William Hill Sportsbook Review

Editor’s Note: William Hill Sportsbook is no longer an active online sports betting brand in the United States following its acquisition by Caesars Entertainment. The William Hill betting app is each state has been upgraded and rebranded as Caesars Sportsbook.

William Hill is an old hand in retail and online sports betting with a history that dates back to 1934. What originally began as a chain of UK betting shops expanded over the years to offer online sports betting and gambling to customers around the world. Today, the company earns annual revenues in excess of $2.1 billion.

$1000 Bonus BetCaesars Sportsbook Promo Code: BUSA1000

Must be 21 or older and physically present in AZ, CO, IL, IN, IA, KS, KY, LA, ME, MD, MA, MI, NJ, NY, NC, OH, PA, TN, VA, WV, or WY. New users only. Must register using eligible promo code. First bet after registration must qualify. Max. Bonus Bet: $1,000. Bonus Bet expires 14 days after receipt. Void where prohibited. See Caesars.com/promos for full terms. Know When To Stop Before You Start®. Gambling Problem? CO, IL, KY, MD, MI, NJ, OH, TN, VA, WV, WY, KS (Affiliated with Kansas Crossing Casino), LA (Licensed through Horseshoe Bossier City and Harrah’s New Orleans), ME (Licensed through the Mi’kmaq Nation, Penobscot Nation, and Houlton Band of Maliseet Indians, federally recognized tribes located in the State of Maine), NC (Licensed through Tribal Casino Gaming Enterprise), PA (Affiliated with Harrah’s Philadelphia): If you or someone you know has a gambling problem, crisis counseling and referral services can be accessed by calling 1-800-GAMBLER (1-800-426-2537) or MD: visit mdgamblinghelp.org or WV: visit 1800gambler.net; AZ: Call 1-800-NEXT-STEP; IN: Call 1-800-9-WITH-IT; IA: Call 1-800-BETSOFF. ©2024, Caesars Entertainment

Gambling Problem? Call 1-800-GAMBLER

MA: CALL 1-800-327-5050 or visit gamblinghelplinema.org

NY: Call 877-8-HOPENY or text HOPENY (467369)

$1000 Bonus BetCaesars Sportsbook Promo Code: BUSA1000

Must be 21 or older and physically present in AZ, CO, IL, IN, IA, KS, KY, LA, ME, MD, MA, MI, NJ, NY, NC, OH, PA, TN, VA, WV, or WY. New users only. Must register using eligible promo code. First bet after registration must qualify. Max. Bonus Bet: $1,000. Bonus Bet expires 14 days after receipt. Void where prohibited. See Caesars.com/promos for full terms. Know When To Stop Before You Start®. Gambling Problem? CO, IL, KY, MD, MI, NJ, OH, TN, VA, WV, WY, KS (Affiliated with Kansas Crossing Casino), LA (Licensed through Horseshoe Bossier City and Harrah’s New Orleans), ME (Licensed through the Mi’kmaq Nation, Penobscot Nation, and Houlton Band of Maliseet Indians, federally recognized tribes located in the State of Maine), NC (Licensed through Tribal Casino Gaming Enterprise), PA (Affiliated with Harrah’s Philadelphia): If you or someone you know has a gambling problem, crisis counseling and referral services can be accessed by calling 1-800-GAMBLER (1-800-426-2537) or MD: visit mdgamblinghelp.org or WV: visit 1800gambler.net; AZ: Call 1-800-NEXT-STEP; IN: Call 1-800-9-WITH-IT; IA: Call 1-800-BETSOFF. ©2024, Caesars Entertainment

Gambling Problem? Call 1-800-GAMBLER

MA: CALL 1-800-327-5050 or visit gamblinghelplinema.org

NY: Call 877-8-HOPENY or text HOPENY (467369)

In 2012, William Hill spun off its US operations to establish William Hill US, a subsidiary targeting the retail sports betting market in Nevada. Today, William Hill is the largest sports betting operator in the United States.

William Hill now has retail operations in Nevada, New Jersey, Michigan, Illinois, Indiana, Delaware, Colorado, Iowa, Pennsylvania and West Virginia with more locations in the works. It should also be noted that the name “William Hill” can refer to any number of individual sportsbooks and international betting sites. Our William Hill review here focuses specifically on the online betting site launched for US customers in 2018.

William Hill Rebrand to Caesars

$1000 Bonus BetCaesars Sportsbook Promo Code: BUSA1000

Must be 21 or older and physically present in AZ, CO, IL, IN, IA, KS, KY, LA, ME, MD, MA, MI, NJ, NY, NC, OH, PA, TN, VA, WV, or WY. New users only. Must register using eligible promo code. First bet after registration must qualify. Max. Bonus Bet: $1,000. Bonus Bet expires 14 days after receipt. Void where prohibited. See Caesars.com/promos for full terms. Know When To Stop Before You Start®. Gambling Problem? CO, IL, KY, MD, MI, NJ, OH, TN, VA, WV, WY, KS (Affiliated with Kansas Crossing Casino), LA (Licensed through Horseshoe Bossier City and Harrah’s New Orleans), ME (Licensed through the Mi’kmaq Nation, Penobscot Nation, and Houlton Band of Maliseet Indians, federally recognized tribes located in the State of Maine), NC (Licensed through Tribal Casino Gaming Enterprise), PA (Affiliated with Harrah’s Philadelphia): If you or someone you know has a gambling problem, crisis counseling and referral services can be accessed by calling 1-800-GAMBLER (1-800-426-2537) or MD: visit mdgamblinghelp.org or WV: visit 1800gambler.net; AZ: Call 1-800-NEXT-STEP; IN: Call 1-800-9-WITH-IT; IA: Call 1-800-BETSOFF. ©2024, Caesars Entertainment

Gambling Problem? Call 1-800-GAMBLER

MA: CALL 1-800-327-5050 or visit gamblinghelplinema.org

NY: Call 877-8-HOPENY or text HOPENY (467369)

$1000 Bonus BetCaesars Sportsbook Promo Code: BUSA1000

Must be 21 or older and physically present in AZ, CO, IL, IN, IA, KS, KY, LA, ME, MD, MA, MI, NJ, NY, NC, OH, PA, TN, VA, WV, or WY. New users only. Must register using eligible promo code. First bet after registration must qualify. Max. Bonus Bet: $1,000. Bonus Bet expires 14 days after receipt. Void where prohibited. See Caesars.com/promos for full terms. Know When To Stop Before You Start®. Gambling Problem? CO, IL, KY, MD, MI, NJ, OH, TN, VA, WV, WY, KS (Affiliated with Kansas Crossing Casino), LA (Licensed through Horseshoe Bossier City and Harrah’s New Orleans), ME (Licensed through the Mi’kmaq Nation, Penobscot Nation, and Houlton Band of Maliseet Indians, federally recognized tribes located in the State of Maine), NC (Licensed through Tribal Casino Gaming Enterprise), PA (Affiliated with Harrah’s Philadelphia): If you or someone you know has a gambling problem, crisis counseling and referral services can be accessed by calling 1-800-GAMBLER (1-800-426-2537) or MD: visit mdgamblinghelp.org or WV: visit 1800gambler.net; AZ: Call 1-800-NEXT-STEP; IN: Call 1-800-9-WITH-IT; IA: Call 1-800-BETSOFF. ©2024, Caesars Entertainment

Gambling Problem? Call 1-800-GAMBLER

MA: CALL 1-800-327-5050 or visit gamblinghelplinema.org

NY: Call 877-8-HOPENY or text HOPENY (467369)

The William Hill US brand name is no more after the brands initial success in the US market made it an attractive target for acquisition. Caesars Entertainment acquired William Hill in 2021 and later announced plans to rebrand all its US operations under the Caesars banner.

After completing the acquisition, Caesars Entertainment converted all William Hill retail sportsbooks, betting websites, and apps to the Caesars Sportsbook brand.

William Hill Online Sports Betting

William Hill Sportsbook launched online and mobile betting for New Jersey residents in 2018 and expanded outward from there. To that end, William Hill has formed partnerships with casino operators in more than a dozen states that will pave the way for further expansion.

Which states is William Hill sportsbook legal in?

William Hill online is now available in:

- Colorado

- Illinois

- Indiana

- Iowa

- Michigan

- Nevada

- New Jersey

- Rhode Island (under the Sportsbook Rhode Island brand)

- Tennessee

- Virginia

- West Virginia

- Washington DC (within a two-block radius of Capital One Arena)

William Hill Mobile Betting App

William Hill Sportsbook offers a mobile-friendly website compatible with all smartphones as well as dedicated apps for iOS and Android devices.

We tested the William Hill iOS app for this review and found it lightweight, responsive and generally of a high quality. Reports from Android users have indicated likewise.

In our experience, William Hill mobile is simple to navigate, menu items are clearly marked, and everything is organized in an intuitive manner that even complete newbies should find easy.

There are not a whole lot of advanced features to be found on the William Hill app, though. This is a fairly straightforward betting application: you choose your sport, choose your game and choose your wagers – and that’s about all there is to it.

In-play betting is also supported through the app, although we noticed during our test drive of the app that live data feeds seem to be missing. The desktop edition of the William Hill app embeds live scoring and statistics into the betting platform, but the mobile app simply displays empty white space where live stats should be.

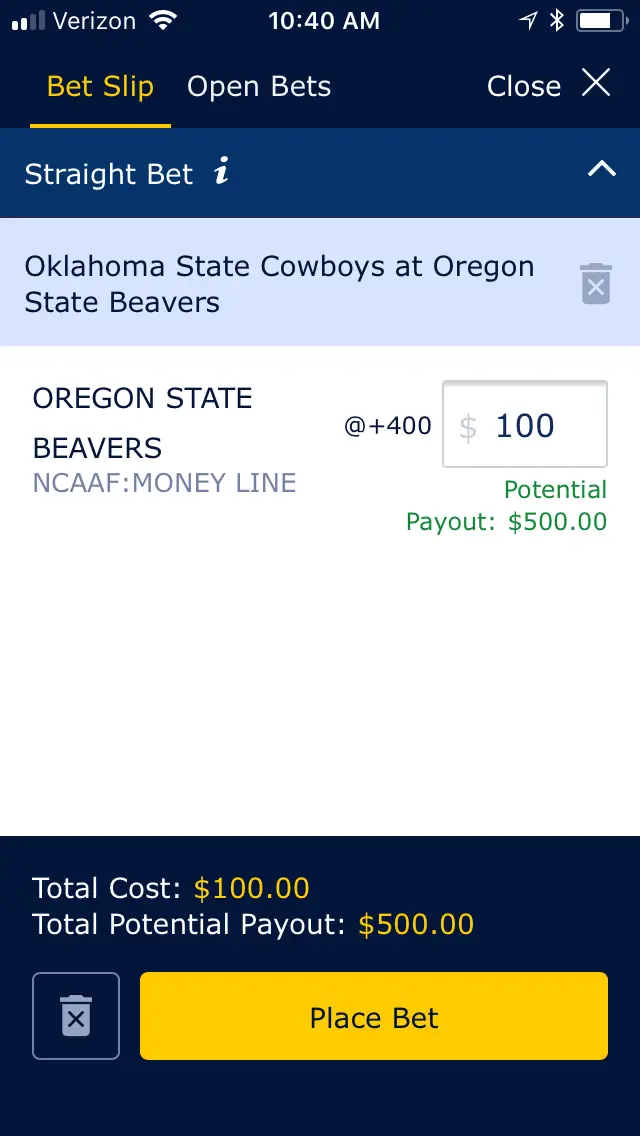

One major difference between the mobile app and desktop website is how the betting slip is managed. While the website shows your current wagers in a betting slip on the same page as the main betting screen, the mobile app keeps the betting slip separate but accessible via a button along the bottom of the screen.

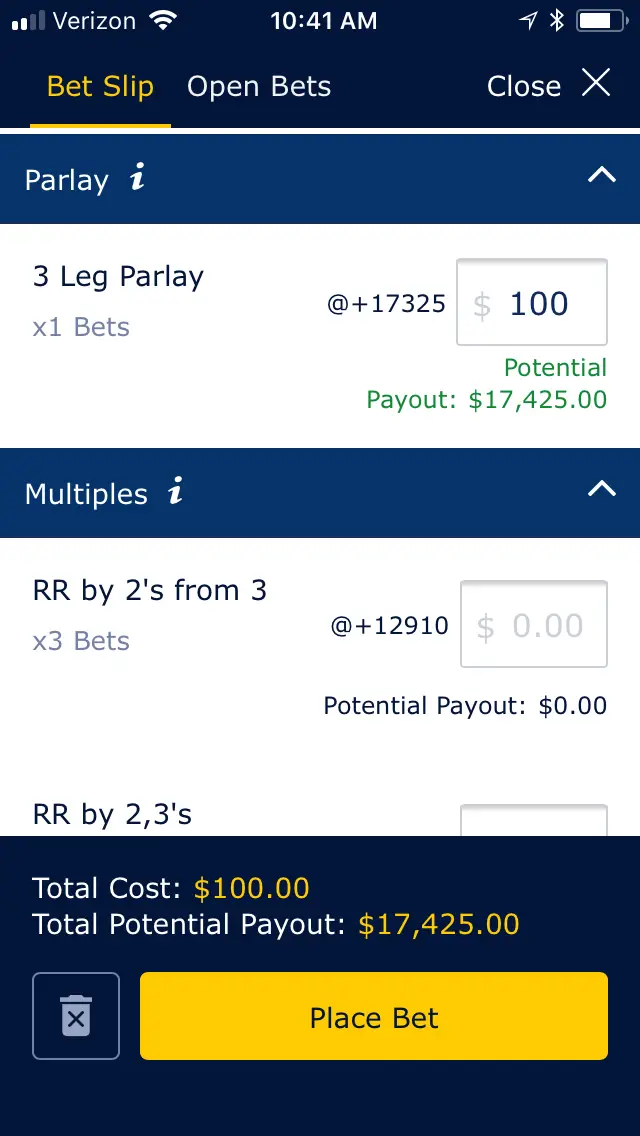

As you add wagers through the William Hill mobile app, you can tap the betting slip button to view all pending wagers, adjust wager amounts and see how much you stand to win. You can also use the betting slip to build parlays, round robins and full covers out of any pending wagers as shown in the screenshot below.

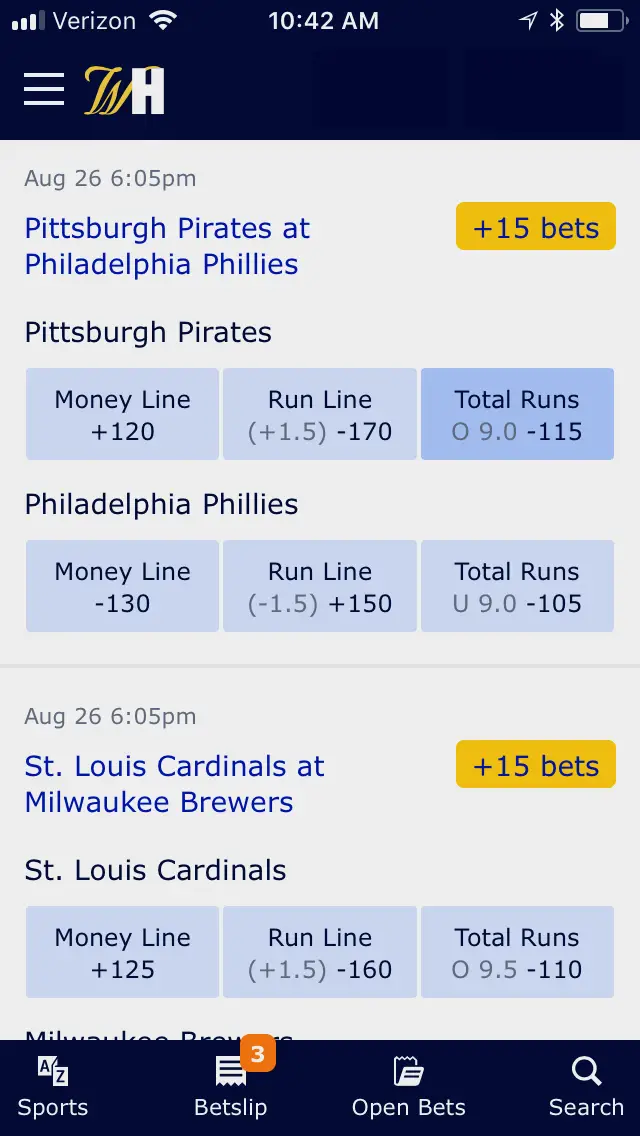

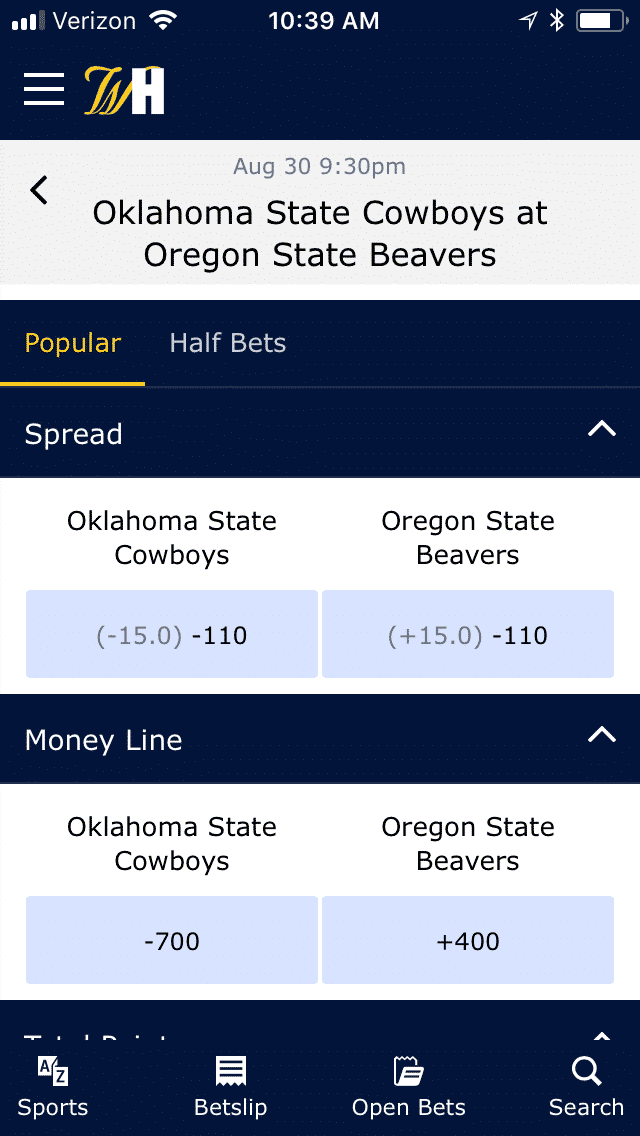

Mobile Screenshots

William Hill Sportsbook In-Play Betting

William Hill has greatly expanded its in-play betting options since we first published this review and now covers a full range of sports with live odds.

A quick visit to the “InPlay” menu through the website or mobile app takes users to an overview of all events scheduled for that day. In-play events are organized by sport from the main live betting area and users can further refine the display by sport to see a full list of all options for that sport.

The major North American sports are covered extensively with in-play betting options – including NFL and MLB games, NHL games, NBA games, tennis, and a whole world of international soccer.

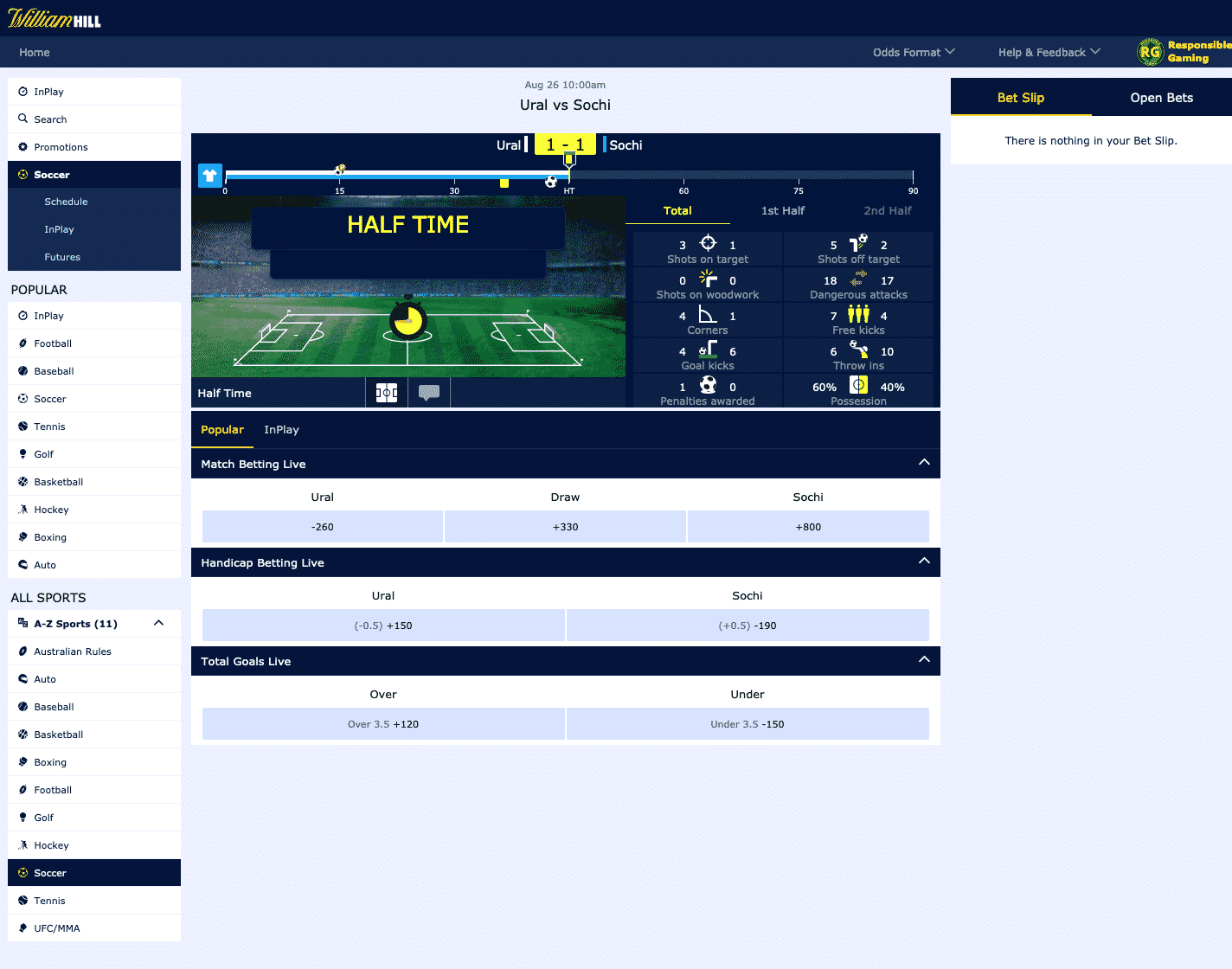

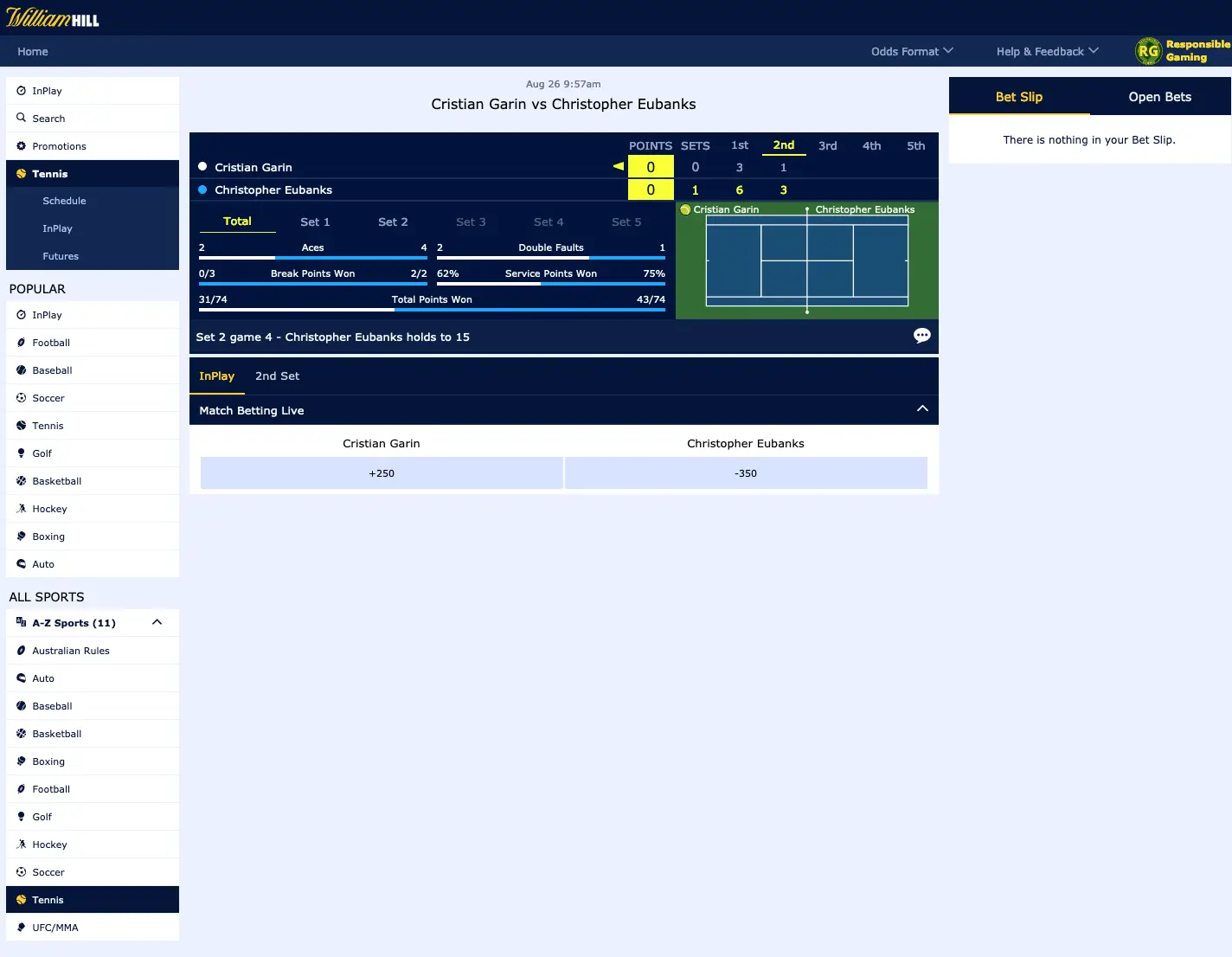

Visiting the dedicated in-play page for a particular game shows a list of all live markets (with odds updated in real-time) along with a stats and scoring display that provides a nice overview of how the event is going. For example, an in-play soccer event shows data regarding time remaining in the match, current score, and stats such as shots on target, shots off target, dangerous attacks, free kicks, and much more.

One area in which William Hill could still improve its in-play betting options is to offer more live markets for each event. We still find William Hill lags behind some of the other sportsbooks when it comes to the variety of in-play wagering types. Most of William Hill’s in-play markets relate to the final outcome of the game and are missing many of the short-term markets offered by competing betting sites.

William Hill Betting Markets

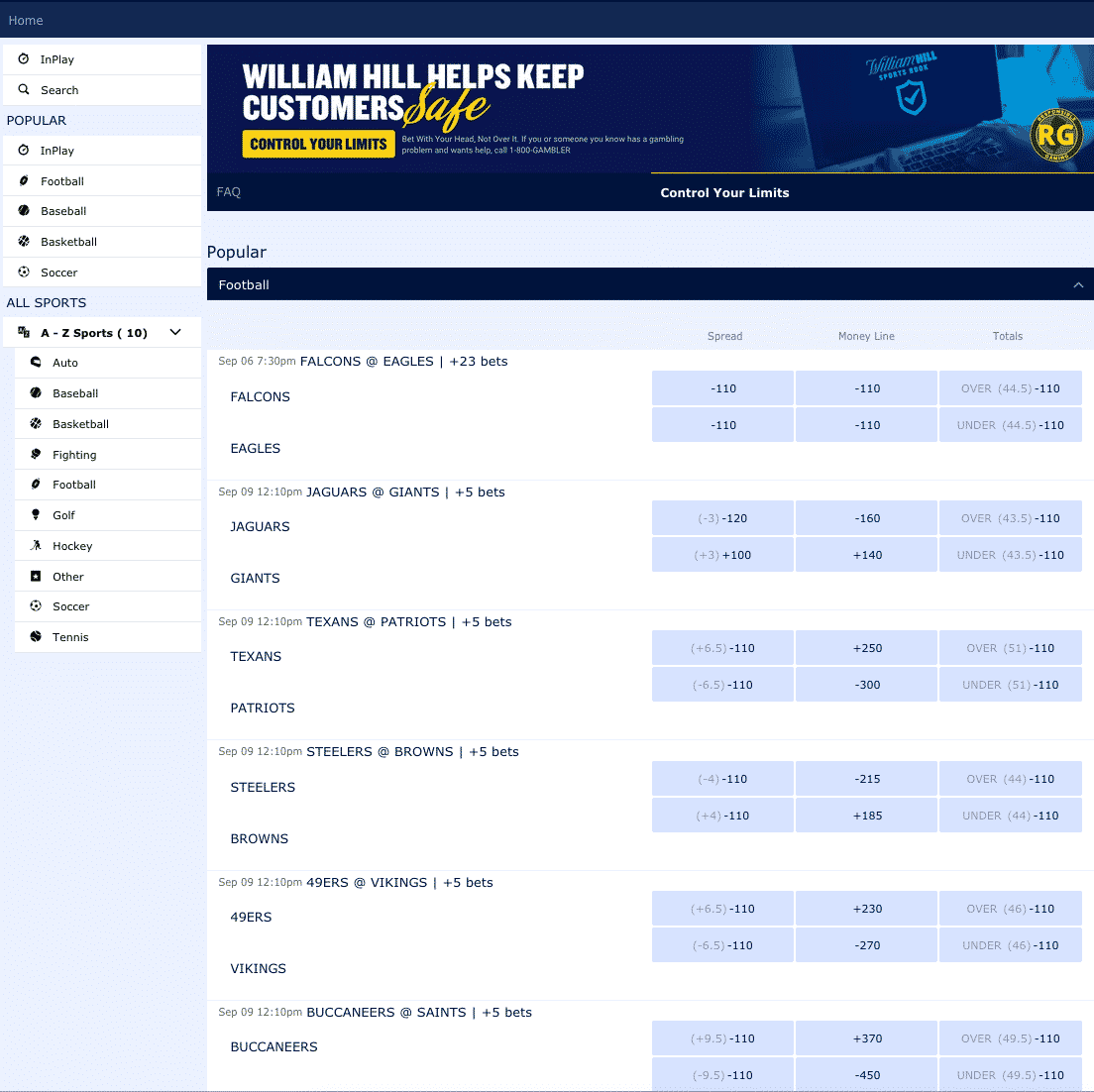

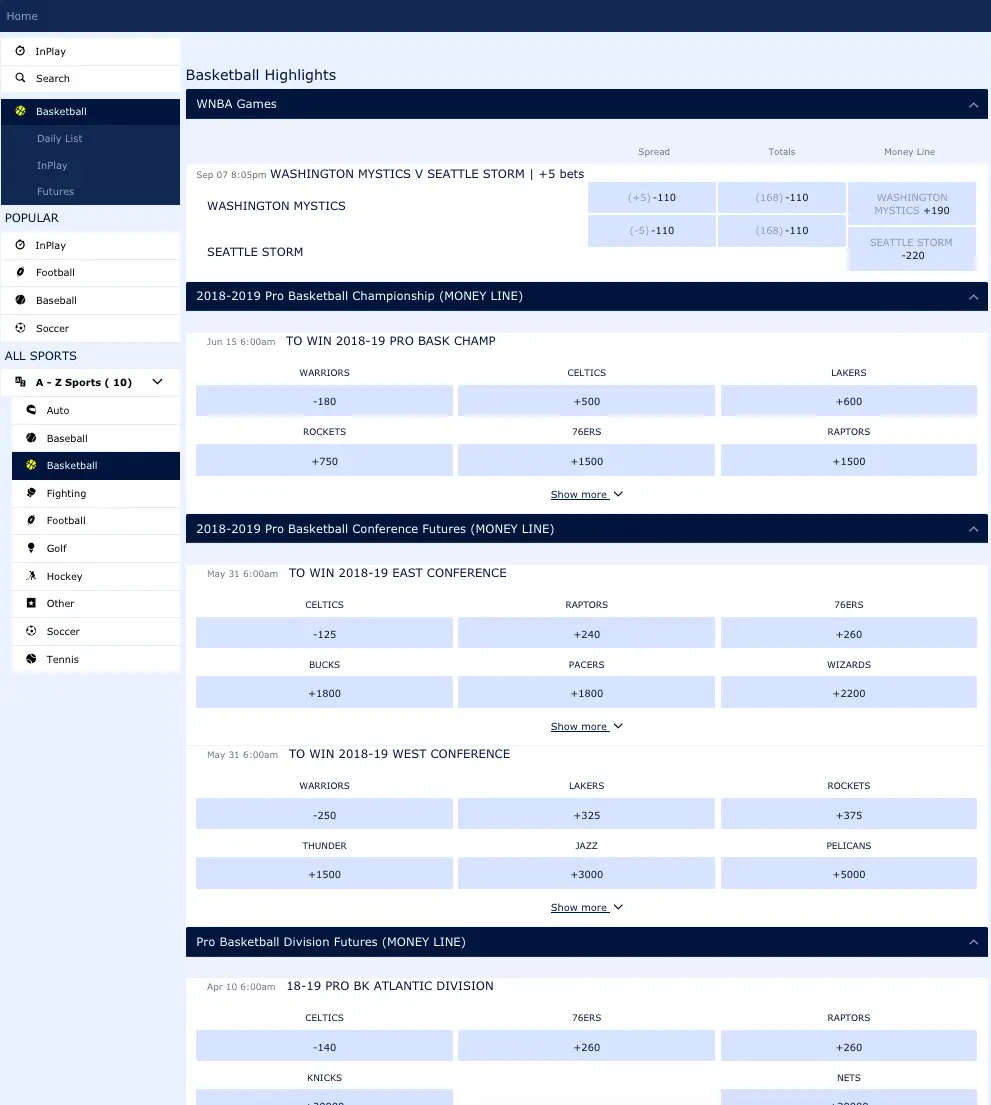

William Hill Sportsbook covers all the basic types of wagers, but the variety here lacks compared to some of the larger betting sites now in operation. All the major professional leagues are covered along with college sports and international options such as soccer and the occasional cricket bet.

While William Hill does cover the main sports leagues with the major types of bets, it would not be fair to call this a comprehensive sportsbook at this point.

For example, a typical baseball game is covered with the standard money line, run like and totals wagers along with a few extras such as alternate lines, first inning scores, score after five inning and a prop or two such as whether or not there will be a Grand Slam.

A typical NFL game offers a greater selection of wagers that includes the usual point spreads and money lines along with totals, 1st half / 2nd half totals and quite a few player props such as QB passing totals, the first player to score, and more.

Overall, the types of wagers and sports covered should be sufficient for casual bettors, but the variety isn’t nearly as comprehensive as what we’re seeing from other betting sites that post over 50,000+ daily betting options.

William Hill will almost certainly improve on both sports covered and the variety of bets offered as it establishes itself in the US market. The international edition that serves the UK and other markets has a much larger variety of sports wagers on offer.

William Hill Casino Review

In a May 2020 trading update, William Hill revealed it had accelerated product development for online casino games in response to the Coronavirus pandemic and would launch an online casino “in the second half of the year” in states that regulate online gambling and where William Hill is operational.

That points to New Jersey as the obvious starting point for the launch of William Hill Casino over the short term. Additional launches in other states seem likely as well over the longer term.

Although William Hill offers online casino games in other countries, the trading update indicated it is developing new products and that may result in a very different experience here in the US. This leaves us somewhat at a loss as to what to expect, but we do know William Hill is a capable online casino provider as its gambling options in other jurisdictions cover more than a thousand online slots, table games and live dealer games.

Once William Hill Casino launches in the US, we will update this review with all key information related to gaming selection, bonuses and more.

William Hill Sportsbook Deposit Methods

William Hill accepts most mainstream deposit methods, although the options vary somewhat from one state to the next. In most states, customers can fund their accounts via the following methods:

- Credit cards (Visa, Mastercard, and Discover)

- Debit cards

- ACH/eCheck

- Online bill pay

- PayPal

- Play+ Prepaid Card

- Skrill

- PayNearMe

Customers in some states can also visit William Hill’s retail sportsbooks in-person to fund their accounts with cash. Customers just need to bring cash, a valid photo ID, and their William Hill account numbers. Below is a list of retail locations that accept William Hill cash deposits:

- Iowa: Prairie Meadows, Isle Casino Bettendorf, Isle Casino Waterloo, Lakeside Hotel Casino, and Horseshoe Council Bluffs

- Illinois: Horseshoe Hammond, Caesars Southern Indiana, and Tropicana Evansville

- New Jersey: Monmouth Park, Tropicana, and Ocean Resort Casino

- West Virginia: Mountaineer Casino

The minimum deposit at William Hill is $20.

William Hill State-Specific Operations

William Hill faces significant regulatory challenges back in the UK and has renewed its focus on expanding internationally, including a major push in the United States in particular. William Hill US was established in 2012 and immediately got to work moving in on the Nevada sports betting market.

Today, William Hill maintains sports betting operations in numerous states and will almost certainly expand further. William Hill formed a partnership with CBS Sports in February 2020 to further expand its name recognition. Under the agreement, CBS Sports is set to feature William Hill odds, data and content across CBS broadcasts and other digital platforms.

Below is an overview of where William Hill is already active or where it may be active in the near future.

William Hill New Jersey

- Land-Based Partners: Monmouth Park, Ocean Resort Casino and Tropicana

William Hill has established a strong base of operations in New Jersey by forming partnerships with three different casinos to operate mobile betting and three individual sportsbooks.

Monmouth Park, Ocean Resort Casino and Tropicana each has a William Hill-themed sportsbook for in-person wagers. William Hill has also established a partnership with the NJ Devils to launch a sports lounge in Prudential Center to further establish itself in the local sports betting scene.

William Hill Pennsylvania

- Land-Based Partners: Harrah’s Philadelphia

William Hill booked Pennsylvania’s first legal sports wager in November 2018 through its sportsbook at Hollywood Casino. Hollywood Casino later parted ways with William Hill to partner with Kambi. Now, William Hill is partnered with Harrah’s Philadelphia and operates the sportsbook there.

Mobile betting is legal in PA as well and William Hill will almost certainly pursue that opportunity in the near future. Pennsylvania represents a major mobile market and William Hill has plenty of experience in online betting to extend its land-based operations in PA to the internet.

William Hill West Virginia

- Land-Based Partners: Hollywood Casino and Mountaineer Casino

In West Virginia, William Hill operates the sportsbooks at Hollywood Casino at Charles Town Races and Mountaineer Casino, although only the sportsbook at Mountaineer Casino is adorned with the William Hill logo.

In September 2020, William Hill commenced online and mobile betting in West Virginia. Customers may now visit the William Hill website or download the mobile app for iOS/Android devices to bet from anywhere within state lines.

William Hill Indiana

- Land-Based Partner: Tropicana Evansville

William Hill operates the retail sportsbook at Tropicana Evansville and launched mobile betting in October 2020.

William Hill Colorado

- Land-Based Partners: Isle Casino Black Hawk and Lady Luck Black Hawk

Colorado voters approved sports betting via public referendum in November 2019 to open the door to William Hill setting up shop. The William Hill partnership with Eldorado Resorts grants William Hill the ability to operate retail sportsbooks at Isle Casino and Lady Luck Casino in Black Hawk in addition to mobile betting.

William Hill Sportsbook took an important step forward in early 2020 after acquiring a mobile betting license from the Limited Gaming Control Commission (LGCC). In September 2020, William Hill officially launched its mobile app to Colorado sports bettors.

William Hill Illinois

- Potential Land-Based Partner: Grand Victoria Casino

Eldorado Resorts operates Grand Victoria Casino in Elgin, Illinois and its partnership with William Hill for sports betting includes that property. In August 2020, William Hill opened its retail sportsbook at Grand Victoria Casino.

William Hill also is also licensed for mobile betting in Illinois and officially launched there in September 2020.

William Hill Virginia

William Hill launched mobile betting for Virginia bettors in February 2021 as the state’s fifth online sportsbook. In Virginia, William Hill operates as a standalone operator because state law does not require online sportsbooks to acquire licenses through land-based interests. Customers 21 and older may visit William Hill from anywhere in Virginia to bet on a full range of professional and college sports.

William Hill Michigan

- Land-Based Partners: Turtle Creek Casino and Leelanau Sands Casino

William Hill has a partnership in place with the Grand Traverse Band of Ottawa and Chippewa Indians to manage statewide online betting and retail sportsbooks at two properties.

In September 2020, William Hill debuted the sportsbook at Turtle Creek Casino & Hotel. The sportsbook features teller windows plus kiosks located inside Turtle Creek and Leelanau Sands. William Hill also holds a mobile gaming license from the MGCB and commenced statewide online betting in January 2021.

William Hill Iowa

- Land-Based Partners: Isle Casino Bettendorf, Isle Casino Waterloo, Prairie Meadows Racetrack & Casino, Lakeside Casino, Harrah’s Council Bluffs, and Horseshoe Council Bluffs

William Hill operates six retail sportsbooks in Iowa along with a mobile betting app accessible throughout the state.

In the lead-up to legal Iowa sports betting, William Hill secured a partnership with Prairie Meadows Racetrack & Casino in early 2019. That partnership included the construction of an 8,600-square-foot sportsbook.

Additionally, William Hill’s existing partnership with Eldorado Resorts gave it entry to the sports betting market via Isle Casino Hotel Bettendorf and Isle Casino Hotel Waterloo. William Hill now operates sportsbooks at both locations.

William Hill has is also partnered with Lakeside Hotel & Casino to operate its sportsbook. Per that agreement, William Hill constructed a full-service sportsbook with teller windows, kiosks 16 HD viewing monitors and in-play betting on tap.

William Hill added two more locations to the list in October 2020 with twin launches of sportsbooks at Harrah’s Council Bluffs and Horseshoe Council Bluffs.

William Hill Tennessee

William Hill Sportsbook launched statewide mobile betting for Tennessee customers in March 2021. The Tennessee Education Lottery (TEL) issued an online betting license to William Hill (American Wagering Inc) in January so it could launch in time for the 2021 Super Bowl.

William Hill Nevada

- Availability: Mobile betting, retail sportsbooks, and self-service kiosks

- Land-Based Partners: Too many to name

Nevada has long served as William Hill’s base of operations in the United States. In 2012, William Hill purchased a chain of 16 betting shops in Nevada and expanded from there to its current position as a market leader. Now, William Hill operates more than 100 sportsbooks and self-service kiosks across the state.

In addition to retail sportsbooks, William Hill mobile offers online wagering across the state. Customers can visit any casino in person to register for an account and then place wagers from anywhere inside Nevada.

William Hill Delaware

- Land-Based Partners: Dover Downs, Delaware Park and Harrington Raceway

William Hill is only tangentially involved in the Delaware sports betting market by offering risk management services to the lottery. The Delaware Lottery is teamed up specifically with Scientific Games to operate sportsbooks at each of the state’s three casinos, while William Hill offers risk management to Scientific Games.

William Hill Mississippi

- Land-Based Partners: 1st Jackpot Tunica, Ameristar Vicksburg, Silver Slipper Casino, Hollywood Casino Gulf Coast, Island View Casino, Treasure Bay Casino, Boomtown Biloxi, Hard Rock Casino and Palace Casino Resort

In 2018, William Hill announced it had reached agreements with 11 Mississippi casinos to manage sportsbooks on their behalf pending regulatory approval. Today, William Hill sportsbooks can be found at nine casinos.

William Hill Maryland and Montana

- Land-Based Partner: Golden Entertainment

William Hill has a partnership in place with Golden Entertainment that includes managing its sports betting operation in Nevada as well as in Montana and Maryland subject to state law.

In Montana, Golden Entertainment operates about 300 video gambling machines, but it is unclear when or if William Hill can take advantage of that to offer sports betting. Montana sports betting law limits sports betting to machines operated by the state lottery.

In Maryland, Golden Entertainment operates the Rocky Gap Casino Resort.

William Hill Rhode Island

- Land-Based Partners: Twin River Casino and Tiverton Casino Hotel

William Hill and IGT were chosen by the RI Lottery to manage sports betting at both of the state’s casinos. Both retail sportsbooks are now open, and mobile betting is coming soon.

William Hill Washington D.C.

- Land-Based Partner: Capital One Arena

William Hill operates a retail sportsbook at Capital One Arena in Washington, D.C. That location launched as the first sportsbook in the US to operate from inside a professional sports stadium.

Later, William Hill deployed a mobile betting app accessible to customers within a two-block radius of Capital One arena.

William Hill Ohio

- Potential Land-Based Partner: Scioto Downs

The William Hill partnership with Eldorado Resorts covers all casinos owned by El Dorado, including Scioto Downs. If Ohio law changes to allow sports betting, this will most likely be the route by which William Hill enters the state.

William Hill Missouri

- Potential Land-Based Partners: Isle of Capri Boonville, Isle of Capri KC, Lady Luck Caruthersville, Lumière Place St. Louis and Isle Casino Cape Girardeau

If and when Missouri sports betting is legalized, William Hill has two obvious points of entry. Those would be the Isle of Capri in Boonville and the Isle Casino in Cape Girardeau, both operated by Eldorado Resorts.

William Hill Louisiana

- Potential Land-Based Partners: Isle of Capri Westlake, Belle of Baton Rouge and Eldorado Shreveport

Some lawmakers in Louisiana have introduced legislation to legalize sports betting and it’s looking to be a matter of time before they can get something across the finish line. When that happens, William Hill may have access through any of the three Louisiana casinos operated by Eldorado Resorts.

William Hill Florida

- Potential Land-Based Partner: Isle Casino Pompano

Florida sports betting does not appear very likely to be legalized at this time thanks to a complicated political situation and multiple competing interests that all have a different vision of the future of the industry. However, if something does get done in Florida, William Hill has an in through the Isle Casino in Pompano Beach thanks to its partnership with Eldorado Resorts.