Sports prediction markets are platforms where users trade on the outcomes of sporting events using contracts that pay based on whether an event occurs.

Unlike online sports betting, which is regulated at the state level and is only legal in some states, prediction markets operate nationwide under federal oversight from the Commodity Futures Trading Commission (CFTC).

In other words, sports prediction markets like Kalshi and Crypto.com serve customers in all 50 states.

Play $5 Get $75 In Fantasy EntriesUnderdog Predict Promo Code: BETUSA

Prediction Event Contracts is a derivatives product offered by Crypto.com | Derivatives North America (CDNA), an exchange regulated by the Commodity Futures Trading Commission (CFTC). Trading CDNA Prediction Event Contracts involves risk and may not be appropriate for all. By trading you risk losing your cost to enter any transaction, including fees. You should carefully consider whether trading on CDNA is appropriate for you in light of your investment experience and financial resources. Any trading decisions you make are solely your responsibility and at your own risk.

Play $5 Get $75 In Fantasy EntriesUnderdog Predict Promo Code: BETUSA

Prediction Event Contracts is a derivatives product offered by Crypto.com | Derivatives North America (CDNA), an exchange regulated by the Commodity Futures Trading Commission (CFTC). Trading CDNA Prediction Event Contracts involves risk and may not be appropriate for all. By trading you risk losing your cost to enter any transaction, including fees. You should carefully consider whether trading on CDNA is appropriate for you in light of your investment experience and financial resources. Any trading decisions you make are solely your responsibility and at your own risk.

How Sports Prediction Markets Work

Sports prediction markets function like financial exchanges: users trade contracts that represent yes/no outcomes on specific events, such as a team winning a game or an athlete exceeding a projected stat total.

Each contract has a price between $0 and $1, reflecting current market sentiment on the likelihood of the event occurring.

For example:

- A contract predicting Team A will win a game is trading at $0.65 per contract

- A user buys 100 contracts at that price, spending $65

If the user keeps the contracts until expiry (the end of the game), there are two possible outcomes:

- Team A wins: Each contract expires at a value of $1, yielding a profit of $0.35 per contract; the user nets a $35 profit

- Team A loses: Each contract expires at $0, resulting in a loss of $0.65 per contract; the user loses $65

Alternatively, the user may elect to close the position early by selling his contracts on the exchange before expiry. The price he receives reflects current market sentiment on the likelihood of Team A winning.

For example:

- Overall market sentiment has grown more favorable toward Team A, and contracts are now trading at $0.75. If the user sells his 100 contracts now, he’ll secure a profit of $0.10 per contract for a net win of $10.

- Market sentiment has shifted against Team A, and contracts are now trading at $0.40. If the user sells his contracts now, he will have a net loss of $0.15 per contract for a total loss of $15.

Related: Political Betting Prediction Markets Explained

What Are Sports Event Contracts?

Sports event contracts are trading instruments that function like financial derivatives. Their prices fluctuate based on traders’ collective beliefs about the probability of an event occurring.

For example, a contract for Team A to win the game might trade at $0.60, implying a 60% chance of that outcome.

Simultaneously, contracts for Team B to win the game would trade for around $0.40, implying a 40% chance.

Sports event contracts resemble binary options with two defining characteristics: they offer binary payouts based on events with binary outcomes.

Binary Payouts Explained

“Binary payouts” means contracts expire at either $1.00 or $0.00, and nothing in between. If you hold sports event contracts until the underlying event concludes, you’ll either receive $1.00 per contract or nothing.

Users can buy and sell contracts at any price during trading, but contracts always expire at either full value or zero at the conclusion of the event.

Note: Contracts at some sports prediction exchanges expire at either $100 or $0, but there’s no functional difference. Whether you hold two hundred contracts worth $1.00 each or two contracts worth $100 each, the result is the same: you’ll receive either $200 or nothing at expiry.

Binary Outcomes Explained

“Binary potential outcomes” means contracts are based on events with clear yes or no answers:

- Will Team A win the game?

- Will Player X rush for at least 100.5 yards?

For example, prediction markets don’t offer contracts that state “which team will win the Super Bowl.” That’s not a binary event because there are many potential outcomes.

Instead, a proper Super Bowl prediction contract would state “Team X to win the Super Bowl.” That outcome has a clear yes/no answer.

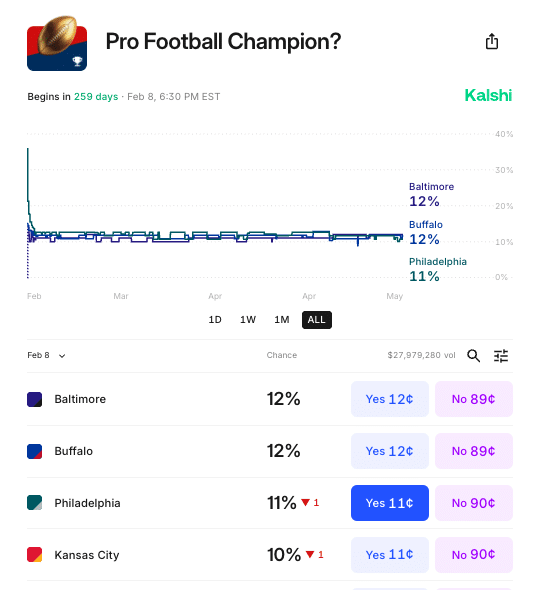

In practice, a Super Bowl prediction market offers yes/no contracts for each remaining team:

Types of Sports Prediction Contracts Explained

When regulated prediction markets ventured into sports event contracts, they initially launched with a cautious approach: futures markets focused on longer-term outcomes like the Super Bowl.

As US prediction markets matured (and gained confidence by winning a few critical legal battles early on), they expanded into more granular markets like single-game winners, point spreads, totals, and individual player props.

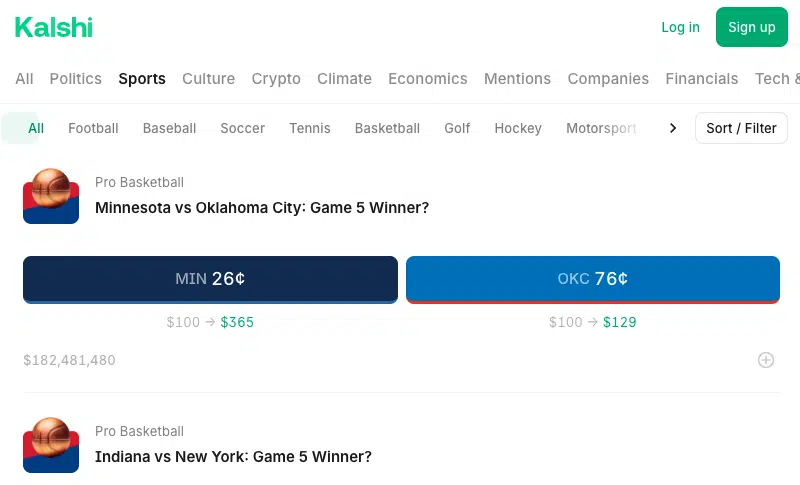

Most Prominent Sports Prediction Markets

Three major trading platforms offer CFTC-authorized sports event contract markets:

- Kalshi

- Crypto.com Sports

- Robinhood (in partnership with Kalshi)

Crypto.com Sports Trading

- Availability: Nationwide

- Legal Status: CFTC-registered Designated Contract Market

- Review: Crypto.com Sports Review

Crypto.com offers sports event trading nationwide, allowing users to speculate on the outcomes of league championships, individual games winners (straight up and against the spread), and point totals.

Supported sports include the NFL, NBA, MLB, NHL, MLS, F1, college sports, and international soccer.

Real examples include:

- Team A to win today’s NFL game

- Team X to win the NBA Finals

- Team Y to win by at least 6.5 points

- Team Z to win the Super Bowl

Position Limits

- Users may hold up to 2,500,000 open positions in any one event

Trading Fees

- $0.20 per contract ($0.10 exchange fee + $0.10 technology fee)

Trading Hours

- Available 24/7 except during scheduled maintenance

- Maintenance window: Fridays from 4:15 PM to 11:00 PM ET

Polymarket Sports Trading

- Availability: Nationwide (coming soon)

- Legal Status: Will soon be a CFTC-registered Designated Contract Market

- Review: Polymarket Review

Polymarket is one of the world’s largest prediction markets and will soon re-enter the US market with CFTC approval.

The Polymarket sports trading catalog spans far more sports than most exchanges, with markets available for professional and college sports, international leagues, esports, high-profile racing events, and more.

Customers can trade contracts on individual game winners, tournament champions, season championships, and prop-style events such as the Super Bowl halftime show.

Position Limits

- Polymarket does not impose position limits; the orderbook supports matches between willing buyers and sellers for any amount.

Trading Fees

- Polymarket will reportedly impose a 1 basis point fee on completed market buy/market sell orders

- 1 basis point = 0.01%

Trading Hours

- Polymarket operates 24/7; Polymarket’s peer-to-peer platform allows users to execute trades at any time, provided there is a counterparty to match the trade.

Kalshi Sports Trading

- Availability: Nationwide

- Legal Status: CFTC-registered Designated Contract Market

- Review: Kalshi Review

Kalshi has steadily expanded its sports event trading offerings and now covers more sports than Crypto.com. The platform offers contracts on both individual games and championship outcomes across most major sports, including:

- NFL

- NCAAF

- MLB

- Soccer

- Tennis

- NBA

- WNBA

- Golf

- NHL

- F1

- Cricket

- Esports

Kalshi has also demonstrated a bold streak, a willingness to venture where other prediction markets have previously shied. For instance, Kalshi was the first licensed operator to launch player props and parlay-style prediction markets.

Beyond sports, Kalshi offers a wide range of non-sports event trading in domains as varied as cryptocurrency prices, weather, economic indicators, popular culture, AI advances, and even disease outbreaks.

Position Limits

- Standard limit of $25,000 per contract

- Limits may vary based on public demand and liquidity

- Occasional limit increases for specific markets

Trading Fees

- Vary based on contract price and trade size

- Calculated using the formula: 0.07 × C × P × (1 – P), where C = number of contracts and P = contract price

- Example: Buying 100 contracts at $0.50 each incurs a $1.75 fee (0.07 x 100 x 0.5 x 0.5)

Trading Hours

- 8:00 AM ET to 3:00 AM ET daily

- No trading from 3:00 AM ET to 8:00 AM ET

Robinhood Sports Trading

- Availability: Nationwide

- Legal Status: Legal (operates via Kalshi’s CFTC-regulated exchange infrastructure)

- Review: Robinhood Prediction Markets review

Robinhood offers in-app access to sports event trading through a partnership with Kalshi. The platform supports a broad range of professional and college sports, including major championships and individual games.

Although available nationwide, Robinhood is more limited than other sports prediction markets in terms of access. Users must hold a Robinhood Derivatives account to trade event contracts. Only customers who have already been approved for margin investing or Level 2/3 options trading may even apply for Robinhood Derivatives accounts.

On the upside, Robinhood offers the lowest trading fees among regulated sports prediction market operators.

Position Limits

- Limits vary by contract but can be substantial

- For example, the most recent NCAAB Championship market had a 50,000-contract limit

Trading Fees

- $0.01 per contract, for both buys and sells

- Some contracts may also include an exchange fee of $0.01 or a built-in spread (typically $0.01)

Trading Hours

- Vary by contract

- Check each event’s detail page for specific trading times

Prediction Markets vs. Online Sportsbooks

Prediction markets and online sportsbooks both offer fans the opportunity to win money predicting the outcomes of sporting events, but the similarities end there.

| Feature | Prediction Markets | Online Sportsbooks |

| Counterparty | Other market users (peer-to-peer) | The sportsbook operator (the “house) |

| Pricing Model | Dynamic, market-determined prices (ranging from $0 to $1) | Fixed odds (e.g., -110, +200, etc.) |

| Fee Structure | Flat trading fees or percentage-based commissions | Built-in house edge (the vigorish) |

| Settlement | Contracts resolve at $1 if the event occurs | Payout based on the fixed odds at the time of the wager |

| Trading Mechanics | Can enter/exit positions dynamically | Typically, a singular belt held until the event’s resolution |

| Regulatory Framework | Federally regulated as derivatives under the CFTC and Commodity Exchange Act (CEA) | Subject to state-level gambling laws, licensing requirements, and prohibitions |

| Market Breadth | Any verifiable future event with a yes/no outcome (sports, politics, etc.) | Primarily sports; limited novelty and entertainment wagers |

| Market Depth | Limited but expanding; player props, some parlays, spreads, totals, alternate lines but still far short of sportsbook menus | Extensive; moneylines, spreads, totals, team/player props, alt lines, parlays, etc. |

Bettors Beware: Prediction Markets Can’t Void-and-Refund

If you’re accustomed to sports betting, there’s a critical quirk you need to be aware of when it comes to injuries, postponements, and cancelled games.

If a player does not play (DNP) or a game is canceled, sportsbooks typically void and refund your bet. Prediction markets work differently.

Because exchanges involve peer-to-peer trading, there’s no way to “void the bet” and issue refunds to every trader because:

- Your position is against other users, not the house

- A single contract can pass through multiple hands at different prices

- When someone buys low and later sells high, they can withdraw that profit

If news breaks (injury/cancellation) and prices move, who gets refunded at which price? Does the platform attempt to claw back the profits that some traders have already withdrawn? There’s no feasible path to refund everyone fairly.

Instead, exchanges may:

- Modify the market’s expiration date (e.g., extend the market if a game is postponed but still slated to be played within a predefined window)

- Let the market resolve normally at $1 or $0 (e.g., in a player prop market, “no” contracts win if the player is marked DNP)

- Pay outstanding contracts using a fair-price mechanism (e.g., the last fair traded price before the injury news broke)

- Resolve the market 50/50 (each side gets half)

This matters because it can catch experienced sports bettors off guard when they move to trading. Just ask this guy who lost $30,000 after trying to take advantage of a cancelled tennis match before Kalshi updated the market.

Here are two practical tips for former bettors getting acquainted with prediction markets:

- Always check the market’s resolution criteria before you trade, especially with player props and outdoor games with iffy weather forecasts

- Expect different rules across platforms; know the rules where you trade

Prediction Markets vs. Betting Exchanges

Prediction markets and betting exchanges have much in common, including:

- Peer-to-peer Wagering: Predictions placed against other users

- Backing and Laying: Users may back (bet an outcome will happen) and lay (bet an outcome will not happen)

- Fee Structure: Platforms impose trading fees or commissions; users do not compete against the house’s built-in edge

- Dynamic Odds: Market sentiment dictates payout odds at any time

However, sports prediction markets and betting exchanges operate under different regulatory models and have distinct characteristics in their underlying mechanics and the scopes of their offerings:

| Feature | Prediction Markets | Betting Exchanges |

| Contract Structure | “Event contracts” with binary payouts ($1 or $0) | Traditional sports bets (moneylines, totals, etc.) with variable payouts |

| Price Display | Contracts trade at prices from $0 to $1 | Traditional decimal or fractional odds |

| Trading Mechanics | Like financial trading; buying/selling shares of outcomes through a centralized order book | More like traditional betting except peer-to-peer backing and laying; platform matches individual wagers |

| Liquidity | Highly liquid nationwide markets due to federal regulation | Liquidity typically restricted to within state lines due to Wire Act and state-level gambling laws |

| Regulatory Framework | Federally regulated as derivatives under the CFTC and Commodity Exchange Act (CEA) | Regulated as gambling by federal and state-level laws |

| Legal Status | Legal at the federal level; available nationwide; legal states contested by gambling commissions in some states | Legal only in states that permit online sports betting and where regulators have approved exchange betting |

Are Sports Prediction Markets Legal?

The legality of sports prediction markets is a subject of ongoing debate because they are regulated differently than traditional sports betting and serve customers in all fifty states.

Sports betting is regulated at the state level, subject to a patchwork of varying state gambling laws, licensing conditions, and consumer protection laws.

In contrast, sports prediction markets operate under a federal framework overseen by the Commodity Futures Trading Commission (CFTC).

The CFTC regulates financial derivatives, including event contracts, and has approved platforms like Kalshi and Crypto.com as Designated Contract Markets (DCMs), allowing them to offer event contracts nationwide.

However, federal approval does not exempt sports prediction markets from scrutiny under state gambling laws, leading to persistent legal challenges.

Legal Questions Remain

The primary legal debate revolves around jurisdiction:

- Does the Commodity Futures Trading Commission have sole regulatory jurisdiction over sports prediction markets, effectively preempting state authority?

- Or do state-level gambling regulators also have regulatory authority over these activities?

Resolving that debate may also hinge on how sports event contracts are classified:

- Financial instruments/derivatives: If so, they fall under exclusive CFTC jurisdiction, permitting nationwide operation. Proponents argue this classification conforms with the Commodity Exchange Act and preempts state law.

- Gambling/sports betting: If so, they are subject to state-level gambling laws and may also violate the Federal Wire Act.

State Actions Against Sports Prediction Trading Markets

Numerous states have sent cease-and-desist orders to operators like Kalshi, Robinhood, and Crypto.com, accusing them of offering unauthorized online gambling.

The expanding list of states that have issued such orders includes Arizona, Illinois, Maryland, Montana, Nevada, New Jersey, and Ohio.

Additional states have launched investigations into sports prediction markets and asked the CFTC to intervene.

For example, the Michigan Gaming Control Board (MGCB) submitted a formal complaint to the CFTC regarding platforms offering sporting event contracts.

The MGCB’s letter outlined numerous concerns, particularly that sports prediction markets are not subject to:

- Licensing requirements and ongoing regulatory oversight

- Mandatory responsible gambling protocols, such as membership in Michigan’s statewide self-exclusion program

- Consumer protection regulations

- Sporting event integrity and monitoring

- State taxes and licensing fees

Kalshi’s Responses to State Actions

Kalshi has been especially proactive in its legal defense against state-level challenges.

Most notably, Kalshi has filed lawsuits in federal courts against regulators in states like Nevada, New Jersey, and Maryland.

Kalshi contends that, as a Designated Contract Market under the CFTC, its operations fall under federal jurisdiction exclusively and are therefore exempt from state gambling laws.

Kalshi has won critical but potentially fleeting legal victories in some of these cases. These victories include preliminary injunctions against cease-and-desist orders in Nevada and New Jersey, which have allowed Kalshi to continue operating in those states while legal challenges proceed.

Although federal courts have provided temporary relief to platforms like Kalshi, the broader question of whether state gambling laws apply to sports event trading remains unresolved.

Sports prediction markets face substantial opposition from vested and well-funded interests. Opponents include state regulators, licensed sportsbook brands, tribal gambling operators, sports leagues, and anti-gambling activists.

Furthermore, a potential outcome of the ongoing litigation is that CFTC-registered prediction markets retain the right to offer certain types of event contracts, they may ultimately lose the right to offer contracts specifically related to sports events.

Prediction Markets Responsible Gambling

Regulated sports prediction markets are not subject to traditional responsible gambling regulations. However, some operators voluntarily offer common responsible gambling safeguards.

For example, Kalshi offers these “Responsible Risk Management” tools:

- Trading Break

- Voluntary Opt-Out

- Personalized Funding Cap

However, critics (particularly state regulators and problem gambling advocates) argue that sports trading platforms offer gambling-like experiences without:

- State licensing or oversight

- Mandatory consumer protection and responsible gambling standards

- Access to state-run self-exclusion programs that span multiple operators

How Prediction Markets Led to Nationwide “Sports Betting”

Traditionally, prediction markets primarily involved contracts related to political and economic events like elections, interest rate changes, and macroeconomic indicators.

The Iowa Electronic Markets (IEM) is one of the oldest prediction markets still in operation. The IEM is the quintessential example of a “traditional” prediction market because it is operated by the University of Iowa and offers contracts based on politics/economics.

Researchers and academics find prediction markets of particular interest because of their unique characteristics:

- Crowdsourced Predictions: Prediction markets leverage aggregate the beliefs of many individuals. In some cases, the “wisdom of the crowd” has produced more accurate forecasts than experts and polls.

- Financial Incentives: Every prediction market participant has a financial incentive to make accurate predictions because their money is at stake.

- Price as Probability: The current market price of a prediction contract represents the market’s collective belief about the probability of an event occurring.

Recently, prediction markets like Crypto.com and Kalshi introduced prediction contracts based on the outcomes of sporting events.

The introduction of sports event contracts instantly broadened the appeal of prediction markets to include sports fans, especially those in states without legal online sports betting.