Culture prediction markets let you trade real-money contracts based on the outcomes of high-profile pop culture events.

Instead of just guessing who will win an Oscar, if a new album will top the charts, or what a movie’s opening-weekend box office will be, you can buy and sell contracts based on your predictions.

Legal Entertainment Betting Sites

Play $5 Get $75 In Fantasy EntriesUnderdog Predict Promo Code: BETUSA

Prediction Event Contracts is a derivatives product offered by Crypto.com | Derivatives North America (CDNA), an exchange regulated by the Commodity Futures Trading Commission (CFTC). Trading CDNA Prediction Event Contracts involves risk and may not be appropriate for all. By trading you risk losing your cost to enter any transaction, including fees. You should carefully consider whether trading on CDNA is appropriate for you in light of your investment experience and financial resources. Any trading decisions you make are solely your responsibility and at your own risk.

Play $5 Get $75 In Fantasy EntriesUnderdog Predict Promo Code: BETUSA

Prediction Event Contracts is a derivatives product offered by Crypto.com | Derivatives North America (CDNA), an exchange regulated by the Commodity Futures Trading Commission (CFTC). Trading CDNA Prediction Event Contracts involves risk and may not be appropriate for all. By trading you risk losing your cost to enter any transaction, including fees. You should carefully consider whether trading on CDNA is appropriate for you in light of your investment experience and financial resources. Any trading decisions you make are solely your responsibility and at your own risk.

Note: Prediction markets are not traditional, state-licensed online sportsbooks. Instead, they are federally regulated trading exchanges, making them legally available nationwide.

Legal pop culture prediction markets transform passive consumption (like watching movies, listening to music, and following celebrity news) into an active, engaging experience.

They also serve as a real-time indicator of public sentiment and cultural “buzz,” often capturing shifts in opinion faster than traditional media.

This guide covers the markets, strategies, and data sources unique to pop culture event contracts. For a complete primer on how event contracts, order books, and the mechanics of trading work, see our introductory guide: US Prediction Markets.

Where to Bet on Pop Culture Events in the USA

Several platforms offer markets on major cultural events, but two operators provide the most consistent, diverse, and liquid selection for US users:

Kalshi Culture Markets

As a CFTC-regulated exchange, Kalshi offers a deep and granular selection of culture markets.

Where Kalshi excels: Recurring events like the Oscars and Grammys, as well as media-based contracts such as Rotten Tomatoes scores and film box office revenue.

What to know: What to know: clearly written market rules and named sources; time-boxed contracts; liquidity clusters around nomination/embargo/live-show windows.

Read more: How Kalshi Works

Polymarket Culture Markets

Polymarket specializes in capturing fast-moving, viral, and social-media-driven events.

Where Polymarket excels: This is where you are more likely to find markets on specific celebrity actions, YouTube milestones, or niche, real-time “Tweet markets.”

What to Know: Lots of time-limited, news-tied questions; read the rules carefully for resolution criteria and confirmation sources.

Read more: How Polymarket Works

How to Trade Cultural Events: An Oscars Betting Example

The simplest way to explain how to bet on cultural events on a prediction market is to work through a couple of straightforward examples.

The Academy Awards, or “Oscars,” are one of the most liquid and popular markets in this category.

Let’s use a past Oscars betting market and then imagine three ways you might have approached this market, depending on your opinion.

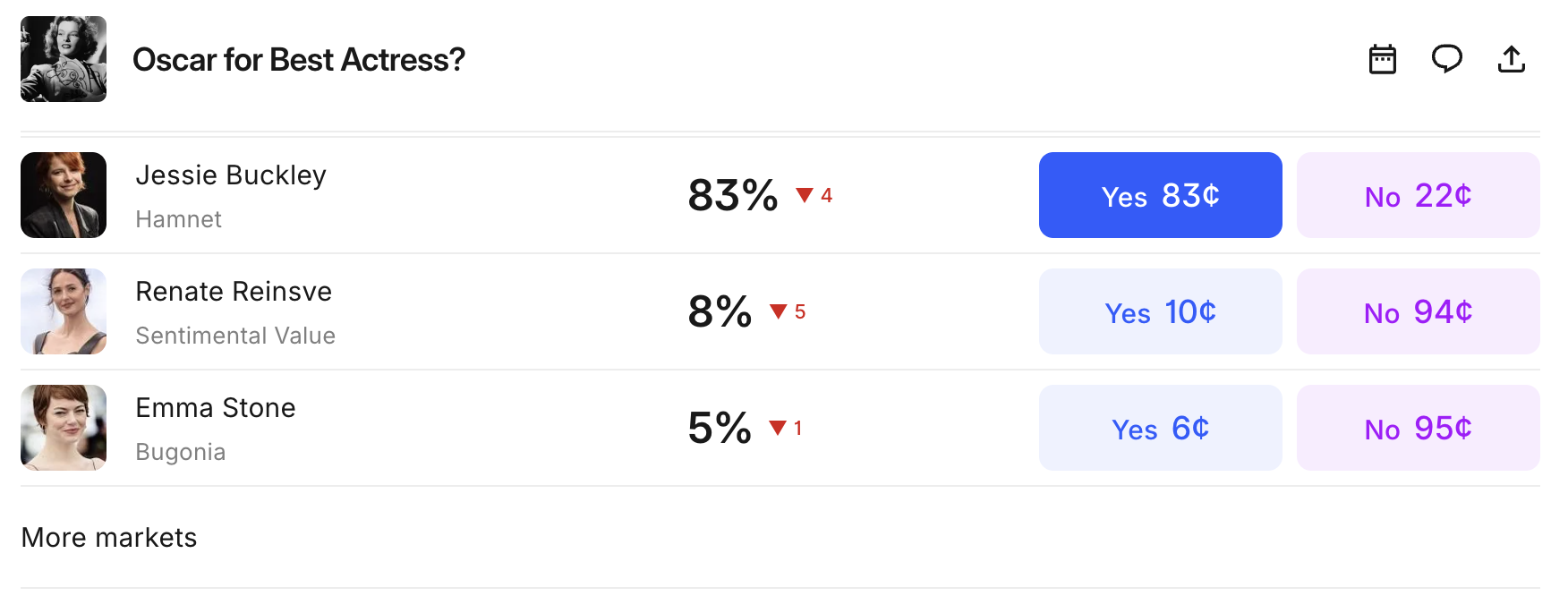

The Market: “Oscar for Best Actress?”

Above, you see each nominee listed with separate “Yes” and “No” contracts. Contract prices range from $0.01 to $0.99, and a correct contract settles at $1.00.

A “Yes” price approximates the market?implied chance that the outcome occurs; a “No” price approximates the chance it does not (subject to fees, spreads, and multi?outcome constraints, so “Yes” and “No” won’t always add neatly to $1.00).

- Jessie Buckley: Yes (83¢) / No (22¢)

- Renate Reinsve: Yes (10¢) / No (94¢)

- Emma Stone: Yes (5¢) / No (95¢)

At these prices, the market is effectively saying Jessie Buckley is the strong favorite (about 83% implied by price). If any other nominee wins, “No” on Buckley resolves correctly to $1.00 per contract.

Now, here are three ways you could trade this market based on your opinion.

The “Yes” Trade (The Favorite)

- Your Prediction: You agree with the market and believe Jessie Buckley is a lock to win.

- Your Trade: You buy 100 “Yes” contracts at 83¢ each.

- Your Cost: 100 contracts x 83¢ = $83.00

- The Result: Jessie Buckley wins Best Actress. Your contracts are correct and settle at $1.00 each.

- Your Payout: 100 contracts x $1.00 = $100.00

- Net Profit: $100 Payout – $83 Cost = $17.00 (minus trading fees)

The “No” Trade (The Upset)

- Your Prediction: You think Jessie Buckley is over-hyped, but you’re not sure which of the other nominees will win.

- Your Trade: You buy 100 “No” contracts on Jessie Buckley at 22¢ each.

- Your Cost: 100 contracts x 22¢ = $22.00

- The Result: On Oscar night, Renate Reinsve wins. The “Yes” contracts for Jessie Buckley are incorrect, meaning your “No” contracts are correct.

- Your Payout: 100 contracts x $1.00 = $100.00

- Net Profit: $100 Payout – $22 Cost = $78.00 (minus trading fees)

Tip: In multi-outcome categories (like awards), a single “No” position on the favorite is a clean way to be “long the field.”

The In-Play Trade: Locking in Profit Early

This hypothetical trade highlights the key difference from a traditional bet. You do not have to hold your contracts until Oscar night.

- The Setup: You buy 100 “Yes” contracts for Jessie Buckley at 83¢ ($83 cost).

- The News: Two weeks before the Oscars, a credible news outlet publishes a rumor from an anonymous source claiming that the Academy vote overwhelmingly favors Jessie Buckley.

- The Price Move: The market reacts instantly. The “Yes” contract price for Jessie Buckley jumps from 83¢ to 90¢.

- Your Move: You can now sell your 100 contracts to another trader at the new, higher price.

- Your Payout: 100 contracts x 90¢ = $90.00

- Net Profit: $90.00 Payout – $83.00 Cost = $7.00

In this scenario, you locked in a smaller, guaranteed profit and eliminated the risk of a last-minute upset on Oscar night.

Types of Culture Prediction Markets

“Culture” is a broad category, covering everything from Hollywood’s biggest nights to niche social media trends. Although individual markets are constantly changing, they generally fall into one of these subcategories:

Preeminent Culture Prediction Markets Calendar

|

Month |

Event |

Key Markets to Watch |

|---|---|---|

|

Jan |

Golden Globes |

Best Picture (Drama/Comedy), Key Acting Awards |

|

Feb |

Grammy Awards |

Album of the Year, Record of the Year, Best New Artist |

|

Feb |

Super Bowl |

Halftime Show Performer, First Song Played, Guest Appearances |

|

Mar |

Academy Awards |

Best Picture, Best Director, All Acting Categories |

|

May |

Eurovision |

“Which country will win?” |

|

May |

Cannes Film Fest |

“Palme d’Or” Winner (a key “feeder” for the next Oscars) |

|

Jun |

Tony Awards |

Best Musical, Best Play |

|

Sep |

Emmy Awards |

Best Drama Series, Best Comedy Series |

|

Dec |

TIME Person of Year |

A high-volume market that trades all year |

|

Varies |

Major Media Releases |

Box Office Openings, Album “First Week Sales” |

Key Risks & Rules for Culture Prediction Markets

In culture markets, the “fine print” is more important than in any other category. A movie’s box office can be restated, an award can be rescinded, and a song’s chart position can be revised.

Because you are trading peer-to-peer, exchanges cannot void and refund contracts as if they were simple sports bets. Think of it this way: if a contract has traded hands three times at different prices, who would the exchange refund, and whose money would they use to issue the refund?

A contract must resolve one way or the other, so it’s critical to read and understand the rules of any market before you buy a single contract.

The “Resolution Source” Is Non-Negotiable

The market contract will always name an official “resolution source” to determine the outcome. This is the only source of truth, regardless of what happens elsewhere.

For example, a market on “Best Picture” may state the resolution source is “the winner announced during the live telecast of the Academy Awards.”

If they announce “Film A” on TV, but 20 minutes later issue a correction that “Film B” actually won (like the Moonlight/La La Land mixup), the contract will settle based on that initial live announcement (or whatever specific contingency is in the rules).

The “Cutoff Time” Is Everything

Many cultural prediction markets are time-sensitive. A contract on a Rotten Tomatoes score or a YouTube view count must have an exact cutoff.

Example: A market asks, “Will ‘Film X’ have a Rotten Tomatoes score above 80%?” The rules will specify a cutoff, such as “at 12:00 PM ET on the Monday following its wide release.” If the score is 79% at that exact moment but rises to 81% an hour later as more reviews come in, the “No” contracts win. Any data after the cutoff is irrelevant to the market.

What if an Event Is Canceled or Postponed?

This is a common risk, especially with film releases.

Example: You buy “Yes” contracts on “Will ‘Film X’ win Best Picture at the 2026 Oscars?” In December 2025, the studio delays the movie’s release to Summer 2026, making it ineligible for the 2026 awards.

In this case, your “Yes” contracts will almost certainly settle at $0. The contract was for a specific event (the 2026 Oscars) that the film is no longer a part of. Exchanges typically treat cancellations the same as candidates dropping out of the race in US Presidential election markets.