Searching for legal weather betting in the USA? You won’t find it at traditional online sportsbooks, but federally regulated prediction markets offer a nearly identical, nationwide alternative.

Weather prediction markets allow you to trade on everything from daily high temperatures and rainfall totals to the likelihood of a major hurricane making landfall. In short, they are the legal way to bet on the weather. This guide explains how weather event contracts work, where to trade them, and how to use them for both profit and protection.

Legal Weather Betting Sites

Play $5 Get $75 In Fantasy EntriesUnderdog Predict Promo Code: BETUSA

Prediction Event Contracts is a derivatives product offered by Crypto.com | Derivatives North America (CDNA), an exchange regulated by the Commodity Futures Trading Commission (CFTC). Trading CDNA Prediction Event Contracts involves risk and may not be appropriate for all. By trading you risk losing your cost to enter any transaction, including fees. You should carefully consider whether trading on CDNA is appropriate for you in light of your investment experience and financial resources. Any trading decisions you make are solely your responsibility and at your own risk.

Play $5 Get $75 In Fantasy EntriesUnderdog Predict Promo Code: BETUSA

Prediction Event Contracts is a derivatives product offered by Crypto.com | Derivatives North America (CDNA), an exchange regulated by the Commodity Futures Trading Commission (CFTC). Trading CDNA Prediction Event Contracts involves risk and may not be appropriate for all. By trading you risk losing your cost to enter any transaction, including fees. You should carefully consider whether trading on CDNA is appropriate for you in light of your investment experience and financial resources. Any trading decisions you make are solely your responsibility and at your own risk.

Weather Prediction Markets Explained

Weather prediction markets are federally regulated platforms where users buy and sell “Yes” or “No” contracts on specific, verifiable weather outcomes.

Weather betting opens two primary opportunities: speculating on forecasts and, perhaps more importantly, hedging against real-world financial risk. For a small business, weather contracts can offset weather-related service disruptions.

The Commodity Futures Trading Commission (CFTC) regulates weather prediction markets as event contracts, making them legally available nationwide.

Note: This page focuses on weather-specific markets. For a complete explanation of how prediction markets, event contracts, order books, and trading mechanics work, see our introductory prediction markets guide.

How Weather Prediction Markets Work

The quickest way to understand weather trading is with a concrete example.

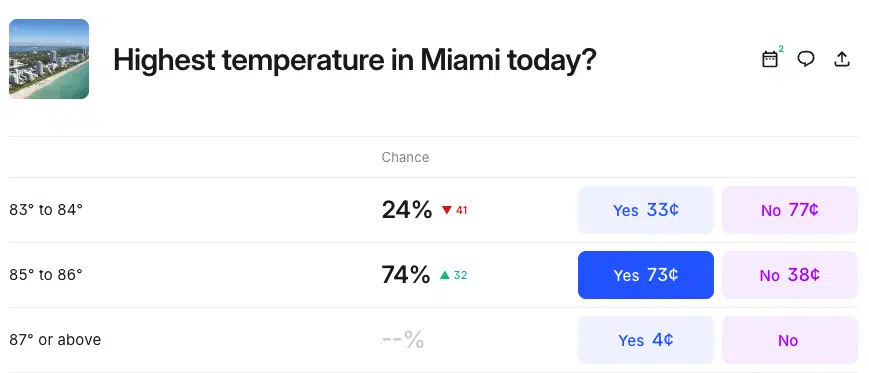

Here’s a Kalshi market asking: “Highest temperature in Miami today?”

Each row is a contract that pays $1 if the official daily high falls in the stated range, and $0 otherwise. You can buy Yes (it happens) or No (it doesn’t).

The “Chance” column is Kalshi’s mid-estimate; the Yes/No numbers are current top quotes and can differ from the mid because of spreads and liquidity.

Current top quotes at the time of the screenshot:

- 83-84°: Yes 33¢ / No 77¢ (Chance shown: 24%)

- 85-86°: Yes 73¢ / No 38¢ (Chance shown: 74%)

- 87° or above: Yes 4¢ / no interest in “No” contracts (thin liquidity)

What these numbers imply:

Collectively, traders lean toward 85-86° as the likeliest outcome (roughly a 74% chance). The 83-84° range is a secondary possibility (about a 24% chance). 87°+ is priced as unlikely (a 4¢ Yes offer), but not impossible.

Remember: Percentage estimates are approximations, not guarantees, and they move as new orders arrive.

Now, let’s assume the roles of two hypothetical traders, each approaching this temperature market from an opposite direction, to demonstrate two example use cases.

Example 1: Speculation with Weather Contracts

You’ve analyzed several weather models and believe a minor cold front will arrive faster than the market is pricing in. You think the 74% chance that the market has attached to the 85-86° range is too high.

You buy 100 “No” contracts at 38¢ each, for a total cost of $38.

Outcome: The official high temperature in Miami reaches only 81°F.

Result: Your “No” contracts are correct (the temperature was not 85-86°) and settle at $1.00 each. Your 100 contracts pay out $100, giving you a net profit of $62 (minus fees).

Example 2: Hedging with Weather Contracts

You are managing an outdoor music festival in Miami. Your ticket sales are strong, but you know from experience that if the heat is unbearable, your high-profit walk-up attendance and beverage sales will collapse.

You buy 4,000 “Yes” contracts on the 87° or above market at 4¢ each, for a total cost of $160 as a financial hedge.

Outcome: The official high is 89°. The heat is oppressive, and walk-up attendance is very low, just as you feared.

Result: Your “Yes” contracts are correct (the temperature was 87° or above) and settle at $1.00 each. Your 4,000 contracts pay out $4,000. The successful trade provides a net profit of $3,840, which helps to offset your business loss.

Best Weather Trading Platforms

Kalshi Weather Markets

Kalshi is the clear leader in the weather category.

As a CFTC-regulated exchange, Kalshi offers a wide and granular selection of weather event contracts. Markets cover daily high/low temperatures for major cities, precipitation amounts (both rain and snow), and major severe weather events.

A critical feature is that all contracts are tied to specific, verifiable data sources, such as a particular NOAA weather station. By ensuring contracts remain centered on verifiable outcomes, weather prediction markets remove all ambiguity from the settlement process.

Polymarket Weather Markets

Polymarket is one of the world’s largest prediction markets and operates using cryptocurrency (USDC stablecoin) rather than US dollars.

Although Polymarket primarily focuses on politics, sports, and crypto, it also offers various weather prediction markets. These markets typically focus on large-scale outcomes, such as hurricane landfalls, seasonal temperature records, and climate milestones, rather than the granular daily forecasts found on Kalshi.

Types of Weather Prediction Contracts

Prediction exchanges list dozens of weather-related prediction markets under several common categories:

How to Read Weather Market Prices vs. Public Forecasts

For new users, the easiest way to read a weather market is to use a simple rule of thumb: Price = Probability.

If a “Yes” contract on “Will it rain more than 0.5 inches in Miami on Saturday?” is trading at 35¢, it means the market collectively believes there is roughly a 35% chance of that event happening.

Why Is the Market Price Different Than My Weather App’s Estimate?

This is the most important question for a weather trader. You might look at your phone’s weather app and see a “70% chance of rain,” while the prediction market for “Rain > 0.1 inches” is trading at just 50¢.

There are two main reasons for this discrepancy:

- Precision vs. Simplicity: A public weather app forecast is simplified for a general audience. A “70% chance of rain” might not specify the amount, timing, or exact location. A prediction market contract is extremely precise: “Will it rain > 0.1 inches between 12:00 AM and 11:59 PM at the official NWS station at LAX?” The market is pricing that exact question, not the general “chance of rain.”

- “Wisdom of Crowds” vs. Single Model: Your app might pull from one or two weather models. The prediction market price represents the combined “wisdom” of hundreds of traders. These traders are analyzing all available models (GFS, Euro, NAM), private forecasts, and long-term climate data in real-time. The market price is a live, financially-backed consensus of all that data.

Hedging vs. Speculating: Two Core Strategies

Users typically approach weather betting markets with one of two distinct goals: profit (speculating) and protection (hedging).

Speculation

Speculation is trading for profit. If you are a hobbyist meteorologist or a data analyst who is skilled at interpreting weather models, you can trade against the market.

The “edge” here is finding a market where the price seems to be lagging the latest data.

Example: if you analyze a new model run and believe a weather event is likelier than the market’s price implies, you can buy “Yes” contracts and sell them when the rest of the market catches up.

Hedging

Hedging is the most potent and unique use case for weather markets. It allows anyone to buy accessible, low-cost financial protection against a specific weather event.

Weather hedging is often referred to as “parametric” hedging. It is similar to insurance, but instead of filing a claim for damages, you receive a fixed payout if a specific parameter (such as “1 inch of rain” or “90°F”) is met.

See below for some theoretical weather hedging examples.

For weather hedging, consider these example use cases:

- Small Business: A roofer can buy “Yes” contracts on a severe hail storm. If the storm hits, the profits can cover the cost of materials while he waits for insurance claims. A ski resort can buy “No” on “Snowfall > 12 inches by Christmas” to hedge against the cost of making artificial snow.

- Event Planning: A wedding planner or festival organizer can buy “Yes” contracts on “Rain > 0.25 inches” for the day of their event. If it rains and the event is a financial loss, the contract payout helps offset the damage.

- Agriculture: A farmer can buy “Yes” contracts on an early frost or “No” on sufficient rain during a dry season. The payout can help offset the loss of a damaged crop.

- Individuals: A homeowner in a hurricane-prone state can buy “Yes” contracts on a “Category 3+ Landfall” in their county. If the storm hits, the payout provides immediate cash to cover their insurance deductible or pay for a hotel.

Weather Betting Pitfalls to Avoid

Like all trading, weather markets carry unique risks. One key concept all weather traders should remember is simple: you are not betting on the weather; you are betting on an official measurement of the weather. The difference is critical.

The Data Source Mismatch

This is the most common pitfall for new traders.

The Mistake: You watch the weather forecast for downtown Chicago and see a high of 91°F. You buy “Yes” on the “90°F+” contract. The next day, your local news reports a high of 91°F, but your contract settles at $0 (a loss).

What Happened: The market contract was tied to the official NWS station at O’Hare Airport (ORD), which is miles away and often cooler. The airport station only recorded a high of 89°F. The market rules always specify the exact data source, and it is non-negotiable.

Chasing a Single Weather Model

Weather models like the GFS and Euro can swing wildly from one 6-hour or 12-hour run to the next. A single model run showing a hurricane plowing into Miami can cause a market to spike.

Chasing that one model run is the weather equivalent of overreacting to a single political poll. Wait for confirmation from other models or a clear trend.

Misunderstanding Your Hedge

The “parametric” nature of weather contracts is a double-edged sword.

The Mistake: Your outdoor event will be ruined by a full day of “miserable, drizzly rain.” You buy a hedge for “Rain > 1.0 inches.”

What Happened: It drizzles all day, ruining your event. But the total official accumulation is only 0.8 inches. Your business loses money, and your hedge fails because you set the parameter too high. You needed to hedge against “Rain > 0.25 inches,” which would have been more expensive but would have actually protected you.

Key Data Sources for Trading Weather

Unlike political markets that rely on polling, weather markets are based on hard science. Successful traders and hedgers watch specific data sources.

Official Resolution Sources

To ensure trust, all regulated markets must be tied to objective, verifiable data. For weather, this is almost always data from the National Oceanic and Atmospheric Administration (NOAA) and the National Weather Service (NWS).

The market rules will always specify the exact data source (e.g., “Official 24-hour rainfall total from NOAA for weather station KORD”).

Weather Models

Weather models are sophisticated computer simulations that predict the atmosphere’s behavior. Just as political traders watch polls, weather traders watch model runs.

- Global Forecast System (GFS): The primary American model. It runs four times a day and is a good baseline for long-range forecasts.

- European Model (ECMWF): The “Euro model,” run by the European Centre for Medium-Range Weather Forecasts, is highly respected for its accuracy.

- North American Mesoscale (NAM): A high-resolution model that runs multiple times a day and is very useful for short-term forecasts (under 3 days), especially for precipitation.