Political prediction markets let the average person have a tangible stake in election outcomes, policy decisions, approval ratings, and more through simple yes/no contracts. In short, they turn political opinions into tradable positions.

Although they’re often referred to as “betting on politics” online, political event contracts are traded on federally regulated exchanges, not sportsbooks. Consequently, political prediction markets are legal and available nationwide.

Read on for a comprehensive political predictions markets guide that explains:

- How political event contracts work (in simple terms)

- Where you can “bet” on politics online legally

- How political event contracts differ from sports wagers

- What to expect from the most popular exchanges

How Political Prediction Markets Work

Political prediction markets are exchanges for buying and selling simple yes/no contracts on well-defined outcomes, like who will win an election or whether a government shutdown occurs by a specific date.

Each market poses a simple question that resolves with a definitive “yes” or “no.” For example, a political market might ask, “Will Candidate X win the 2028 Presidential election?”

Each contract settles at $1 if it’s correct or $0 if it’s wrong. Prices trade between $0.01 and $0.99 and move based on user sentiment as new information arrives.

For example, if you buy “yes” contracts on Candidate X at $0.30 and that candidate wins, you’ll receive $1.00 per contract at expiry for a net profit of $0.70 per contract. If the candidate loses, your contracts will settle at $0 for a loss of $0.30 per contract.

Legal Political Prediction Markets

Currently, no state with legal online sports betting allows licensed sportsbooks to offer wagers on political events like elections and policy decisions.

The only way to “bet” on politics online is through prediction markets like Kalshi, Crypto, and other similar platforms. Fortunately, the experience is similar (you try to predict political outcomes for real-money payouts), and political prediction markets are available nationwide.

The following prediction markets are legal, reputable, and registered with the Commodity Futures Trading Commission (CFTC).

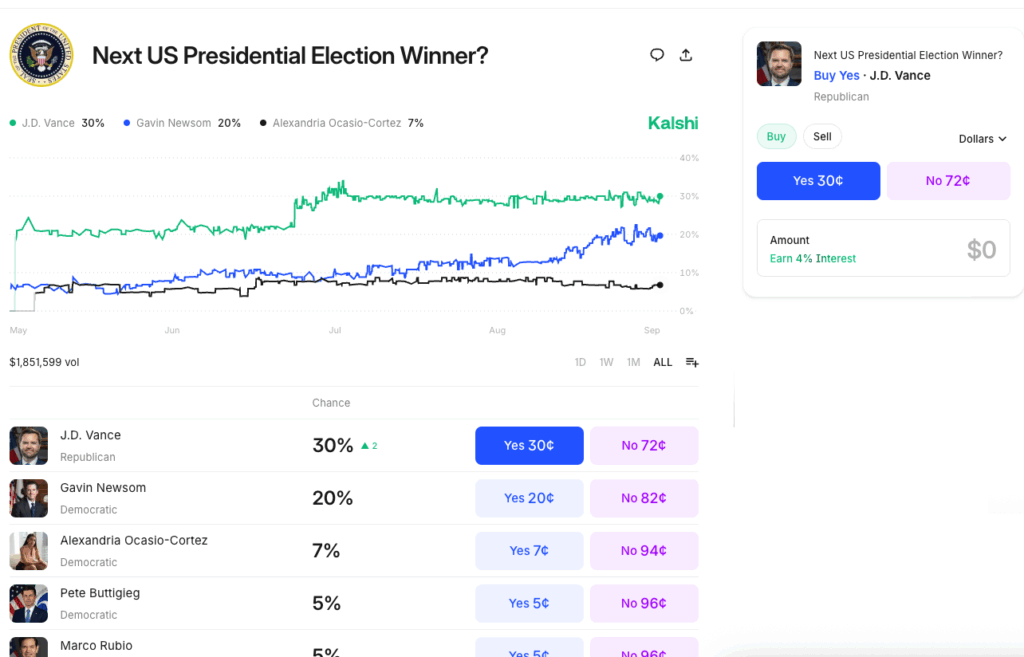

Kalshi Politics

Kalshi has one of the most extensive ranges of political prediction markets, ranging from the next US Presidential election winner to whether Congress will make Daylight Saving Time permanent.

The Kalshi political predictions tab includes submenus to drill down to specific categories, including US elections, the Presidential agenda, foreign elections, culture war issues, proposed legislation, SCOTUS rulings, debt ceiling debates, cabinet picks, speech mentions (will the speaker mention a specific topic during an upcoming speech), and more.

Read More: Kalshi Review

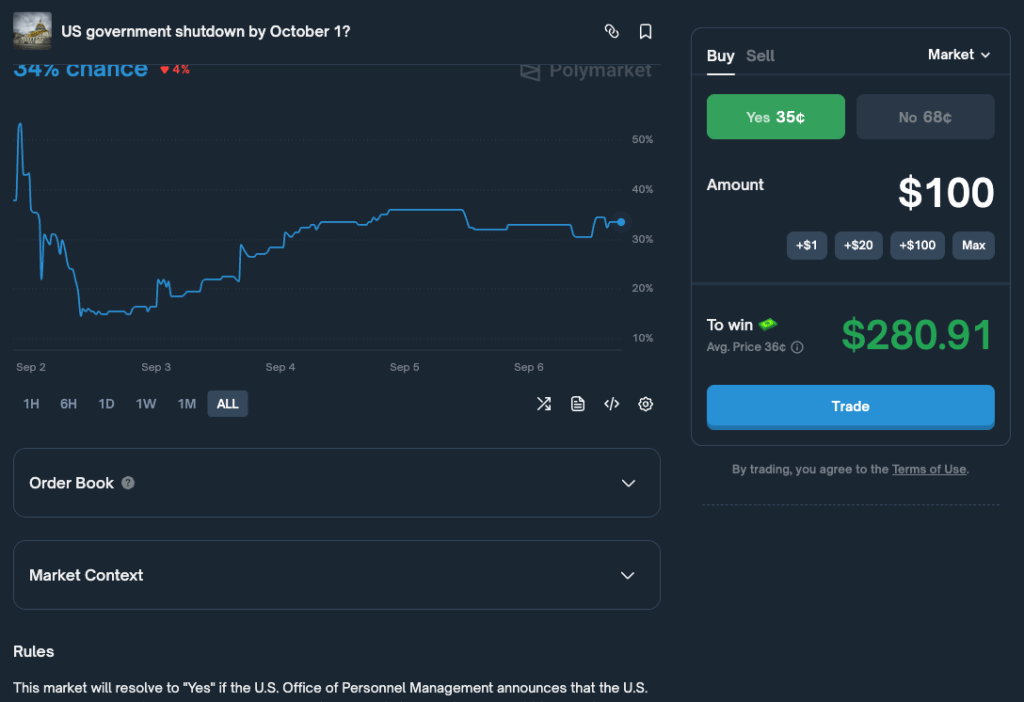

Polymarket Politics

Polymarket US also offers a massive selection of political prediction markets. Its options include national races (US presidential election), local politics (mayoral/state elections), foreign policy, international conflict, and much more.

Customers can use submenus, filters, and a search tool to drill down to specific types of political outcomes, which is critical because Polymarket has so many politics-related prediction markets available on any given day.

Read More: Polymarket Review

PredictIt Politics

PredictIt is a politics-focused prediction market and one of the oldest platforms of its type, having launched in November 2014.

Naturally, PredictIt maintains a vast array of election and political prediction markets. The elections category covers national and local elections, party nominations, and foreign elections. PredictIt also has some of the most granular election prediction markets (e.g., who will win the WI-03 House race).

PredictIt left the US market temporarily after the CFTC found the company in violation of its no-action agreement with the CFTC. However, PredictIt has since regained US access (registered with the CFTC via Aristotle Exchange).

Read More: PredictIt Review

Crypto.com Politics

Crypto.com offers a minimal selection of political markets, limited to upcoming elections and a handful of adjacent markets like Fed rate changes.

Whereas other prediction markets cover dozens if not hundreds of political outcomes at any given time, Crypto.com sticks to the absolute basics. Crypto.com also does not list political markets far in advance, so if an election isn’t imminent, you likely won’t find any contracts related to it.

Overall, Crypto.com’s political markets are more of an add-on than a staple. Crypto.com is fine if you use it for other purposes, but it shouldn’t be the first stop for anyone interested specifically in betting on politics online.

Read More: Crypto.com Review

Political Prediction Market States

Political event contracts are generally accessible nationwide.

However, availability can vary by state and platform because some states have taken positions that may affect access.

Regulators in several states are actively challenging their legality, and pending legal action could result in operators suspending some or all of their markets in specific states.

That said, the vast majority of readers will remain able to bet on politics online for the foreseeable future using CFTC-registered prediction markets.

Legal Basis for Nationwide Political Trading

Prediction markets operate in all fifty states because they are classified and regulated as exchanges, not online sportsbooks.

The Commodity Futures Trading Commission (CFTC) regulates US commodity futures and options markets. Political event contracts fall under the CFTC’s (federal) jurisdiction as a type of derivative.

A 2023 federal court case solidified this legal standing. The CFTC had initially denied a request from Kalshi to list political markets, leading to Kalshi challenging the decision. In May 2025, the CFTC voluntarily dropped its appeal, clearing a near-term path for election contracts on registered exchanges.

In contrast, state gaming commissions regulate online sportsbooks and create rules specifically for sports wagering. Their authority generally does not extend to federally regulated derivatives exchanges.

In short, political prediction markets are legal because:

- They are legally distinct from online sportsbooks

- They operate under federal law, which typically pre-empts state-level gambling laws that would otherwise prohibit political prediction markets

- Kalshi’s 2023 legal challenge established precedent

Political Betting Uncertainty Remains

Most state-level actions initiated to date focus on sports-related prediction contracts, not political listings. However, there are exceptions.

For example, Nevada’s March 2025 cease-and-desist order to Kalshi specifically stated that prediction contracts “on sporting events and election outcomes” are illegal under state law.

Additionally, some state actions focused on sports event contracts cite laws that also prohibit election wagering. For example, Illinois’ April 2025 cease-and-desist letters to Crypto.com and Kalshi were titled “Suspected Illegal Sports Wagering,” but the very law they cited also bans wagers on a “political nomination, appointment, or election.”

In short:

- Political prediction markets remain available nationwide

- Most state-level actions focus on sports event contracts

- Some exchanges may have to cease offering some products in specific states, depending on how legal challenges play out

US Political Betting Timeline

- 1868: Betting on elections flourishes after the Civil War. By the 1888 presidential election, over $165 million (in 2002 dollars) was wagered in New York alone, according to a research paper from the Journal of Economic Perspectives. By the 1920s there were de facto political bookmakers operating out of offices on Wall Street in New York City and notable wagers were published in newspapers.

- 1940: Cultural attitudes, the proliferation of polling data, regulatory measures as well as the expansion of legal pari-mutuel horse racing betting in New York and across the country mitigate the interest in political betting. Newspapers stop publishing political wagers and the market fades from the mainstream of public consciousness.

- 1974: Congress establishes the Commodity Futures Trading Commission (CFTC), which regulates derivatives including futures, swaps and other options. The CFTC grows to oversee political betting options as well.

- 1985: Regulators in Nevada, the only state with widespread legal sports and casino gambling, clamp down on bets that don’t feature a sporting competition, including current events, the outcomes of television programs, and elections.

- 1992-1993: The CFTC issues a no-action letter to the Iowa Election Markets in 1992, and broader relief arrives in 1993.

- 2006: Lawmakers pass the UIGEA to prohibit funding for online wagers, which includes risking something of value “upon the outcome of a contest of others.”

- 2012: The CFTC prohibits NADEX from taking bets on the 2012 Presidential and Congressional elections under Rule 40.11.

- 2013: Nevada legislators nix a bill to permit legal wagers on elections.

- 2014-2025 (PredictIt): CFTC issues no-action letter to PredictIt; staff withdraws it in 2022; a 2025 ruling vacates the withdrawal and enjoins shutdown (allows PredictIt to remain operational).

- 2018: West Virginia launches legal sports betting but maintains a ban on election betting (WV Code §3-9-22).

- 2020: FanDuel briefly posts Presidential election betting odds in WV; they’re pulled within an hour after officials say election betting is illegal under state law.

- 2024-2025: CFTC proposes amendments to Rule 40.11 on event contracts; federal court vacates the CFTC’s Kalshi ban; CFTC drops its appeal (May 2025).