Daily fantasy sports (DFS) contests put fans in the driver’s seat by giving them a chance to build their dream teams and compete against players from around the country for real cash.

Today, daily fantasy sports sites and the best DFS apps are legal in most US states. Some states have passed legislation legalizing and regulating DFS sites, while others allow the industry to operate under existing law.

Best Daily Fantasy Sites

Play $5, Get $50 in LineupsPrizePicks Promo Code: BUSA

$50 provided as promo funds, only for use on PrizePicks. Promo funds provided under this promotion must be played within 90 days of receipt or shall become null and void at PrizePicks’ discretion. Promo ends 12/31/25. Void where prohibited. If you or someone you know has a gaming problem, get help. Crisis services and responsible gaming counseling can be accessed by calling 1-800-426-2537 or online at www.ncpgambling.org. 18+ in most eligible jurisdictions, but other age and eligibility restrictions may apply. Valid only in jurisdictions where PrizePicks operates. See prizepicks.com/terms for full PrizePicks terms of service.

Play $5, Get $50 in LineupsPrizePicks Promo Code: BUSA

$50 provided as promo funds, only for use on PrizePicks. Promo funds provided under this promotion must be played within 90 days of receipt or shall become null and void at PrizePicks’ discretion. Promo ends 12/31/25. Void where prohibited. If you or someone you know has a gaming problem, get help. Crisis services and responsible gaming counseling can be accessed by calling 1-800-426-2537 or online at www.ncpgambling.org. 18+ in most eligible jurisdictions, but other age and eligibility restrictions may apply. Valid only in jurisdictions where PrizePicks operates. See prizepicks.com/terms for full PrizePicks terms of service.

$250 First Entry RefundBoom Fantasy Promo Code: BUSA

Users must be 18+ years of age to play and deposit (19+ in Nebraska). T&Cs Apply. Gambling Problem? Call 1-800-GAMBLER. All users must have only 1 account. If a user is found to be less than 18 years old, their account will be banned and all their entries will be canceled and refunded. If a user is found to have more than 1 account, they will be subject to a ban at Boom’s discretion.

$250 First Entry RefundBoom Fantasy Promo Code: BUSA

Users must be 18+ years of age to play and deposit (19+ in Nebraska). T&Cs Apply. Gambling Problem? Call 1-800-GAMBLER. All users must have only 1 account. If a user is found to be less than 18 years old, their account will be banned and all their entries will be canceled and refunded. If a user is found to have more than 1 account, they will be subject to a ban at Boom’s discretion.

50% up to $1000Underdog Fantasy Promo Code: BETUSA

18/21+, T&Cs apply. Concerned with your play? Call 1-800-GAMBLER or visit www.ncpgambling.org; AZ: 1-800-NEXT-STEP (1-800-639-8783) or text NEXT-STEP to 53342; NY: Call the 24/7 HOPE line at 1-877-8-HOPENY or Text HOPENY (467369) Learn more about Underdog Contests and how to identify highly experienced players at www.underdogfantasy.com/rules; Learn more about average results at www.underdogfantasy.com/average-results.

50% up to $1000Underdog Fantasy Promo Code: BETUSA

18/21+, T&Cs apply. Concerned with your play? Call 1-800-GAMBLER or visit www.ncpgambling.org; AZ: 1-800-NEXT-STEP (1-800-639-8783) or text NEXT-STEP to 53342; NY: Call the 24/7 HOPE line at 1-877-8-HOPENY or Text HOPENY (467369) Learn more about Underdog Contests and how to identify highly experienced players at www.underdogfantasy.com/rules; Learn more about average results at www.underdogfantasy.com/average-results.

Free Entry + $100 Deposit BonusParlayPlay Promo Code: BUSA

18/21+, T&Cs Apply. Welcome offer is for players who make their first successful deposit to ParlayPlay. Following the deposit, you receive promo entry(s) that matches the deposit amount up to $100. The promo entry can only be used to enter up to 4-pick More/Less contests. If you lose the promo entry, your account balance is not impacted. The deposit promo entry(s) must be used within 7 days of deposit. After 7 days the free entry will expire. If you have concerns about managing your play on ParlayPlay or anywhere else, or if you’re concerned about a family member or friend, the National Council on Problem Gambling offers support through telephone or text. They can be reached confidentially (24-hours a day) at 1-800-522-4700. Or contacted on their website at https://www.ncpgambling.org/ or through chat at ncpgambling.org/chat.

Free Entry + $100 Deposit BonusParlayPlay Promo Code: BUSA

18/21+, T&Cs Apply. Welcome offer is for players who make their first successful deposit to ParlayPlay. Following the deposit, you receive promo entry(s) that matches the deposit amount up to $100. The promo entry can only be used to enter up to 4-pick More/Less contests. If you lose the promo entry, your account balance is not impacted. The deposit promo entry(s) must be used within 7 days of deposit. After 7 days the free entry will expire. If you have concerns about managing your play on ParlayPlay or anywhere else, or if you’re concerned about a family member or friend, the National Council on Problem Gambling offers support through telephone or text. They can be reached confidentially (24-hours a day) at 1-800-522-4700. Or contacted on their website at https://www.ncpgambling.org/ or through chat at ncpgambling.org/chat.

$500 Deposit BonusOwnersBox Referral Code: BUSA

18/21+ to play. Terms & conditions apply. See ownersbox.com for full offer details. If you or somebody you know has a gambling problem, help is available. Call (1-800-GAMBLER).

$500 Deposit BonusOwnersBox Referral Code: BUSA

18/21+ to play. Terms & conditions apply. See ownersbox.com for full offer details. If you or somebody you know has a gambling problem, help is available. Call (1-800-GAMBLER).

21+ to Play, T&Cs Apply. Gambling Problem? Call 1-800-GAMBLER

Only a handful of states have laws on the books that actively prohibit fantasy sports sites.

Read on for BettingUSA’s most highly recommended daily fantasy sites, reviews of major DFS providers, and detailed explanations of how fantasy sports betting works.

Fantasy Sports Sites We Recommend

The best daily fantasy sports sites we recommend joining are listed below:

PrizePicks

Play $5, Get $50 in LineupsPrizePicks Promo Code: BUSA

$50 provided as promo funds, only for use on PrizePicks. Promo funds provided under this promotion must be played within 90 days of receipt or shall become null and void at PrizePicks’ discretion. Promo ends 12/31/25. Void where prohibited. If you or someone you know has a gaming problem, get help. Crisis services and responsible gaming counseling can be accessed by calling 1-800-426-2537 or online at www.ncpgambling.org. 18+ in most eligible jurisdictions, but other age and eligibility restrictions may apply. Valid only in jurisdictions where PrizePicks operates. See prizepicks.com/terms for full PrizePicks terms of service.

Play $5, Get $50 in LineupsPrizePicks Promo Code: BUSA

$50 provided as promo funds, only for use on PrizePicks. Promo funds provided under this promotion must be played within 90 days of receipt or shall become null and void at PrizePicks’ discretion. Promo ends 12/31/25. Void where prohibited. If you or someone you know has a gaming problem, get help. Crisis services and responsible gaming counseling can be accessed by calling 1-800-426-2537 or online at www.ncpgambling.org. 18+ in most eligible jurisdictions, but other age and eligibility restrictions may apply. Valid only in jurisdictions where PrizePicks operates. See prizepicks.com/terms for full PrizePicks terms of service.

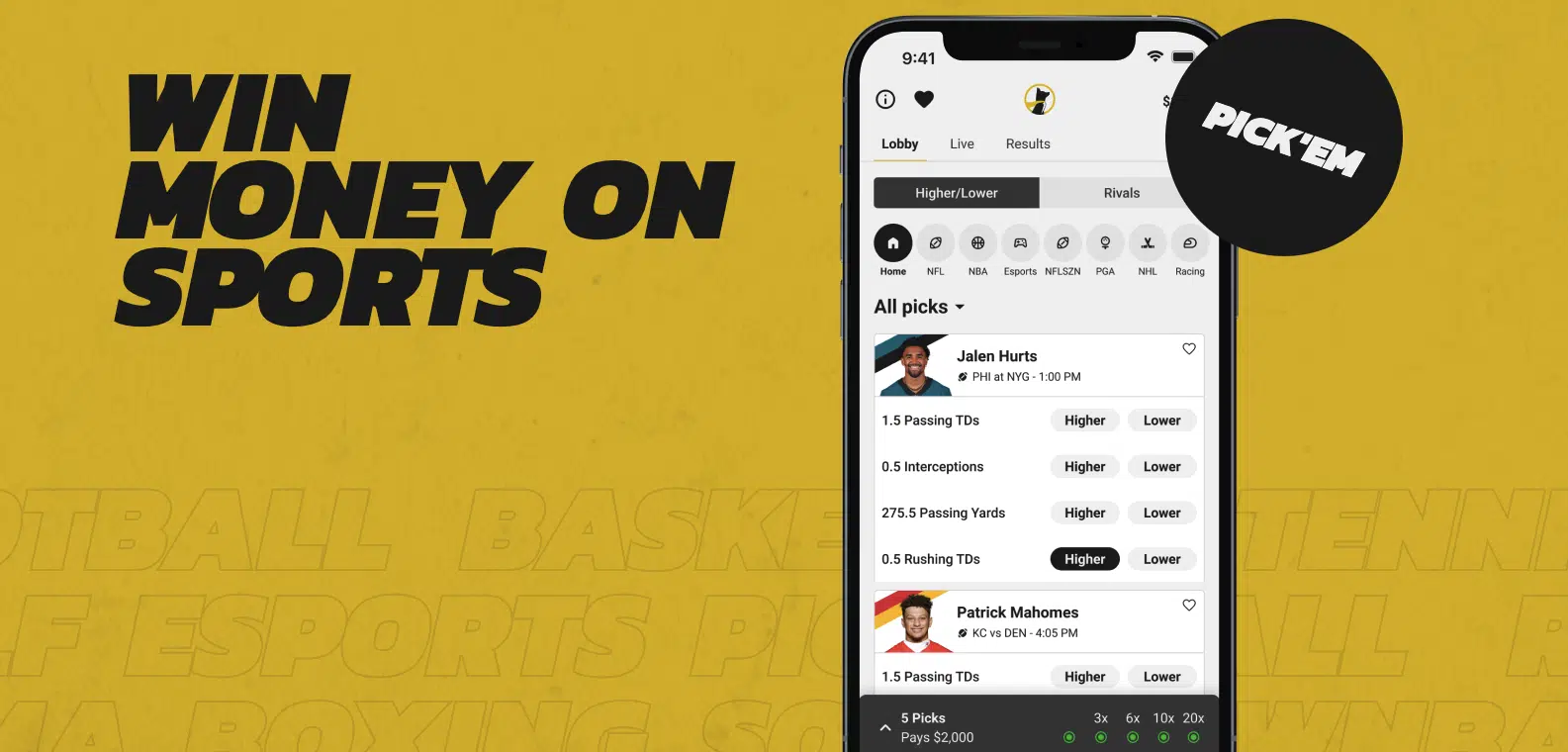

- Sports Covered: NFL, MLB, NBA, NHL, PGA, UFC, tennis, soccer, college sports, esports, niche sports like disc golf and jai alai; special events like the hot dog eating contest, NBA dunk contest, celebrity boxing matches

- Pick’em Game Types: Power Play (higher payouts, must get all predictions right); Flex Play (lower max payouts but secondary payouts for not getting all predictions right); Arena (peer-vs-peer pick’em contests played against other players)

- Max Payouts: Up to 100x entry fee

- Notable Features: Demons and Goblins; Reboots

PrizePicks provides a simple form of daily fantasy that feels a lot like traditional sports betting. In each PrizePicks contest, users select a handful of athletes and make over/under predictions on each athlete’s projected fantasy points total.

Unlike standard fantasy contests, PrizePicks players do not play against other users. Instead, they earn payouts based on the accuracy of their predictions. Players can earn up to 100 times their initial buyins for making just five accurate predictions or make fewer predictions for smaller prizes.

PrizePicks is the best all-around fantasy pick’em site for multiple reasons.

Most importantly, PrizePicks is a reputable operator with a massive customer base and no shortage of experience.

Other highlights include an excellent mobile app that’s intuitive to use and runs smoothly, unique game types, a vast variety of supported sports leagues, and player-friendly features.

For example, the PrizePicks Reboot policy keeps players in the game if one of their athletes leaves the game in the first half and doesn’t return in the second. In that case, the entry reverts down one level (e.g., a 6-Pick Flex becomes a 5-Pick Flex) instead of losing outright.

Standard PrizePicks games offer payouts up to 25x, but players can submit “Demon” projections that are more difficult to win but that boost the max payout to up to 100x.

Likewise, players can submit “Goblin” predictions that are much easier to win but reduce the maximum potential payout.

Underdog Fantasy

50% up to $1000Underdog Fantasy Promo Code: BETUSA

18/21+, T&Cs apply. Concerned with your play? Call 1-800-GAMBLER or visit www.ncpgambling.org; AZ: 1-800-NEXT-STEP (1-800-639-8783) or text NEXT-STEP to 53342; NY: Call the 24/7 HOPE line at 1-877-8-HOPENY or Text HOPENY (467369) Learn more about Underdog Contests and how to identify highly experienced players at www.underdogfantasy.com/rules; Learn more about average results at www.underdogfantasy.com/average-results.

50% up to $1000Underdog Fantasy Promo Code: BETUSA

18/21+, T&Cs apply. Concerned with your play? Call 1-800-GAMBLER or visit www.ncpgambling.org; AZ: 1-800-NEXT-STEP (1-800-639-8783) or text NEXT-STEP to 53342; NY: Call the 24/7 HOPE line at 1-877-8-HOPENY or Text HOPENY (467369) Learn more about Underdog Contests and how to identify highly experienced players at www.underdogfantasy.com/rules; Learn more about average results at www.underdogfantasy.com/average-results.

- Sports Covered: NFL, MLB, NBA, NHL PGA, UFC, NASCAR, tennis soccer, college sports, cricket, and special events like the MLB All-Star Game

- Pick’em Game Types: Standard Pick’em, Rivals, and Pick’em Champions (peer-to-peer pick’em contests played against other players)

- DFS Contest Types: Salary Cap DFS Contests and Season-Long Best Ball Leagues

- Max Payouts: Up to 20x

- Notable Features: Rescues, Insurance, Scorchers, Specials, In-Play Projections

Underdog Fantasy is another popular, well-established sports prediction site with an excellent selection of game types and features:

- Standard Pick’em: Make 2-5 more/less projections on athlete stats like rebounds, rushing yards, etc. for payouts ranging from 3x to 20x

- Rivals Pick’em: Underdog Fantasy provides pairs of athletes for particular stats, and players predict which athlete will perform better in that stat. Players select 2-5 pairs and make one prediction for each. Payouts range from 3x to 20x.

- Pick’em Champions: Make 2-5 more/less projections and compete against other players. If exactly one player gets the most projection correct, they win the predesignated Champions Prize. Players who tie for the greatest number of accurate picks split the Champions Prize evenly.

Unique Underdog Fantasy features include Scorchers that boost any entry’s max payout and Specials that heavily adjust an athlete’s projection to give the customer a significantly improved chance of getting that prediction right.

Underdog Fantasy also offers Rescues, where if an athlete leaves the game in the first half and doesn’t return in the second half, Underdog will refund the entry and drop a Special in the customer’s account.

Additionally, Underdog Pick’em offers in-play projections, the pick’em equivalent of in-game sports betting.

In summary, Underdog Fantasy ranks among the best fantasy pick ‘em sites because it is reputable, intuitive, and offers a huge range of game types and leagues.

ParlayPlay

- Sports Covered: NFL, NBA, NHL, MLB, UFC, various soccer leagues, and esports like CS:GO, LoL, Valorant, and Dota

- Pick’em Game Types: More or Less and Hit-It (predict stat totals within predetermined ranges)

- Max Payouts: Up to 155x

- Notable Features: Alt lines, stat shifts

ParlayPlay is an app like PrizePicks that offers pick ’em predictions contests with cash prizes.

In a typical ParlayPlay contest, players select two or more athletes and predict whether they will accumulate over or under their projected statistical totals.

For example, a player might predict whether each of three quarterbacks will pass for more or less yards than their projected passing totals.

ParlayPlay isn’t as well-known as some of the other fantasy pick’em sites discussed on this page, but it has numerous strong points that make it a legitimate contender.

For one, ParlayPlay covers a good range of sports, including all major professional US leagues, international soccer, and esports.

Second, ParlayPlay is the only prominent fantasy pick’em app with a game type other than “more or less” predictions. ParlayPlay’s Hit-It contests require players to predict two athletes’ stat totals within ranges to earn payouts of 2x if they get one right or 6x if they get both right.

ParlayPlay also allows customers to use one stat shift per day, which moves the projection up or down by a half point to make that prediction easier. Stat shifts are essentially the pick’em fantasy equivalent of teasers in sports betting but don’t negatively impact the potential payout.

The most noticeable negative point is ParlayPlay’s app. The interface is unintuitive, looks dated, and seems to list athletes randomly, which can make it frustrating to ensure every entry contains athletes from at least two different teams.

Boom Fantasy

$250 First Entry RefundBoom Fantasy Promo Code: BUSA

Users must be 18+ years of age to play and deposit (19+ in Nebraska). T&Cs Apply. Gambling Problem? Call 1-800-GAMBLER. All users must have only 1 account. If a user is found to be less than 18 years old, their account will be banned and all their entries will be canceled and refunded. If a user is found to have more than 1 account, they will be subject to a ban at Boom’s discretion.

$250 First Entry RefundBoom Fantasy Promo Code: BUSA

Users must be 18+ years of age to play and deposit (19+ in Nebraska). T&Cs Apply. Gambling Problem? Call 1-800-GAMBLER. All users must have only 1 account. If a user is found to be less than 18 years old, their account will be banned and all their entries will be canceled and refunded. If a user is found to have more than 1 account, they will be subject to a ban at Boom’s discretion.

- Sports Covered: NFL, MLB, NBA, NHL, NBA All-Star Game, college sports

- Max Payouts: Up to 500x

- Pick’em Game Types: Standard (up to 20x payout), Favorites (easier predictions with a 3x max payout), Longshots (harder predictions for up to 40x payouts), and Pick & Spins (randomized payout of 2x to 500x).

- Notable Features: Spin the bonus wheel in Pick & Spin games for a randomized payout multiplier of up to 500x; Coverage option to enable consolation cash prizes when you miss one or two predictions at the cost of reduced max payouts for perfect entries

Boom Fantasy is the most intuitive and straightforward operator in this space, making it ideal for fans who don’t have experience with other fantasy pick’em sites.

All Boom Fantasy pick’em games involve making 2-5 over/under predictions, and players can choose from three difficulty levels.

For example, Favorites contests offer easy predictions (like taking the OVER on the NFL’s best quarterback getting at least 200 passing yards) at the cost of reduced payouts.

Additionally, Boom Fantasy’s Pick & Spin games offer the chance to play for some of the biggest fixed payouts in daily fantasy. In Pick & Spin games, players submit two predictions and spin the prize wheel for a randomized payout multiplier ranging from 2x to 500x.

The Boom Fantasy app uses a straightforward interface that makes it easy even for inexperienced players to log in, select a game type, and submit predictions.

FanDuel DFS

FanDuel.com opened for business in 2009 and quickly grew to become one of the most prominent players in the fantasy sports industry.

FanDuel.com has earned a reputation for quick payouts and fair games.

FanDuel DFS players can join public events and compete for massive prize pools, start private contests with their friends, or compete in heads-up contests for payouts just shy of 2x.

FanDuel DFS contest buyins range from $1 to $200, sometimes higher for special events.

FanDuel offers DFS players some of the highest payouts in daily fantasy sports, with first-place prizes occasionally exceeding $1 million.

For fans who want to compete for the biggest prizes, FanDuel is an easy choice.

DraftKings DFS

Boston-based DraftKings is home to massive prizes, innovative social features, and varied DFS contest formats such as season-long best ball games.

DraftKings accepts convenient payment methods, including credit cards, debit cards, PayPal, and prepaid gift cards. As a result, DraftKings is one of the best DFS sites for new fans to play at for real money.

DraftKings DFS also hosts frequent mega contests with seven-figure payouts to the winners and significant prizes to the runners-up.

Many players prefer DraftKings’ software and mobile app over FanDuel’s because it embeds many features without cluttering the interface or complicating navigation.

OwnersBox DFS

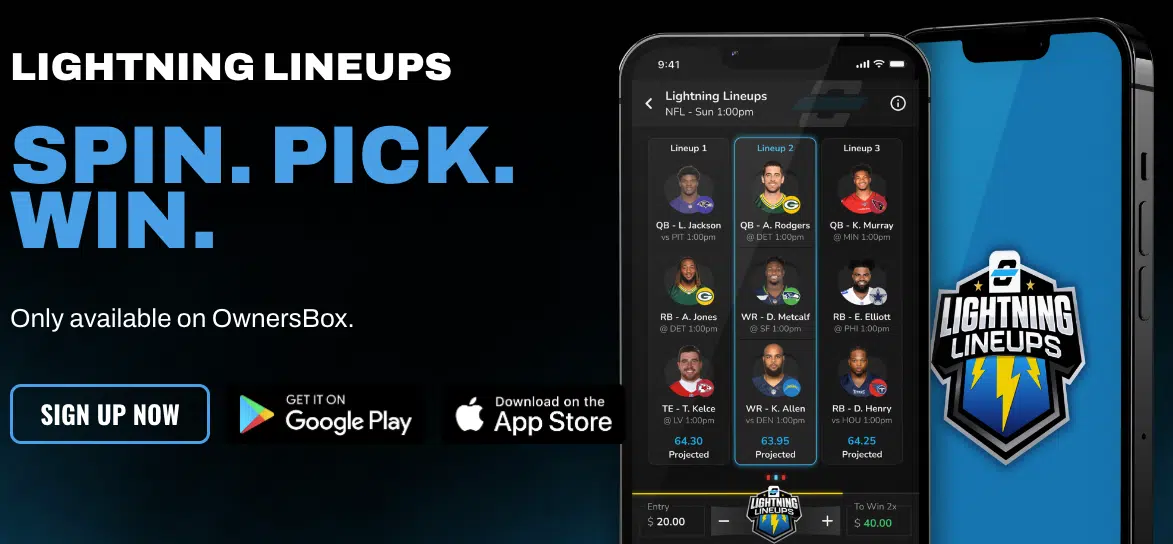

- Sports Covered: NFL, NBA, MLB, and NHL

- Pick’em Game Types: Lightning Lineups

- DFS Contest Types: SuperFlex DFS

- Max Payouts: Lightning Lineups pay up to 6x; daily and weekly fantasy contest payout vary

- Notable Features: Daily and weekly salary cap contests in addition to pick’em games; social media element to add friends and chat with other users; daily, weekly and season-long challenges to earn OwnersBux, which are convertible to real money

OwnersBox operates closer to the DFS side of fantasy sports than most fantasy pick’em sites.

Instead of more-or-less projections on individual stats like passing yards or three points, OwnersBox contests involve projections on fantasy point totals.

Basic Lightning Lineup contests generate three random lineups and ask players to select which lineup of the three will earn the most fantasy points. If the chosen lineup outscores the others, the player wins a cash payout.

If players don’t like the three lineups they’ve been given, they can hit the spin button as many times as they wish to generate new random lineups.

Players can also increase the payout multiplier by adding lineups to the selection pool. In short, the more lineups you have to pick from, the bigger the payout when you pick the one that outscores all the others.

Which States Allow Daily Fantasy Sports?

Key

- Red = Prohibited

- Blue = Legal

Fantasy

Each state takes a different approach to legal daily fantasy sports.

Some states have passed laws to regulate DFS operators, others states prohibit daily fantasy sports, and some states do not regulate the industry at all.

Below are brief overviews of daily fantasy sports legal status in every state.

States Where DFS Is Allowed

- Alabama Daily Fantasy Sports

- Alaska Daily Fantasy Sports

- Arizona Daily Fantasy Sports

- Arkansas Daily Fantasy Sports

- California Daily Fantasy Sports

- Colorado Daily Fantasy Sports

- Connecticut Daily Fantasy Sports

- Delaware Daily Fantasy Sports

- Florida Daily Fantasy Sports

- Georgia Daily Fantasy Sports

- Illinois Daily Fantasy Sports

- Indiana Daily Fantasy Sports

- Iowa Daily Fantasy Sports

- Kansas Daily Fantasy Sports

- Kentucky Daily Fantasy Sports

- Louisiana Daily Fantasy Sports

- Maine Daily Fantasy Sports

- Maryland Daily Fantasy Sports

- Massachusetts Daily Fantasy Sports

- Michigan Daily Fantasy Sports

- Minnesota Daily Fantasy Sports

- Mississippi Daily Fantasy Sports

- Missouri Daily Fantasy Sports

- Nebraska Daily Fantasy Sports

- New Hampshire Daily Fantasy Sports

- New Jersey Daily Fantasy Sports

- New Mexico Daily Fantasy Sports

- New York Daily Fantasy Sports

- North Carolina Daily Fantasy Sports

- North Dakota Daily Fantasy Sports

- Ohio Daily Fantasy Sports

- Oklahoma Daily Fantasy Sports

- Oregon Daily Fantasy Sports

- Pennsylvania Daily Fantasy Sports

- Rhode Island Daily Fantasy Sports

- South Carolina Daily Fantasy Sports

- South Dakota Daily Fantasy Sports

- Tennessee Daily Fantasy Sports

- Texas Daily Fantasy Sports

- Utah Daily Fantasy Sports

- Vermont Daily Fantasy Sports

- Virginia Daily Fantasy Sports

- West Virginia Daily Fantasy Sports

- Wisconsin Daily Fantasy Sports

- Wyoming Daily Fantasy Sports

States Where DFS Is Prohibited

- Hawaii

- Idaho

- Montana

- Nevada

- Washington

Daily Fantasy Sports Apps

FanDuel and DraftKings dominate the daily fantasy industry, but new DFS sites like PrizePicks, Boom Fantasy, and Underdog Fantasy are creating innovative content formats and gaining market share.

There are numerous daily fantasy sports apps to choose from today, and the differences between DFS sites can be significant.

Choosing the best daily fantasy sports apps involves finding safe DFS operators that match players personal preferences.

Players interested in massive, guaranteed DFS prize pool contests with million-dollar payouts should consider mainstream operators such as FanDuel and DraftKings.

Likewise, fans looking for the closest alternative to sports betting should consider entirely different types of DFS apps like PrizePicks.

BettingUSA’s daily fantasy sports reviews are neutral and unbiased, openly discuss pros and cons, and explain how each fantasy app works.

Key Considerations in Our DFS Reviews

Below is an explanation of BettingUSA’s approach to reviewing daily fantasy sports sites. These are the key considerations BettingUSA makes when writing DFS app reviews and making recommendations.

DFS Bonuses and Promotional Offers

Daily fantasy sports bonuses come in many forms: first deposit bonuses and welcome promotions play a prominent role in the marketing efforts of almost every fantasy sports app. Most DFS sites regularly offer deposit bonuses, free contest entries, and other perks to players who sign up and enter real-money contests.

How Daily Fantasy Sports Works

Daily fantasy sports contests are a twist on traditional, season-long fantasy leagues. The biggest difference between the two is that daily fantasy contests only last for a limited slate of games, typically covering a day or a single week’s worth of action.

Sports fans can try playing fantasy sports contests for real money by creating an account at any DFS site recommended on this page, and checking the app for a list of upcoming contests.

Most daily fantasy sports apps offer contests for a range of leagues, including the NFL, NBA, MLB, NHL, NASCAR, UFC, golf, tennis, and college sports.

Every fantasy sports contest covers a specific “slate” of games spanning a single week, weekend, or day. For example, a typical Sunday NFL slate covers all NFL games scheduled for that day.

After entering a contest, entrants draft a team of athletes expected to play in that slate of games. Most DFS contests give each athlete a fixed cost according to their recent performances and desirability.

For example, a star quarterback will cost significantly more than a backup QB.

DFS players can pick any player as long as they stay within the salary cap.

For example, let’s use a total starting budget of $50,000:

If you draft one of the best quarterbacks in the league for $10,000, you will inevitably give up strength in another key position because your pick just took 20% of your salary cap, and you still have several slots to fill in your lineup.

After assembling your lineup, watch how the athletes on your team perform and earn points as your players rack up stats in real-time. Touchdown passes earn points for your quarterback, turnovers earn points for your defense, and so on.

If your draft lineup collectively scores more points than the competition, you receive a real money payout.

Daily fantasy sports sites structure contests in many formats. Players can compete in head-to-head matches against a single opponent, join tournament-style competitions with thousands of other players, or make simple predictions against the house.

Payouts vary based on the rules of each contest and the number of entrants. Some DFS contests have winner-take-all prizes, while others provide tournament-style payouts to the top X% of finishers.

In any case, the goal is to score as many points as possible by selecting athletes who perform well on game day.

Start Playing Fantasy Sports

For anyone completely new to daily fantasy sports, this section details the basic step-by-step process of how to play daily fantasy sports for real money prizes.

Are Fantasy Sports Sites Legal?

Yes. Fantasy sports contests are legal at the federal level and in most states.

A handful of states with strict gambling laws prohibit daily fantasy contests, but most fans nationwide have access to daily sports fantasy apps.

Many states are now focused on legalizing sports betting, but the DFS industry had a head start thanks to a special exemption from the UIGEA.

The legality of daily fantasy sports wasn’t always this clear, though. When FanDuel and DraftKings were undergoing their first significant growth phase, they had to deal with substantial legal uncertainty in nearly every state.

DFS sites consider their real money contests games of skill, but Attorneys General in multiple states challenged that view and ordered FanDuel and DraftKings to cease operations, initiating a multi-state legal battle that had both companies fighting for their very existence.

DFS operators also initiated extensive state-level lobbying campaigns, hoping to shape the perception of lawmakers across the country.

In addition, FanDuel and DraftKings went on a national advertising blitz, forged partnerships with professional sports teams, and held multiple investment rounds.

These efforts were largely successful, and fantasy sports sites secured access to most states thanks to a combination of lawmakers passing DFS regulation, and Attorneys general in other states choosing not to intervene.

Only a few states today have laws on the books that explicitly prohibit daily fantasy sports.

Types of Daily Fantasy Sports Contests

Fantasy sports sites have introduced many contest types that can generally be classified into two overarching categories: DFS tournaments and cash games.

Types of Daily Fantasy Drafts

Daily fantasy cash games and tournaments also vary in how players build their lineups:

- Salary Cap: Most fantasy sports games use the salary cap model for lineups. That is, players receive a virtual salary to spend on athletes and build the best team possible. In a salary cap game, drafting an athlete does not remove him from the pool for everyone else; all athletes are available to all contestants.

- Snake Draft: Season-long fantasy football leagues have used snake drafts for years. In a snake draft, players take turns drafting athletes from around the league, and once an athlete is drafted, no other player may select that athlete. The snake draft format keeps things fair by reversing the order of picks each round. For example, the person who picks first in the 1st round will pick last in the 2nd round.

- Auction Draft: An auction draft works sort of like a snake draft, but rather than simply drafting an athlete when it’s their turn, players nominate an athlete to go on auction. During the action, everyone can bid on the athlete, who goes to the highest bidder. Auction drafts are highly strategic because players have limited salaries and must carefully choose not only who they draft but who they nominate.

- Pick’em: Various fantasy sites use the term “pick‘em” differently. For example, DraftKings offers pick‘em contests in which players build lineups by making one selection at a time from groups of athletes chosen by DraftKings. However, some daily fantasy sports sites have pick’em contests that involve making in-game predictions for fixed payouts.

Fantasy Pick’em Sites

Some daily fantasy sports sites provides an experience remarkably similar to sports betting that is legal in most states.

Pick’em fantasy sites function completely differently than sites that specialize in DFS tournaments and cash games.

Instead of building lineups, contestants make more-or-less predictions on individual athlete’s stats, like rushing yards and three-pointers. Some pick’em fantasy sites also offer more-or-less predictions on how many fantasy points individual athletes will score.

Pick’em fantasy predictions resemble sports betting totals (over/under wagers) but they meet the legal definition of daily fantasy sports because they always require players to build “lineups” consisting of predictions for at least two athletes from different teams.

This style of fantasy sports contests takes a unique approach to predictions and over/under props, providing an exciting way for fans in states without legal online sports betting to play for real money.

Fantasy props and over/under DFS contests differ from standard daily fantasy sports contests in two primary ways:

- Players attempt to predict the statistical performances of two or more individual athletes

- Players compete against the house for fixed payouts (a growing point of contention in some states, which has resulted in some operators offering peer-to-peer pick’em contests in which players compete with each other for payouts)

For example, a typical PrizePicks contest involves three steps:

- Select two to five athletes slated to play in upcoming games

- Predict whether each will have OVER or UNDER the projected number of passing yards, points, shots on goal, etc.

- Receive a payout of up to 25x the initial buyin fee

Other DFS prediction apps offer similar types of contests, with payouts as high as 500x the initial buy-in.

The most popular daily fantasy sports predictions apps include:

- PrizePicks

- Underdog Fantasy (also offers best ball DFS)

- OwnersBox

- ParlayPlay

Tip: fantasy props and over/under contests are the next best thing to full-fledged sports betting for fans in states without legal online sportsbooks.

Legal Issues Involving Fantasy Pick’em Apps

Increasingly, state gambling regulators are investigating the fantasy pick’em business model and concluding that it meets the state’s legal definition of sports betting.

As a result, fantasy pick’em sites have had to adjust their contest rules, apply for sportsbook licenses, or exit some states entirely. The increased scrutiny creates legal risk for fantasy pick’em operators but not for customers.

In multiple states, local officials have sent cease-and-desist orders to popular pick’em fantasy sites.

The future of pick’em fantasy is uncertain, but none of the legal issues operators face are direct concerns to fans. In every state where fantasy pick’em has come under fire, regulators have only targeted operators with threats of legal action.

How Fantasy Pick’em Apps Manage Regulatory Risk

Operators have responded to the legal issues they face by adjusting their contest rules in some states or pausing their operations indefinitely in others.

Additionally, a handful of fantasy pick’em operators have joined forces to form the Coalition for Fantasy Sports. PrizePicks, Underdog Fantasy, Betr, and Dabble established the Coalition for Fantasy Sports to advocate for favorable legislation, discourage unfavorable regulatory action, and enhance goodwill by promoting responsible gambling.

As its mission statement explains, the Coalition aims “to protect fantasy sports fans and users by promoting innovation, ensuring responsible play, and removing barriers to growth that threaten the fantasy sports industry.”

For instance, the Coalition of Fantasy Sports partnered with responsible gambling firm idPair to launch the industry’s first national self-exclusion program. The program allows fans to self-exclude from all Coalition members’ platforms nationwide with a single request.

How Pick’em Fantasy Works

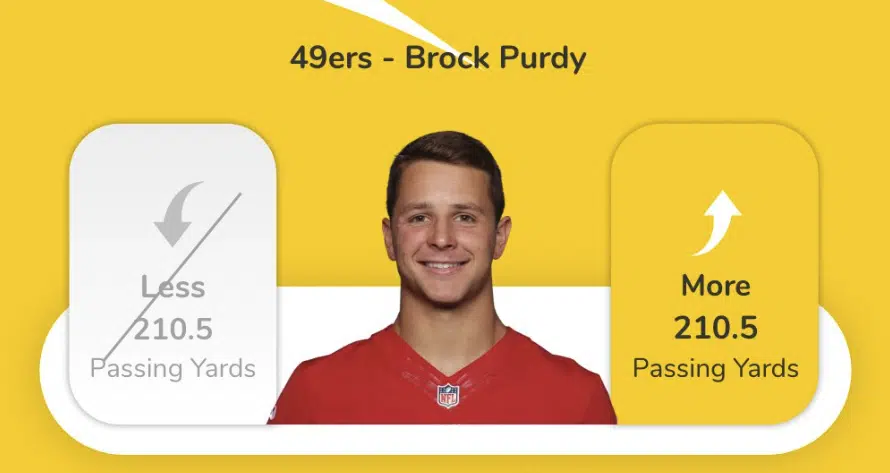

The pick ‘em fantasy concept revolves around predicting whether athletes will exceed their projected totals in key stats.

Most pick ‘em fantasy sites present a list of athletes and their projected stat totals on the homepage.

For example, a pickem fantasy site might list Patrick Mahomes with a projected total of 300.5 passing yards in his next game.

From there, the player can start building an entry by adding Mahomes and selecting “more” or “less.”

If the player selects “more” and Patrick Mahomes throws for more than 300.5 passing yards, their prediction is correct.

The concept is a lot like sports betting totals up to this point. The difference is that fantasy pick ‘em sites require players to build entries (also sometimes referred to as lineups or pick sets) consisting of at least two athletes from two different teams.

The best fantasy pick’em apps introduce various tweaks on the concept to offer unique game types, but the fundamental question is always this:

Will my athletes exceed their projected stat totals?

If every prediction on the lineup is correct, the player wins a cash prize. Some fantasy sites also offer reduced payouts as consolation prizes to fans who get most but not all of their predictions right.

Fantasy Pick’em Payouts

Most pick‘em fantasy sites use multipliers to determine payouts and allow players to select their own entry fees. For example, a player who chooses a $10 entry fee would stand to win $100 in a contest with a 10x multiplier.

Pick’em fantasy sites use a variety of internal metrics to determine multipliers, but these are the two primary factors:

- The number of predictions in a pick set: The more predictions a player makes, the bigger the potential payout. For example, a contest where the player only needs to get two predictions correct will pay less than a contest where the player needs to get five or more predictions correct.

- The odds of each prediction: Longshot predictions offer higher payouts, just like in regular sports betting. For example, a fantasy pick’em site recently listed an alternative line of 11.5 rebounds for a certain NBA player, which was way over his norm. There was no option to pick “less,” but anyone who picked “more” had a potential payout of 7.5x their entry fee for that prediction alone.

The best fantasy pick’em sites display a running total of the potential payout as players build their lineups. That way, players can always se what they stand to win as they add and remove predictions.

Fantasy Sports Sites vs. Online Sportsbooks

Daily fantasy sports sites and online sportsbooks have a lot in common at the surface level. Both give everyday fans a way to have a stake in the sports they love, and knowledge of the game significantly impacts customers’ results.

How much they differ depends on whether one is comparing sports betting to traditional DFS operators or pick’em fantasy sites.

Comparing DFS Contests to Sports Betting

Traditional DFS sites like FanDuel, which specialize in lineup-building salary cap contests, are completely distinct from online sportsbooks.

The differences between the two activities have significant legal implications and offer completely unique user experiences.

Comparing Pick’em Fantasy Sites to Online Sportsbooks

Fantasy pick’em apps like PrizePicks blur the line between DFS and sports betting to such an extent that regulators in some states require them to acquire sportsbook licenses.

Unlike classic DFS apps, fantasy pick’em sites resemble sports betting in form and function but certain twists to satisfy the UIGEA-compliant definition of “fantasy sports.”

Here are some of the key similarities and differences between fantasy pick’em apps and online sportsbooks.