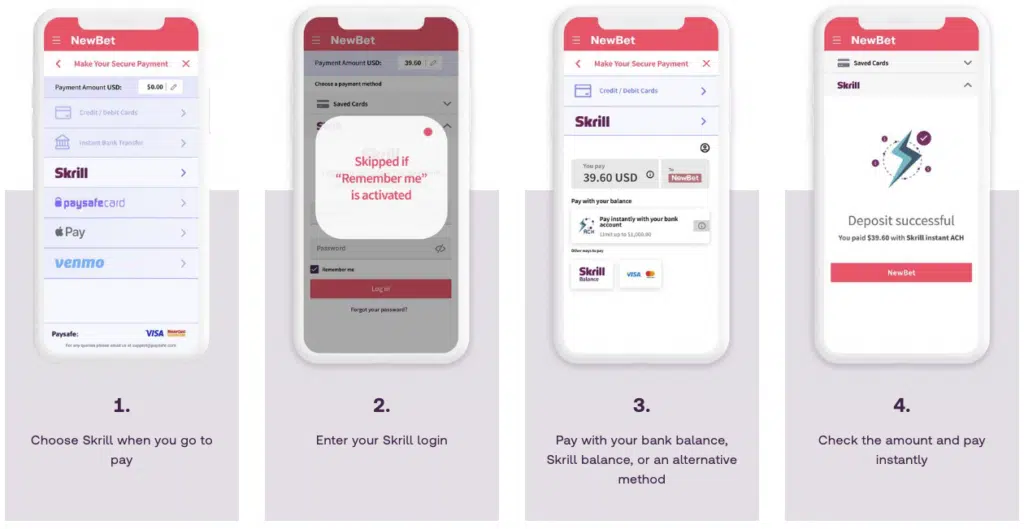

Here’s the step-by-step process for depositing at betting sites that accept Skrill:

- Log in to your online betting account

- Visit the cashier and select “Skrill” as your deposit method

- Log in to your Skrill account when prompted

- Choose an amount to deposit

- If you have a balance on Skrill, those funds will be used to complete the deposit

- If you do not have a balance, Skrill can initiate an instant transfer while still protecting your banking details

- After the transfer, your sportsbook will instantly credit the funds to your betting account

Note: Skrill asks customers who fund their accounts with a credit or debit card if they intend to use those funds for gaming or non-gaming purposes. Users who select non-gaming purposes cannot use that money to fund a mobile betting account. As such, anyone who uses Skrill to fund an online sportsbook must choose “gaming” to ensure their deposit is successful.

Skrill Deposit Methods

Customers can fund their Skrill accounts via the following methods. Skrill does not charge any deposit fees, regardless of the method used to upload funds.

- ACH Bank Transfer: Select your bank from the list of supported institutions and log in with your existing online banking credentials to initiate the transfer. Skrill aims to process ACH deposits within 2-5 business days.

- Wire Transfer: Select “wire transfer” on the deposit screen inside your Skrill account to see the receiving bank details and instructions for initiating the wire transfer. Your bank may require an in-person visit or offer wire transfers online. Skrill processes wire transfers within 2-5 business days.

- Credit Card: Skrill accepts Visa and Mastercard. Visit the deposit area inside your account, select “Add a card,” and input your card number, expiration date, and CVV code. Customers can link up to five credit and debit cards to their accounts. Skrill processes credit card transfers within 20 minutes.

- Debit Card: Skrill accepts debit cards issued by Visa and Mastercard and aims to process debit card deposits in 20 minutes or less.

- Paysafecard: Find the nearest Paysafecard sales outlet, purchase a voucher in person, and redeem it online within your Skrill account. Skrill usually processes Paysafecard deposits instantly.

- Paysafecash: Log in to your Skrill account, visit the deposit screen, select “Paysafecash,” and choose a deposit amount. Skrill will generate a barcode that you can take to the nearest payment point, give the cashier your barcode, and pay with cash. Skrill processes most Paysafecash deposits instantly.

Skrill Visa Card Overview

Skrill users can sign up for a prepaid Visa card that connects to their accounts for quick access to cash and in-person purchases.

For example, cardholders can withdraw funds from their online betting accounts to Skrill and then use their prepaid card to withdraw cash at ATMs or make purchases anywhere Visa is accepted.

Because the Skrill card is prepaid, customers can apply with no credit check or bank account necessary. Skrill also waives the $10 application fee for users who meet the following requirements:

- Have a fully verified Skrill account

- Have funded their Skrill accounts at least one time with a method other than Paysafecard or Paysafecash

- Have downloaded and logged into the Skrill app

Skrill assesses a fee of $2.50 for ATM withdrawals and an annual $10 fee, but customers may make purchases online or in person for free.

Customers may also sign up for a virtual Visa card to make purchases online using their Skrill balances. However, neither the physical nor virtual prepaid cards support transactions related to sports betting or online gambling.

Skrill Knect Loyalty Program

Skrill stands out from other deposit methods as the only mainstream payment option with a loyalty program. The Skrill Knect loyalty program operates on a simple premise: the more customers use their accounts, the more points they earn.

Customers earn Knect points for using Skrill to make deposits, withdrawals, and purchases. Later, customers can redeem their loyalty points for vouchers, gift cards, and other benefits. Users can also redeem Knect points for cash at a rate of 1,000 points per $1.00 increase in their balances.

The exchange rate isn’t great, but any loyalty program is an improvement over none – and Skrill is unique in that regard.

Skrill users can join the loyalty program by signing into their accounts, visiting the “Knect” tab from the top navigation area, and agreeing to the terms and conditions. Once enrolled, customers earn points for their Skrill activity:

- Every $1.00 transferred to a merchant: 1 loyalty point

- Every $1.00 received from a merchant: 1 loyalty point

- Every $1.00 spent with the Skrill prepaid Visa card: 1 loyalty point

Customers can earn up to 1,000 points per transaction and 500,000 points per calendar month, and they have until January 1st of the following year to redeem any points earned throughout the year.

Skrill VIP Program

In addition to the Knect loyalty program, Skrill offers VIP benefits to high-volume users. Customers who transfer $15,000 or more in any quarter to Skrill betting sites qualify for VIP membership, which bestows the following benefits:

- A personal account manager

- 24/7 VIP customer support

- Higher transfer limits

- Increased Skrill Visa prepaid spending limits

Skrill sports betting customers also earn VIP rewards such as invitations to exclusive experiences and tickets to high-profile sporting events. However, Skrill doesn’t provide a clear roadmap for earning specific rewards.

Skrill Betting Pros and Cons

Skrill is a comprehensive payment solution with uses that extend well beyond online sports betting. As such, readers should consider the following pros and cons to decide if Skrill is the best deposit method for their needs.

Advantages

- Keep banking details private: When users fund their accounts at Skrill betting sites, they do not need to divulge their credit card or bank account numbers to anyone other than Skrill.

- Fast deposits and withdrawals: Skrill gambling sites typically process deposits within minutes and withdrawals within a few days.

- Valid workaround for declined credit card deposits: If bettors have had trouble funding their sportsbook accounts with credit or debit cards, they can sign up for a Skrill account and fund it with the same cards as a workaround

- Loyalty program: Skrill offers a loyalty rewards program for repeat customers

Disadvantages

- Withdrawal fee: Skrill charges a flat $5.50 fee when users withdraw funds from their Skrill accounts to their bank accounts. Other online betting deposit methods charge zero withdrawal fees.

- Not widely accepted: There are few Skrill sportsbooks to choose from; only one or two betting sites accept Skrill deposits in most states.

- Slow bank transfer deposits: Customers who fund their Skrill accounts via online bank transfer must wait 2-5 business days for the transaction to be completed. However, credit cards, debit cards, Paysafecard, and Paysafecash deposits are usually processed within minutes.

Skrill Sports Betting Fees

Skrill processes most transactions for free, but it is one of the only payment methods that charges customers for every withdrawal.

Skrill Online Betting Fees

- Uploading funds to Skrill: Free

- Funding a Skrill casino or online betting account: Free

- Withdrawing funds from Skrill via ACH transfer: $5.50

Prepaid Skrill Debit Card Fees

Customers who opt for a prepaid Skrill card for purchases and cash withdrawals are subject to additional fees:

- Prepaid Visa card application: $10

- Inactivity fee: $5 per month after 12 months of inactivity

- ATM withdrawal fee: $2.50; third-party banks may charge additional fees for cash withdrawals from out-of-network ATMs

- Annual fee: $10

Skrill Betting FAQ

Below are answers to common questions regarding Skrill betting deposits. Readers can visit the Skrill website for additional information and customer support.