- Trade yes/no prediction contracts for money

- Markets for sports, politics, and more

- Legal and regulated by the CFTC

- Available nationwide

Pros

Legal and regulated in the USA Clean, intuitive trading interface Straightforward order types Integrated into default Crypto.com appCons

Cluttered app until you enter the prediction markets Per-contract fees add up fast Limited withdrawal methodsCrypto.com Prediction Markets allow US customers to trade simple yes/no event contracts across topics ranging from sports to politics and economics for real money.

Contracts pay a fixed amount if correct and $0 if wrong, so risk is capped at your cost to enter any position. As a federally approved exchange regulated by the Commodity Futures Trading Commission (CFTC), Crypto.com is available nationwide.

In the following Crypto.com review, we’ll explain how its prediction markets work, the market categories it offers, its fee structure, where it’s strong, and where it could improve.

Crypto.com Bonuses and Promotions

Crypto.com offers a rotating lineup of new user bonuses and promotions, but they aren’t necessarily tied directly to prediction market trading. The types of welcome offers vary, ranging from earning crypto bonuses for trading cryptocurrencies on the exchange to profit boosts for buying your first sports prediction contract.

For example, one recent Crypto.com bonus invited new users to try prediction trading and offered a 2x payout (up to $100) when they completed a profitable trade.

The Positives: Crypto.com is by far the most promo-heavy prediction market. If you log in to the Crypto.com app or website and visit the current promos page, you’ll see a long list of promotional offers for completing various missions, achieving milestones, and more.

The Negatives: Crypto.com doesn’t always offer a new customer bonus tailored to users signing up to try its prediction markets. Crypto.com’s promotional approach suggests that it views prediction markets as a secondary feature to drive engagement with Crypto.com’s other products.

How Crypto.com Prediction Markets Work

Crypto.com Prediction Markets allow users to trade yes/no contracts that represent predictions on upcoming events in categories like sports, finance, politics, and pop culture:

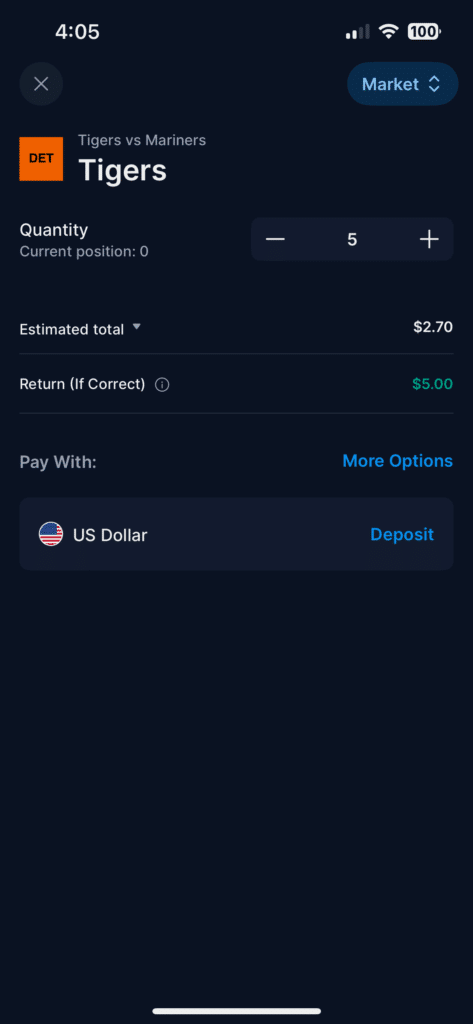

- If you believe an outcome will occur, select the “Yes” button to buy contracts on that outcome at the current market price

- Buy and sell contracts until the sporting event begins

- Contracts expire at their full value ($1 or $10, depending on the market) if they correctly predict the outcome and $0 if not

How to Win Money on Crypto.com Markets

There are two ways to profit from Crypto.com event contracts:

- Buying a contract and selling it at a higher price before the event begins

- If you hold contracts until the event begins, you receive $1 per contract that correctly predicted the outcome

How to Lose Money on Crypto.com Markets

Similarly, there are two ways to lose money trading event contracts on Crypto.com:

- Selling a contract at a lower price than you initially paid for the contract before the event begins

- If you hold contracts until the event begins, you receive $0 per contract that did not correctly predict the outcome

- The most you can lose is the amount you paid to enter the position

Crypto.com Position Limits

Crypto.com enforces the following position limits to reduce market manipulation and promote responsible trading:

- $1 Contracts: Up to 2,500,000 contracts

- $10 Contracts: Up to 250,000 contracts

Crypto.com Prediction Trading Example

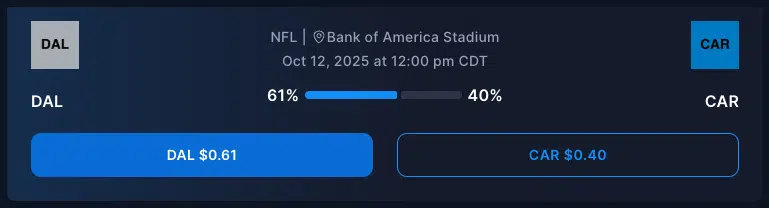

Imagine you’re looking at an NFL market for an upcoming Sunday showdown between the Dallas Cowboys and Carolina Panthers:

Let’s say you think the Cowboys will win the game, so you decide to buy 100 “Yes” contracts at $0.61 each:

- “Yes” contracts for the Cowboys are trading at $0.61. This price implies the market sees a roughly 61% chance of them winning.

- Your total initial cost, before fees, is $61 (100 contracts x $0.61)

There are two possible outcomes if you hold the contracts until the game ends:

- The Cowboys win: Your prediction is correct. Each of your 100 contracts settles at $1, for a total payout of $100. Your net profit is $39, minus any applicable fees.

- The Cowboys lose: Your prediction is incorrect. Your contracts settle at $0, and you lose your initial $61 investment.

Crypto.com Market Offerings

Crypto.com organizes its prediction markets into two broad categories: sports and everything else – each with its own subcategories.

Sports Event Contracts

Crypto.com offers sports event contracts through its official app and website interface.

Additionally, Crypto.com has a strategic partnership with Underdog Fantasy to offer sports event contracts in select states. The agreement allows Underdog Fantasy users to access Crypto.com’s sports prediction markets through the Underdog Fantasy app.

In either case, Crypto.com’s sports event contracts function as a legal alternative to sports betting for fans in states without licensed online sportsbooks.

Available markets cover all major US sports, including:

- NFL

- NBA

- MLB

- College Football

- College Basketball

- Motorsports

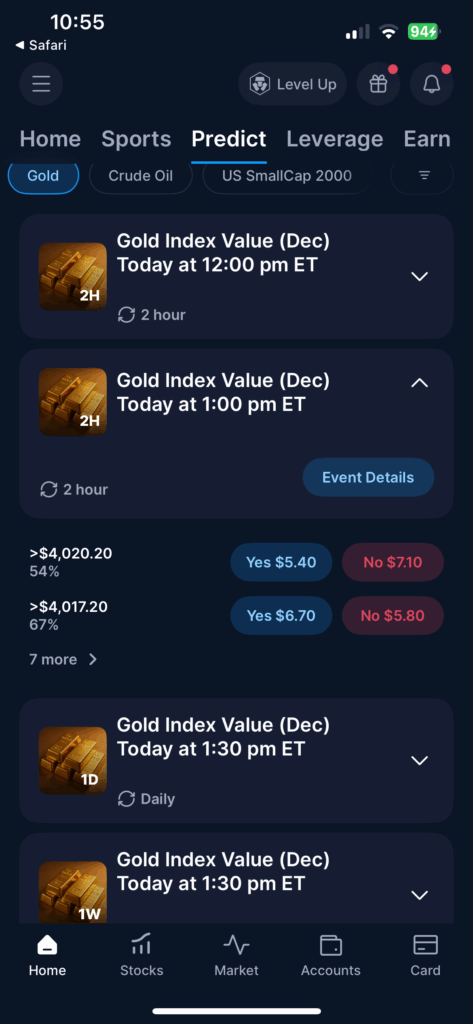

Other Prediction Markets

Although Crypto.com specializes in sports trading markets, it also covers an increasingly broad range of events in other categories, including:

- Politics: US Presidential Elections and other political outcomes.

- Economics: Unemployment rates, inflation data, and other economic indicators.

- Financials: Federal Reserve interest rate decisions and other financial events.

- Culture: Timely markets on cultural events and current affairs.

Who Can Use Crypto.com?

To use Crypto.com’s prediction markets, you must first create and verify an account on the Crypto.com app. Crypto.com’s eligibility requirements are standard for a regulated financial service:

- You must be at least 18 years old

- You must complete a mandatory Know Your Customer (KYC) verification process.

- The KYC process requires your full legal name, a photo of a government-issued ID (like a driver’s license), and a selfie.

Crypto.com Deposit Methods

Crypto.com conducts all prediction market trading in US dollars; users cannot trade directly with cryptocurrency. To participate, you must set up a dedicated USD Cash Account within the app and complete KYC verification.

Once you have a cash account, you can deposit funds via the following methods:

| Deposit Method (Crypto.com Fee) | Limit | Processing Time |

| ACH Transfer ($0) | Up to $1,000,000 per 24 hours | 3-5 business days |

| Wire Transfer ($0) | Up to $1,000,000 per 24 hours | 1-2 business days |

| Instant Deposit ($0) | Varies; new users start at $3,000 max per 24 hours; can increase up to $100,000 per 24 hours | Instant |

| Cryptocurrency ($0) | No maximum | Usually instant but can vary by cryptocurrency |

| Debit Card (Visa and Mastercard) (1.49% fee) | New users start at $1,000 per month; can increase up to $40,000 per month | Instant |

| Google Pay (1.49% fee) | New users start at $1,000 per month; can increase up to $40,000 per month | Instant |

| Apple Pay (1.49% fee) | New users start at $1,000 per month; can increase up to $40,000 per month | Instant |

Currently, the only way for US customers to withdraw from their USD Cash Accounts is via ACH bank transfer:

- Minimum withdrawal: $100

- Maximum daily limit: $100,000 ($1 million for Crypto.com Prime users)

- Maximum monthly limit: $500,000

- Fee: $0

Crypto.com Event Contract Trading Fees

Crypto.com charges per-contract fees that vary by payout tier and how you close the trade. Fees apply on open and again when you close early. If you hold to settlement, treatment varies based on contract value:

| Action | $1 Contracts | $10 Contracts |

| Open a position | $0.02 exchange fee | $0.10 exchange fee $0.10 technology fee |

| Close before expiry | $0.02 exchange fee | $0.10 exchange fee $0.10 technology fee |

| Hold to expiry (correct prediction) | Fees waived | Exchange fee: $0.10 |

| Hold to expiry (incorrect prediction) | Fees waived | Fees waived |

Crypto.com App Review and User Experience

As contradictory as it may sound, the Crypto.com app is simultaneously confusing and intuitive.

On one hand, new users may find the Crypto.com app cluttered and confusing because prediction markets are just one aspect of Crypto.com’s wider offerings.

Note: If you find Crypto.com too confusing, consider using Underdog Fantasy instead. Users in select states can use the Underdog Fantasy app to trade on Crypto.com’s prediction markets without ever leaving the app. See our Underdog Fantasy review for details.

If you don’t already use Crypto.com, it’s easy to feel overwhelmed by the many options that greet users upon opening the app: stocks vs. markets, cash accounts vs. crypto accounts, UpDown options, strike options, crypto earn, crypto staking, missions vs. rewards, and so on.

For example, new users must establish cash accounts before they can trade prediction contracts, and the app doesn’t immediately make it clear how to set one up.

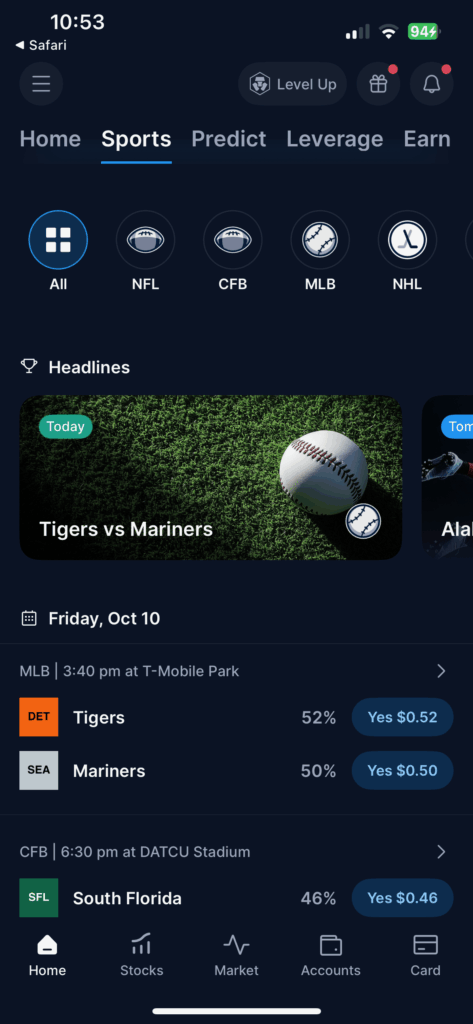

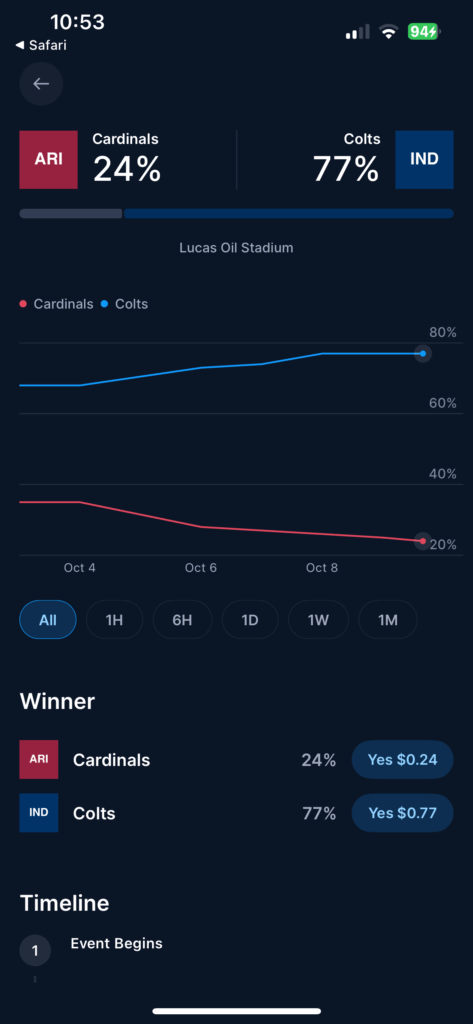

On the other hand, if you just tap the “Sports” or “Predict” tab at the top of the Crypto.com app, it will take you straight to the prediction markets and walk you through enabling event contract trading in your account.

Once you’re inside Crypto.com’s prediction markets, the rest is easy and intuitive.

All you need to do is browse the categories, open the contract card, and place your order (market or limit). The trading interface is streamlined and designed for users of all experience levels, guiding them through selecting an event, choosing Yes/No, and confirming the order details.

Crypto.com App Screenshots

How Are Crypto.com’s Sports Prediction Markets Legal?

Crypto.com’s sports prediction markets are legal nationwide because they do not constitute sports wagering and are not regulated as such.

Instead, they are derivative trading products regulated by the Commodity Futures Trading Commission (CFTC) as event contract swaps under the Commodity Exchange Act (CEA).

Crypto.com was the first licensed exchange to offer derivative products based on sporting events because it comes so close to actual sports betting.

However, the development did not occur out of the blue. Crypto.com’s sports trading markets follow the successful rollout of election contract trading by trading platforms like Kalshi and Robinhood during the run-up to the 2024 US Presidential election.

That development followed a US federal appeals court ruling in favor of Kalshi in its suit against the CFTC, which had previously prohibited derivatives based on election outcomes.

Crypto.com submitted a product filing on December 19th, 2024, informing the CFTC of its intention to offer sports event trading markets. Crypto.com’s sports markets launched a few days later.

Crypto.com Versus Sports Betting Exchanges

Crypto.com operates much like legal US sports betting exchanges.

For example, Sporttrade also offers sports contracts that expire at $0 or $100. However, Crypto.com’s sports markets differ from US sports betting exchanges in several critical aspects:

Is Crypto.com Legit?

Crypto.com is a legitimate trading platform used by 100 million+ users worldwide.

Additionally, Crypto.com | North American Derivatives Exchange is a CFTC-registered exchange. Its US credentials include:

- Broker-Dealer Registration via acquisition of Watchdog Capital (CRD#: 282331/SEC#: 8-69712)

- Derivatives Clearing Organization License (No. 38)

- Designated Contracts Market License (No. 34536)

- Money Services Business Registration (No. 31000272354498)

- Money Transmitter Licenses in 40+ States

Who Should Use Crypto.com’s Prediction Markets

- Existing customers who already use Crypto.com for trading cryptocurrencies and stocks, staking, etc. Its prediction markets slide neatly into Crypto.com’s familiar app and website.

- Sports fans in states without legal online betting (you can access its prediction markets via the Crypto.com app or Underdog Fantasy app safely and legally).

Who Should Not Use Crypto.com’s Prediction Markets

- Users who want a far wider selection of non-sports event markets in categories like politics, business, climate, health, etc.

- Users who would rather use a simpler platform that focuses exclusively on prediction markets (Kalshi, PredictIt, or Polymarket).