Revenue vs Handle: How Should Gambling Industry Report?

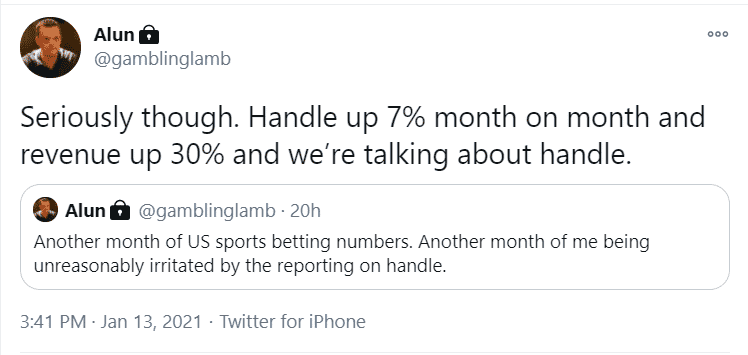

The latest New Jersey sports betting revenue report contained some very big numbers. Sports betting hit nearly $1 billion in handle, and because it’s the December report, it also includes the big year-end numbers. That said, the framing of these numbers didn’t go unnoticed on Twitter and opened up a discussion on the reporting of legal US sports betting numbers.

So what is the best way to report on sports betting markets?

Handle Numbers Jump Off the Page

Let’s face it, revenue isn’t as sexy a number as handle, especially in smaller markets.

There’s something about using “hundreds-of-millions” and “billion” that resonates. The more significant numbers also perk up lawmakers’ ears, who deal in multi-billion-dollar state budgets and don’t want to devote time and energy to controversial things like gambling for what amounts to budget dust (h/t Richard Schuetz for the term).

Put simply, getting a percentage of billions will open more doors than getting a portion of millions, even if those opportunities are one and the same.

And because the immediate goal is legal expansion, it’s not overly surprising to see sports betting handle being the number the industry is parading around.

Further, sports betting revenue can vary. Yes, players can have a good month at the blackjack tables, and a progressive slot machine can make it look like a casino had a down month, but the hold percentages for these games are pretty consistent every month. That’s not the case with sports betting.

In Nevada, hold percentages ranged from 1% to over 10% in 2020 (and that doesn’t include a negative month during casino and sport lockdowns).

In Delaware, the monthly hold percentages are all over the map, ranging from -4% to over 30% last year.

That makes sports betting revenue extremely difficult to project in the short term and next to impossible to demonstrate market growth until several years have passed. Basically, this is a good argument for using handle in developing markets.

The Problem with Using Sports Betting Handle

As problematic as revenue can be, handle has its own issues.

The amount of money wagered isn’t precisely the amount wagered.

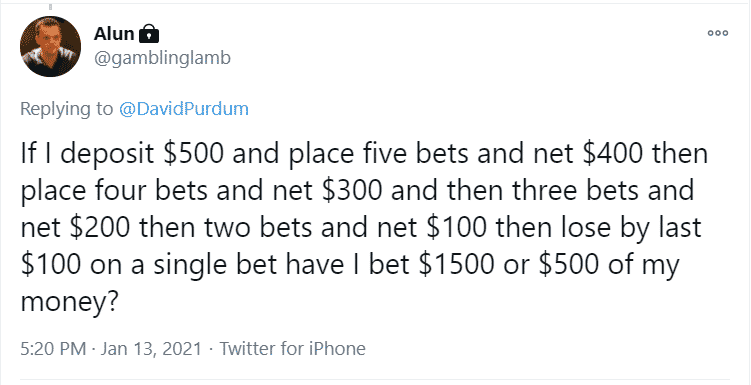

Alun Bowden provided a simple example of this on Twitter:

This hypothetical bettor managed to wager his $500 deposit three times over. That doesn’t mean they didn’t wager $1,500 (they did); it merely shows the folly of using handle as a metric.

If you were to use handle in a poker game, the amount wagered (the total of every pot) would be astronomical compared to the amount of money brought to the table by the players and the amount collected by the house.

The same holds for slot machines. The casino is returning somewhere in the neighborhood of $.90 of every dollar wagered to the customer, so $100 inserted into a slot machine, played $1 at a time, would result in nearly $1,000 wagered. The amount wagered is even higher online, where slot hold percentages hover around 95%. Online, that $100 doesn’t buy you 100 $1 spins; it gets you close to 1,000 spins.

That’s why revenue at New Jersey online casinos is reported instead of handle. In fact, sports betting is the only non-parimutuel gambling vertical that focuses on handle.

But a lot of the reported handle is recycled money that grows smaller and smaller over time until it’s replenished with new money. The structure of gambling is to take the customers slowly with a mixture of wins and losses, providing them with entertainment. And one of the best ways to accomplish that is to allow them to place more bets with the same amount of money.

Furthermore, because of this dynamic, handle is easily manipulated by a sportsbook. Free bets and other promotions change the hold percentage, which means the customer’s dollar goes further, allowing it to get wagered more times. It’s like changing the slot payout percentage from 90% to 99%, which would result in you getting 10,000 spins rather than 1,000.

It can also get artificially inflated by a massive bet on an overwhelming favorite, evidenced by the never-ending supply of stories about a $500,000 moneyline bet that would net the bettor $800.

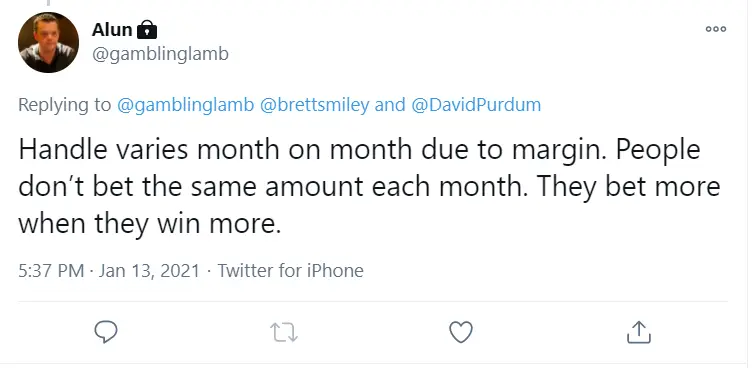

And as Bowden points out, players tend to bet more when they’re winning.

Total Deposits are the Key Metric To Monitor

The one metric that would solve all reporting issues is deposits. Unfortunately, that’s not something operators are required to or want to divulge in US markets.

Additionally, there are other ways to gauge the health of the market. Active customers and new depositing customers being two.

But until that time, we have to make do with what we have, which is a choice between handle and revenue. Or, perhaps the best option is a mixture of both.