Horse Racing Betting Handle Bounces Back In 2021

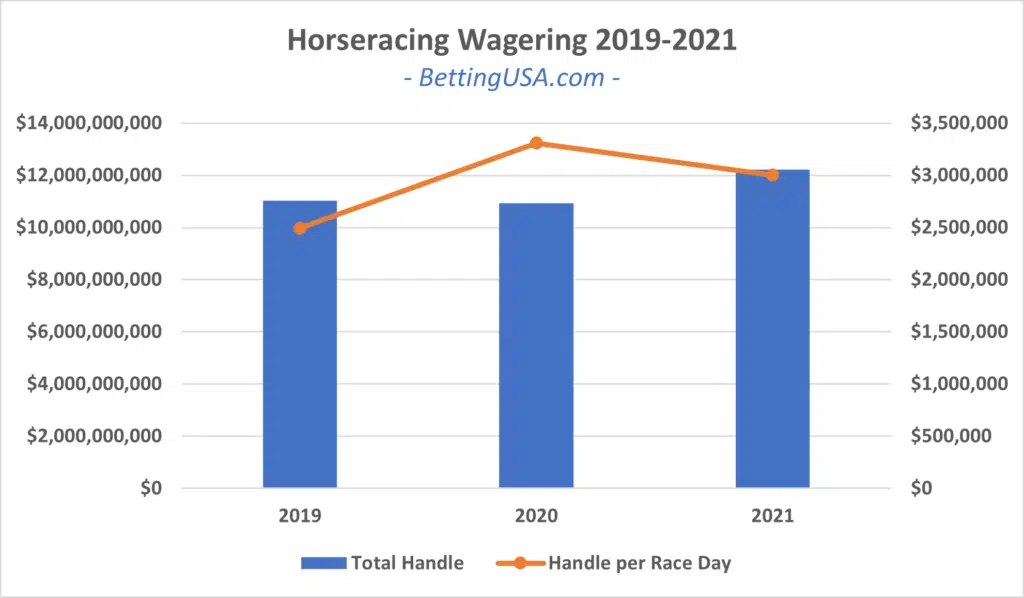

The US horse racing industry had a bounce-back year in 2021. According to data from Equibase, the industry tallied $12.2 billion in betting handle in 2021, the highest total since 2009.

“Against an extraordinarily difficult backdrop, the resiliency of Thoroughbred racing was on full display in 2021 as we concluded the year with significant growth in purses and total handle of more than $12 billion, the highest since 2009,” said Tom Rooney, president, and chief executive officer of the National Thoroughbred Racing Association. “We thank our customers for their ongoing support as their wagering dollars continue to fuel our industry. As we turn the page to 2022, we look forward to the beginning of a new era for US Thoroughbred racing with the launch of the Horse Racing Integrity and Safety Act (HISA) and an even greater focus on equine safety and welfare and the integrity of America’s oldest sport.”

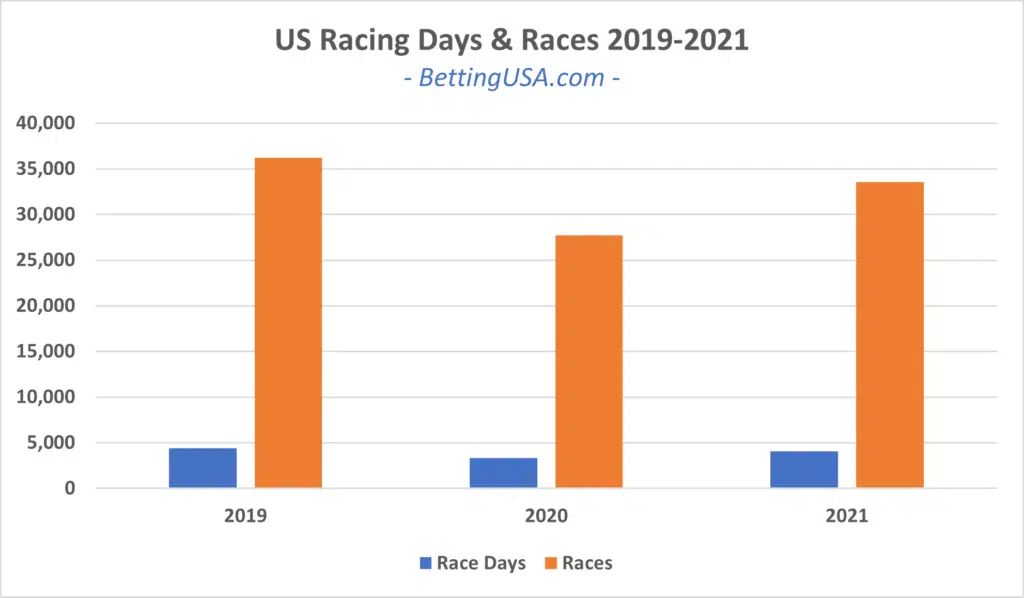

Racing Volume Still Lags 2019 Numbers

The number of bettable events (race days and races) jumped considerably year-over-year but is still markedly down compared to 2019’s pre-pandemic numbers.

Who Is Coming to the Track?

Interestingly, the number of racing days and races aren’t having a significant impact on horse racing handle, as it appears the people who stayed home during the pandemic were perhaps the smaller, more casual bettors. Evidence for this conclusion can be found in the handle per race day numbers being highest in 2020 and lowest in 2019.

This has become a familiar trend during the COVID era. Las Vegas visitation is down, but revenue is up, and according to AGA data, declining visitation and increasing revenue appear to be a nationwide trend.

A Long-Term Comparison

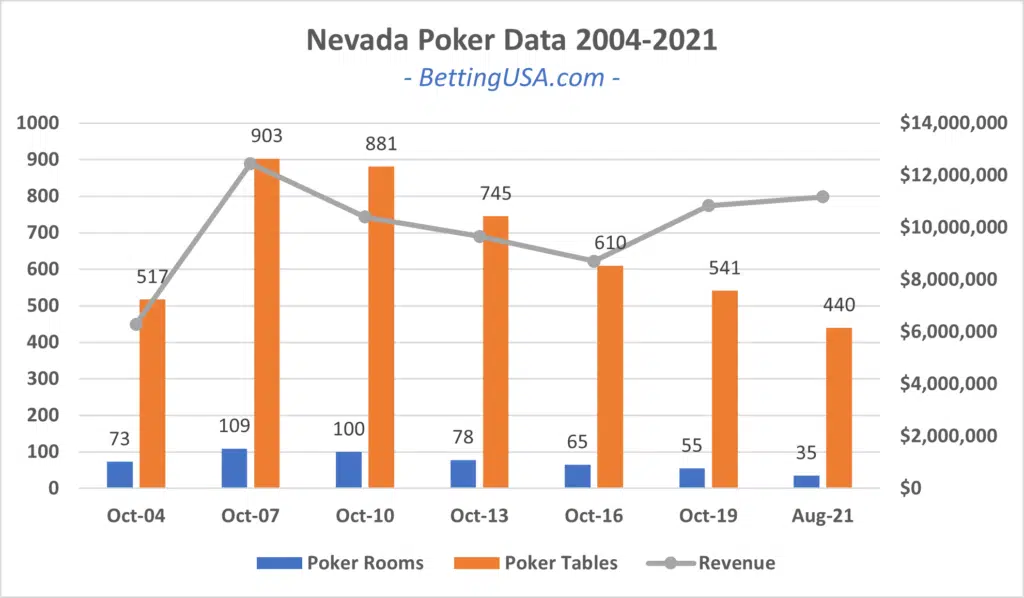

Poker has been going through a similar transformation for quite some time. Drawing on Nevada Gaming Control Board data, the number of cardrooms and poker tables in Las Vegas was in a constant state of decline during the last decade. At first, revenue was following suit, but eventually, the revenue trend reversed even as the number of cardrooms and tables continued to dwindle.

The chart below shows revenue ebbing and flowing with inventory (rooms and tables) from 2004-2016 before the two metrics diverged to the point where 2021 revenue numbers best 2010’s numbers, despite a third of the locations and half the tables.

I’ve argued in the past that poker is a victim of its own success when it comes to coverage. For comparisons, everyone points to the Poker Boom era, when online poker burst onto the scene, but that period is the outlier, and the pre-Poker Boom numbers are better comps for poker rooms and tables.

The rising revenue, despite declining inventory, is likely a case of poker rooms growing more efficient over the years. We’re in an era of fewer promotions and higher rake, which has undoubtedly contributed to the declining numbers. Still, it’s also proven to be a good business model, as poker rooms are generating more revenue with less overhead.

This is the classic example of finding the “sweet spot.” Like a restaurant or hotel that is constantly full and turning away customers, poker rooms are trying to find the right price that keeps them almost full, with the highest spending customers, which means fewer customers overall but higher revenue and profit.

This sweet spot could very well be what the racing industry is struggling to find.

Upshot

Like poker, the underlying trends in the horse racing industry don’t paint a rosy picture, but the metric that matters most (betting handle and purses) is trending in a positive direction.