FanDuel Daily Fantasy Sports Review

FanDuel Daily Fantasy Sports contests are offered in 44 states.

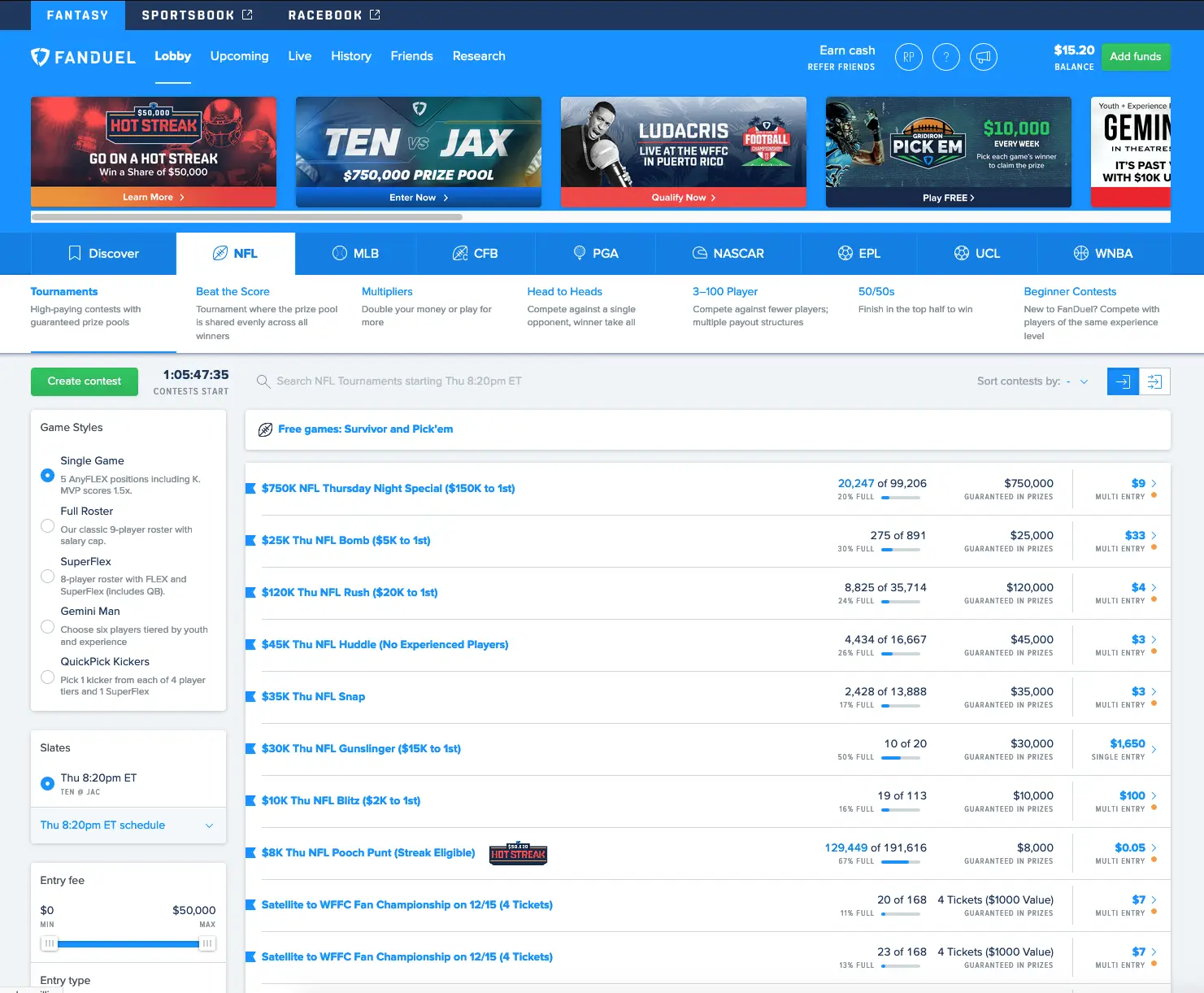

As one of the nation’s most successful DFS operators, the FanDuel Fantasy app provides a vast range of contest types with entry fees ranging from free to $50,000.

As a licensed fantasy sports site and the official partner of every major professional sports league, FanDuel DFS leaves no questions regarding its legitimacy or safety.

This FanDuel Daily Fantasy Sports review will outline the contest types, payment options, and signup bonus for DFS players.

- Legal In 44 States

- New Customer Bonus

- Free Pick'em Games

Pros

Customer Friendly Bonus Lightweight Mobile AppCons

Weak Rewards Program No Season Long LeaguesWhich States Is FanDuel DFS Available In?

FanDuel Daily Fantasy Sports app is available in the following states:

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Delaware

- Florida

- Georgia

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Nebraska

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- West Virginia

- Wisconsin

- Wyoming

FanDuel DFS Promo Code

| Title | Details |

|---|---|

FanDuel Fantasy Promo Code | Not Needed |

| Welcome Offer | 100% up to $100 First Deposit Bonus |

| How to Qualify |

|

FanDuel Daily Fantasy Sports Bonus

The FanDuel welcome bonus changes regularly, but there is always something on offer for new customers.

The current FanDuel Fantasy bonus gives new customers a 100% first deposit bonus worth up to $100. For example, a new user who registers and makes a first deposit of $75 qualifies for $75 in bonus funds to use on contest entry fees.

FanDuel DFS bonus funds are non-withdrawable, but customers may immediately withdraw any winnings obtained by using the bonus. Any unused bonus funds expire 14 days after receipt. New users do not need to use a FanDuel Fantasy promo code of any type to claim this offer; signing up for an account and depositing at least $5 is all that’s needed to receive the deposit bonus.

Compared to other DFS bonuses, this one of the better offers on the market.

Other FanDuel DFS Promotions

FanDuel also hosts frequent short-term promotions for existing customers. For reference, below is a review of the promos FanDuel had on offer at the time of this review.

- NBA Hot Streak: Players who finished in the top 50% of FanDuel’s daily “Streak Eligible” contest started or continued their streaks. The players who finished with the longest streaks qualified for cash prizes at the end of the month.

- Captain Morgan Soccer Pick’em: The weekly Captain Morgan’s Soccer Pick’em contest was free to play and offered $3,000 worth of prizes every week. Players simply entered the promo, made quick predictions for Saturday’s games, and got paid if their picks were correct.

- Hoops Challenge: The free Hoops Challenge by Hulu promotion had players pick which team will win each playoff series and in how many games. A new contest began each round, and the players with the most points earned a share of a $10,000 prize pool. The top 1,000 players qualified for the final round and a shot at the $5,000 prize pool.

- NBA Over/Under: The NBA Over/Under promotion offered users a free chance to win $5,000 in prizes. After entering, players chose the over or under for selected prop bets and won cash prizes if they got more picks correct than the competition.

How FanDuel DFS Works

Players can enter daily fantasy games at FanDuel by signing up for an account, logging in, and choosing an open contest from the lobby.

The FanDuel lobby provides all critical information at a glance, including all upcoming contests, their entry fees, prize pools, and the number of registrants. Players may sort the lobby by sports league, contest type, and buyins.

Selecting a contest opens a new window, which provides all the game details and is where players draft their teams. FanDuel provides many fantasy contest types, but they all involve selecting athletes who earn points based on their real-world counterparts’ performances. The players whose teams score the most points win cash prizes.

FanDuel DFS Contests

FanDuel hosts many different types of fantasy sports contests and frequently releases new variants, so there is always something new. The goal in every game is to accumulate the most fantasy points.

Contests vary by duration, the number of players, prize structure, drafting rules, and scoring rules. FanDuel hosts DFS contests for the following sports:

- Football

- Baseball

- Basketball

- Hockey

- Golf

- Soccer

- NASCAR

- College basketball

- College football

- UFC

- Tennis

- League of Legends

- CS:GO

- ENASCAR

- Rocket League

- Call of Duty

- Valorant

FanDuel.com DFS Championship Events

One of the primary advantages of playing with an operator as large as FanDuel is it has the numbers to support massive tournaments with huge prize pools. The weekly Sunday Million with its $500,000+ first place prize may be impressive, but FanDuel hosts contests with even bigger prize pools every season.

Typically, FanDuel’s season-finale events fly the qualifiers to destinations around the country to compete in person.

FanDuel DFS Deposit Options

Expert Opinion: Is FanDuel DFS Legit?

FanDuel.com has not maintained roughly 40% market share for years as one of the top-two fantasy sites in the country by accident. Massive prize pools, varied contest types, and buyins for any budget make FanDuel is an easy pick for anyone new to daily fantasy.

The competition can get tough at higher buyin levels and in multi-entry guaranteed prize pool tournaments, but the beginners-only contests and smaller tournaments give everyday sports fans a legitimate chance. Most importantly, FanDuel holds licenses in multiple states and pays winners quickly.