Robinhood Prediction Markets Review

Robinhood’s prediction markets allow users to trade on the outcomes of future events ranging from the Super Bowl to Federal Reserve interest rate hikes.

Unlike traditional sportsbooks that set fixed odds, Robinhood uses an exchange model where users trade “Yes” and “No” contracts that settle at $1 (win) or $0 (lose). It feels a lot like betting on sports or news events, but it’s available nationwide and packaged inside the familiar Robinhood app.

- Available nationwide

- Trade yes/no contracts for money

- Users must be 18+ to trade

Read on for our full Robinhood Prediction Markets review. Below, we’ll explain how Robinhood predictions work, where it’s legal, trading fees, available markets, and how the user experience compares to dedicated prediction exchanges like Kalshi and Polymarket.

Pros

Easy access in the Robinhood app Federally regulated by the CFTC Trading available 24/7 Simpler, beginner-friendly interfaceCons

Fees can add up for high-volume traders Sports markets restricted in some states Fewer niche markets than some competitorsRobinhood Prediction Markets States

One of the most significant advantages Robinhood holds over traditional sportsbooks is its availability. Because these markets are regulated as financial derivatives by the CFTC rather than state-level gambling commissions, Robinhood can legally offer prediction trading in jurisdictions where sports betting remains illegal, such as California and Texas.

However, complete nationwide access comes with a few asterisks. Economic and political markets are available in all 50 states, but sports-specific contracts face tighter restrictions. Currently, Robinhood does not offer sports event contracts in Maryland, Nevada, and New Jersey.

These restrictions exist because state regulators in those specific jurisdictions have stricter interpretations regarding sports-related derivatives competing with licensed sportsbooks. For the vast majority of the country, however, Robinhood serves as a fully legal, regulated platform for trading on sports and current events.

Robinhood Predictions Promo Code

| Title | Details |

|---|---|

Robinhood Promo Code | Not needed |

| Welcome Offer | One Free Stock Worth $5 to $200 Choose from a list of 26 stocks Customers may use the bonus to purchase fractional shares of stocks |

| Terms & Conditions | 99% of new customers receive a $5 stock 0.9% receive a $10 stock 0.1% receive a $200 stock |

Robinhood Predictions Bonus Details

Robinhood offers a standard welcome bonus to all new customers, regardless of whether they’re signing up to trade stocks or event contracts: A free stock of your choice worth between $5 and $200.

Approximately 99% of new customers receive a $5 stock, but all new users have a chance to receive a free stock worth significantly more (up to $200).

Note: Even if you’re one of the 99% of new users who receive a $5 stock through the Robinhood bonus, you can still use it to claim a fractional share of the stock of your choice.

Here’s how to claim your Robinhood predictions bonus:

- Sign up for an account (new customers only)

- Receive approval for your first taxable, individual investing account

- Link your bank or debit card to your Robinhood account

Other key terms:

- You must claim your bonus stock within 60 days of registering

- You may sell your gift stock three days after claiming it

- If you sell your gift stock, you may (a) immediately use the proceeds to buy other stocks or (b) withdraw the proceeds once 30 days have passed since claiming your gift stock

Robinhood Referral Program

Existing Robinhood customers can refer their friends to receive free stocks worth $5 to $200.

If you have an active account in good standing, you can log in and visit the rewards center for a unique referral link to share with your friends. For each friend who signs up and links their bank account, you’ll each receive a free stock worth $5 to $200.

The amount of free stock you receive for each referral is randomized as follows:

- 99% chance you’ll receive a free $5 stock

- 0.9% chance you’ll receive a free $10 stock

- 0.1% chance you’ll receive a free $200 stock

You must claim your free stock awards within sixty days of receipt, and you can earn up to $1,500 in stock annually through the Robinhood refer-a-friend program.

How Robinhood Prediction Markets Work

Robinhood simplifies derivatives trading by presenting it in a straightforward “Yes” or “No” format. Every market poses a specific question with a binary outcome, such as “Will the Chiefs win the Super Bowl?” or “Will the Fed cut rates in December?”

If you already use Robinhood for stocks or crypto, the experience will look and feel familiar. You fund your account the same way, browse a list of markets, and buy contracts with a tap.

The difference is in what you’re trading: outcomes tied to sports, elections, economic releases, company events, and more, all structured as small, all-or-nothing contracts.

Buying and Selling

To enter a position, you select your desired outcome and enter the number of contracts you wish to buy.

For example, imagine you buy 100 contracts on “Yes” for the Dallas Cowboys to win their next game. If “Yes” contracts are currently trading at $0.60, your upfront cost is $60.

- If the Cowboys win: Your 100 “Yes” contracts settle at $1.00 each, paying out $100. Your profit is $40 (minus fees).

- If the Cowboys lose: Your “Yes” contracts expire worthless, and you lose your $60 stake.

- Closing Early: You do not have to hold contracts until the event ends. If the price of your contract rises to $0.80 before the game ends, you can sell your 100 contracts for $80, locking in a $20 profit immediately.

Robinhood Fees and Commissions

Unlike sportsbooks that build vigorish into the odds, Robinhood charges a transparent transaction fee. Users pay a $0.01 commission to Robinhood plus an exchange fee (typically $0.01 per contract or a spread built into contract pricing).

In most cases, Robinhood’s commissions total to roughly $0.02 per contract to open a position and another $0.02 to close it. Although small for a single dollar, these fees can eat into margins for high-volume traders dealing with low-priced contracts.

Settlement is automatic and fast, usually the next business day after resolution.

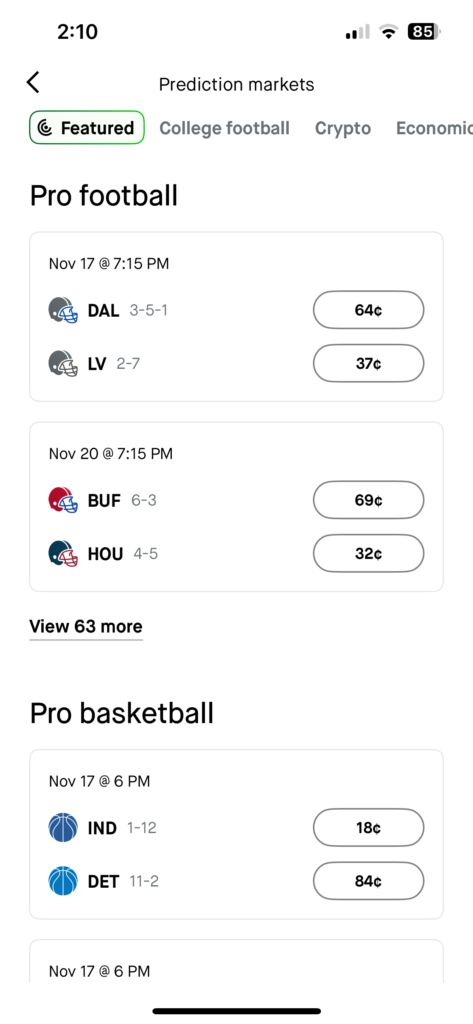

Robinhood Sports Prediction Markets

Robinhood’s sports prediction markets attract the most liquidity and span a full range of major US professional leagues, international games, and a growing lineup of secondary sports.

Most Robinhood sports markets focus on game-level outcomes, such as:

- Who will win straight up

- Who will win against the spread

- Game point totals

Robinhood also offers other market types with increasing frequency, such as season-long outcomes (the equivalent of sports betting futures) covering championships, season win totals, and MVP awards.

Depending on the season, traders can expect to find markets for the following sports/leagues:

- NFL and college football

- NBA and college basketball

- MLB

- NHL

- Golf

- F1

- Soccer

- Tennis

NFL and College Football: The most liquid markets on the platform. Users can trade contracts on the winner of every NFL game and NCAA matchup. During the Super Bowl, Robinhood expands its offering to include more granular outcomes, though it generally avoids player-specific props (like passing yards) in favor of team-based results.

NBA and College Basketball: Trade on daily game winners and futures, such as the NBA Finals champion. The platform also covers significant NCAA basketball tournaments, providing a legal way for fans in non-betting states to get action on March Madness.

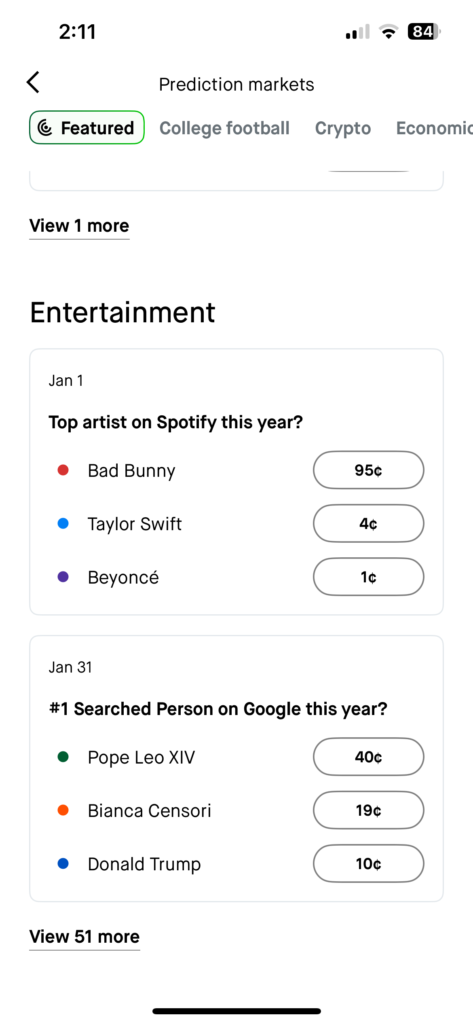

Other Robinhood Prediction Market Categories

Moving beyond sports, Robinhood offers a growing menu of event contracts in these additional categories:

- Economics

- Politics

- Entertainment

- Crypto

- Technology

Examples include questions about the Federal Reserve’s target rate, monthly CPI prints, jobs reports, GDP growth, the US Presidential election, Bitcoin prices, and advances in artificial intelligence.

How Robinhood Differs from Other Platforms

Robinhood’s biggest differentiator relative to other platforms is that its event contracts live inside a full-service brokerage.

You don’t need to move money to a new site, learn a new interface, or manage a separate tax profile just to trade Robinhood’s event contracts. For existing Robinhood users, that convenience is significant.

Robinhood vs. Kalshi

Robinhood and Kalshi have a “partner-competitor” relationship. Robinhood acts as an introductory broker (FCM) that funnels all its trades onto Kalshi’s exchange (DCM).

Compared to Kalshi, Robinhood sits closer to the consumer end of the spectrum. Kalshi offers a broader range of market categories and deeper contract-level data, but its interface feels like a purpose-built derivatives exchange.

As a result, Robinhood simplifies the experience, hides some of the trading plumbing, and prioritizes a clean, app-first interface.

On the downside, Robinhood does not show full order-book depth or contract volume, which are standard on Kalshi and Polymarket. For sophisticated traders, this makes it harder to judge liquidity and slippage before entering large orders. That trade-off is part of Robinhood’s push to keep the UI approachable for mainstream users.

- Liquidity: Robinhood wins, hands down. By bringing 20M+ users to Kalshi’s exchange, Robinhood is the market.

- Fees: Robinhood’s flat fee ($0.02) is simpler than Kalshi’s variable fee, which can be confusing for new users.

- Platform: Kalshi wins. Kalshi offers a dedicated web platform for trading. Robinhood is mobile-only.

- Market Variety: Kalshi wins. Kalshi’s direct platform offers a much wider range of markets, including more entertainment, weather, and science markets, which Robinhood only covers to a limited extent.

Robinhood vs. Online Sportsbooks

Robinhood’s sports event contracts compete directly with online sportsbooks, but these are two very different products with unique pros and cons.

- Availability: Robinhood offers sports prediction markets in almost every state, including some that don’t yet have legal online sports betting. Sportsbooks are restricted to specific states. However, sportsbooks are more reliable in their approved states, as Robinhood’s sports markets face constant legal threats.

- Mechanics: Sportsbooks offer fixed-odds bets against the house with a far wider variety of bet types, more parlay options, and far more granular in-play wagering. Robinhood offers peer-to-peer contract trading. Placing a bet with an online sportsbook is simpler and faster than trading event contracts on a prediction market like Robinhood.

- Pricing: Robinhood’s pricing is market-driven and transparent (you see the $0.02 fee). Sportsbooks have a hidden, non-negotiable “vig” (or “juice”) built into their odds.

Robinhood Predictions App Review

From a user-experience standpoint, Robinhood’s most significant advantage is familiarity. If you have used the app for stock or crypto trading, the Prediction Markets hub feels like a natural extension: cards for each market, simple Yes/No buttons, and a swipe-to-submit order flow.

For millions of existing Robinhood customers, this is a massive “pro.” The feature is one tap away. It uses the same login, security (like 2FA), and cash balance as their stock and crypto portfolios. The interface is sleek, fast, and uses the minimalist design style Robinhood is famous for.

For users who only want to trade predictions, this is a significant “con.” You must download a large, complex brokerage app and navigate past stocks, options, and retirement accounts to find the “Predictions” tab. It’s a cluttered and distracting experience.

Critically, Robinhood’s prediction markets are mobile-only. You cannot trade event contracts from the Robinhood web platform on a desktop or laptop.

Robinhood’s mobile-only interface limits its utility for serious traders who rely on multi-screen setups and advanced charting. The trading interface itself is simple: a list of markets, a detail page with a basic price chart, and a clean trade ticket to buy or sell “Yes” and “No” contracts.

As a result, Robinhood’s main UX drawback is limited data density. Unlike dedicated exchanges, Robinhood does not expose full volume, open interest, or ladder views showing how many contracts sit at each price level.

Robinhood Predictions Deposit Methods

Robinhood offers fast deposits into a singular account that you can use to trade event contracts, stocks, options, and more. Most deposit methods are quick and incur no fees, although your bank or cryptocurrency network may assess its own fees.

In addition to bank transfers and debit cards, Robinhood supports dozens of cryptocurrencies. However, Robinhood does not accept credit cards or third-party e-wallets like PayPal. Deposit limits vary based on your account status and transfer method.

| Deposit Method | Robinhood’s Fee | Speed |

| ACH Bank Transfer | $0 | 3-5 business days |

| Instant Bank Deposit | $0 | Instant |

| Wire Transfer | $0 (your bank may charge a fee) | 1-2 business days |

| Debit Card (Visa/Mastercard) | Up to 1.75% | Instant |

| Cryptocurrency | $0 | Up to one hour |

Robinhood Predictions Customer Support

Customer support is a well-documented weak point for Robinhood. Although the company has invested in 24/7 support, it is not as accessible as competitors who offer a clear “Live Chat” button.

Robinhood primarily handles customer support through the app’s “Help” section. Users must navigate a series of help articles before seeing an option to contact a human. The primary contact methods are:

- Email / In-App Message: The most common method, but responses can be slow.

- Phone (Callback): You cannot call Robinhood directly. You must submit an in-app request for a callback.

Based on Better Business Bureau (BBB) complaints and online forums, the most common frustrations involve account restrictions.

Users report that their accounts are often “locked” for security reviews, and getting a clear, human answer on when the restriction will be lifted can be a slow and automated process.

Responsible Trading at Robinhood

Although Robinhood is technically a brokerage, not a sportsbook, it offers tools to help users manage their risk, especially given the fast-paced, volatile nature of prediction markets.

- Trading Breaks: Users can institute a voluntary “cooling-off” period, suspending their ability to trade event contracts for a set duration (e.g., 72 hours or longer).

- Position Limits: To prevent overexposure on a single outcome, contracts typically have caps on the number of positions a single trader can hold.

- Self-Exclusion: Users can voluntarily exclude themselves from accessing the prediction markets feature if they feel their trading is becoming problematic.

It is important to remember that, unlike licensed online sportsbooks, which have customizable “deposit limits” specific to wagering, your principal Robinhood account balance funds your prediction trades. As a result, you must be disciplined about how much of your total investment portfolio you allocate to high-risk, high-reward event contracts.

Robinhood Prediction Markets FAQ

Final Thoughts: Is Robinhood Prediction Markets Legit?

From a regulatory standpoint, Robinhood’s prediction market contracts are legitimate, regulated financial products. They operate through a CFTC-regulated exchange partner, and Robinhood itself is a publicly traded US broker subject to SEC and FINRA oversight.

At the same time, the Robinhood Prediction Markets app sits at the frontier of US law. Multiple states have challenged whether sports event contracts are really just sports bets under another name, leading to cease-and-desist letters, investigations, and lawsuits.

For everyday users, the bottom line is this: Robinhood’s prediction markets are real, regulated, and already large-scale, but they are not risk-free.

If you already use Robinhood and want a single, USD-based venue to trade event outcomes alongside your stocks and crypto, the Prediction Markets hub is worth exploring.

If you prioritize niche markets, full order-book transparency, or a purely forecasting-focused experience, dedicated platforms like Kalshi and Polymarket may still be better options.