Bet365 Sportsbook Review

Bet365 offers legal sports betting in the U.S. and around the world as the largest privately-owned sportsbook operator.

The Bet365 app differentiates itself from other U.S. sportsbooks in several key areas and is especially strong in select betting markets.

- Sports Betting In 13 states

- Horse Racing Betting in Colorado

- $150 Welcome Bonus

In this Bet365 review, BettingUSA will discuss what makes the app unique, beginning with an overview of its low-risk, high-reward welcome bonus for new players.

21+, T&Cs Apply. Gambling Problem? Call 1-800-GAMBLER

Pros

Reputable Global Operator Customer Favorite Sportsbook Superior In-Play Pricing Offers Live-Streaming SportsCons

Infrequent Sports Betting Promos Antiquated Looking InterfaceWhich States Is Bet365 Legal In?

Bet365 Sportsbook is available in the following states:

- Arizona

- Colorado

- Illinois

- Indiana

- Iowa

- Kentucky

- Louisiana

- New Jersey

- North Carolina

- Ohio

- Pennsylvania

- Tennessee

- Virginia

Gambling problem? Call the National Council on Problem Gambling at 1-800-GAMBLER

Bet365 Bonus Code

Bet $5 Get $150 Win Or LoseBet365 Bonus Code: BETUSAGAMBLING PROBLEM? CALL OR TEXT 1-800-GAMBLER (AZ, CO, IL, IN, KY, LA, NC, NJ, OH, PA, VA), 1-800-BETS OFF (IA) or 1-800-889-9789 (TN). 21+ only (18+ in KY). Must be present in AZ/CO/IA/IL/IN/KY/LA (select parishes)/NC/NJ/OH/PA/TN/VA. New Customer Offer Bet $5 and Get $150 in Bonus Bets at bet365. *Subject to meeting qualifying criteria. Minimum wager $5. Minimum odds -500 or greater. $10 minimum deposit. Paid in Bonus Bets. Bonus Bets wager excluded from returns. New customers only. Available in app only, time restrictions and T&Cs apply.

Bet $5 Get $150 Win Or LoseBet365 Bonus Code: BETUSAGAMBLING PROBLEM? CALL OR TEXT 1-800-GAMBLER (AZ, CO, IL, IN, KY, LA, NC, NJ, OH, PA, VA), 1-800-BETS OFF (IA) or 1-800-889-9789 (TN). 21+ only (18+ in KY). Must be present in AZ/CO/IA/IL/IN/KY/LA (select parishes)/NC/NJ/OH/PA/TN/VA. New Customer Offer Bet $5 and Get $150 in Bonus Bets at bet365. *Subject to meeting qualifying criteria. Minimum wager $5. Minimum odds -500 or greater. $10 minimum deposit. Paid in Bonus Bets. Bonus Bets wager excluded from returns. New customers only. Available in app only, time restrictions and T&Cs apply.| Title | Details |

|---|---|

Bet365 Sportsbook Bonus Code | BETUSA |

| Welcome Bonus | Bet $5+ and Get $150 in Bonus Bets, Win Or Lose |

| Minimum Deposit Required | $10 (must deposit within the Bet365 app) |

| Eligible States | AZ, CO, IL, IN, IA, KY, LA, NJ, NC, OH, PA, TN, VA |

| Eligibility Period | Must claim the offer within 30 days of registration Qualifying bet must settle within 30 days of claiming the offer Unused bonus bets expire after seven days |

Bet365 Sportsbook Bonus Offer

Bet $5 Get $150 Win Or LoseBet365 Bonus Code: BETUSAGAMBLING PROBLEM? CALL OR TEXT 1-800-GAMBLER (AZ, CO, IL, IN, KY, LA, NC, NJ, OH, PA, VA), 1-800-BETS OFF (IA) or 1-800-889-9789 (TN). 21+ only (18+ in KY). Must be present in AZ/CO/IA/IL/IN/KY/LA (select parishes)/NC/NJ/OH/PA/TN/VA. New Customer Offer Bet $5 and Get $150 in Bonus Bets at bet365. *Subject to meeting qualifying criteria. Minimum wager $5. Minimum odds -500 or greater. $10 minimum deposit. Paid in Bonus Bets. Bonus Bets wager excluded from returns. New customers only. Available in app only, time restrictions and T&Cs apply.

Bet $5 Get $150 Win Or LoseBet365 Bonus Code: BETUSAGAMBLING PROBLEM? CALL OR TEXT 1-800-GAMBLER (AZ, CO, IL, IN, KY, LA, NC, NJ, OH, PA, VA), 1-800-BETS OFF (IA) or 1-800-889-9789 (TN). 21+ only (18+ in KY). Must be present in AZ/CO/IA/IL/IN/KY/LA (select parishes)/NC/NJ/OH/PA/TN/VA. New Customer Offer Bet $5 and Get $150 in Bonus Bets at bet365. *Subject to meeting qualifying criteria. Minimum wager $5. Minimum odds -500 or greater. $10 minimum deposit. Paid in Bonus Bets. Bonus Bets wager excluded from returns. New customers only. Available in app only, time restrictions and T&Cs apply.New users who open a Bet365 sports betting account and place an eligible first wager of $5 receive $150 in bonus bets, win or lose.

Bettors can claim this offer in three steps:

- Sign up for an account with Bet365

- Make a minimum deposit of $10 through the Bet365 app within 30 days of registration

- Place a minimum first bet of $5 on any sport within seven days of depositing

The Bet365 bonus comes with terms and conditions like all sportsbook promos, but a careful reading of the fine print reveals nothing unusual or negatively impactful of the offer’s value. One noteworthy caveat is that bettors must claim the offer within the Bet365 app.

In fact, the Bet365 offer features better terms than similar bet-and-get promos found elsewhere. For instance, a typical sportsbook bonus requires the first wager to have odds of around -200 or longer. That means bets with odds of -200, -110, +110, +210, etc. qualify, but wagers at odds of -210, -300, etc. do not.

In contrast, the Bet365 Sportsbook bonus requires the first wager to have odds of -500 or longer, giving bettors more flexibility in choosing where to place their initial qualifying wager.

In addition, the first wager must settle within 30 days to qualify. Once the wager settles, bettors will receive $150 in bet credits that they can use all at once or divide into multiple smaller bets. Bet365 bonus bets expire seven days after receipt.

Note: Bet365 bet credits cannot be transferred to the online casino or used to place banker bets, if bets, reverse if bets, or teasers. Bet365 bonus bets expire seven days after receipt.

Winning wagers placed with Bet365 bonus bets do not return the initial stake, only the net profits.

For example, a $20 cash wager at +200 odds normally pays out $60 ($20 upfront stake + $40 profit). If the same wager was made using bonus bets, the total return would only be $40. For this reason, some savvy gamblers advocate using bonus bets at longer odds because the potential profits dwarf the stake.

Overall, the Bet365 welcome bonus is a fantastic deal that doesn’t force bettors to make a large initial deposit or lose their first wager to earn rewards.

The monetary cap is low compared to some sports betting bonuses, but that’s a more than fair tradeoff for only having to wager $5.

Other Bet365 Sportsbook Promotions

Bet365 tends to run a few promotions year-round while regularly switching out other offers depending on the sport of the season.

One especially noteworthy promotion is Bet365’s alternative welcome bonus.

New users who don’t want Bet365’s headline offer can claim a $1,000 “First Bet Safety Net” bonus.

Bettors who choose the Bet365 First Bet Safety Net promo can deposit $10 or more and place a wager on any sport. If it loses, they’ll get a 100% refund paid as bonus bets worth up to $1,000.

Two long-running sports betting promotions Bet365 has offered since launching involve parlay wagers:

- Enhanced Parlay Payouts: Earn an enhanced payout (awarded as site credit) on your successful parlays when you add two or more pregame selections involving the NFL, college football, CFL, NBA, WNBA, college basketball, MLB, MMA, and the NHL. The more legs included in your parlay, the bigger the bonus payout. Successful two-leg parlays receive a 5% bonus, and payout bonuses increase from there to up to 70% extra on 14-leg parlays.

- Enhanced Tennis Parlay Payouts: Bet365 treats tennis parlay bettors to the same payout bonuses as detailed in the above promotion. All users who place a pre-match tennis parlay with two or more legs receive an extra 5% to 50% in site credit on their winning wagers.

In addition to the above longstanding promotions, Bet365 Sportsbook holds other types of promos for the main in-season sports. Below are examples of early payout promos Bet365 has held for major sports.

- NFL early payout offer: Bet365 grades your straight bet a winner if your team gains a 17-point lead anytime during the game

- MLB early payout offer: Bet365 grades your straight bets winners if your team takes the lead by five runs at any point

- NBA early payout offer: Bet365 pays if your team gets ahead by 20 points at any time

- NHL early payout offer: Bet365 pays if your team gets ahead by three goals at any point

- College basketball early payout offer: Bet365 pays if your team gets ahead by 18 points at any time

- Soccer early payout offer: Bet365 pays if your team gets ahead by two goals at any point

Finally, Bet365 offers frequent profit boosts for a fair selection of markets, which it displays on the main homepage and league subpages.

Bet365 profit boosts can be substantial, often giving bettors an extra 30% in winnings, and Bet365 offers multiple boosts daily.

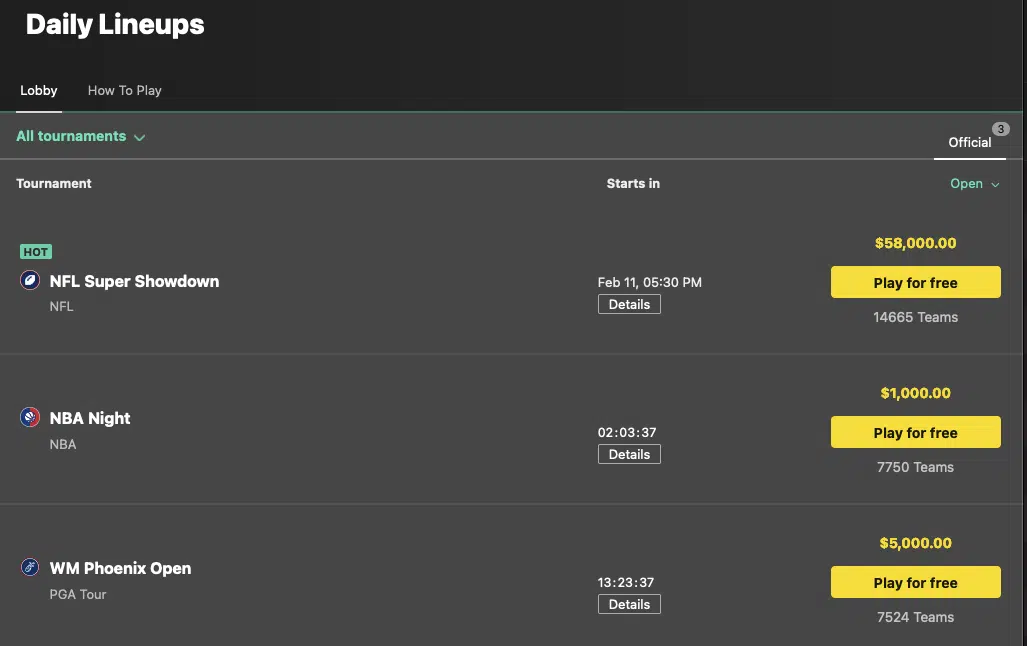

Bet365 Daily Lineups

Bet365 Daily Lineups are free-to-play fantasy sports contests that award cash and bonus bets to the top-scoring entrants.

As the name indicates, Daily Lineups offers fans a chance to win cash and bonus bets every day.

With guaranteed prizes on offer every day, Daily Lineups is practically a long-term rewards program open to all current Bet365 Sportsbook customers.

Scoring and drafting rules vary, but standard Daily Lineup contests give entrants virtual salaries of $50,000 to draft six to eight professional athletes, including a team captain who scores 1.5x points with a 1.5x salary.

After players build their lineups and submit them, their rosters earn points based on their athletes’ real-world performances. Most Daily Lineups issue significant cash prizes to the top few finishers and bonus bets for all other high-ranking entries.

Prize pools vary wildly, with average pools ranging from $1,000 to $5,000 in cash and bonus bets. Occasionally, Bet365 hosts even larger guaranteed prize pool contests for major events.

For example, a Daily Lineup Super Bowl contest awarded nearly $60,000 in prizes, with $10,000 cash reserved for first place and smaller amounts paid down to 5,000th place.

Bet365 Daily Lineups contests are free to enter, but only open to Bet365 customers in select states.

Bet365 Daily Lineups are available for football, basketball, baseball, hockey, golf, Formula 1, and MMA.

Bet365 Sportsbook Loyalty Program

Bet365 does not currently offer a VIP loyalty program, nor does it provide a referral bonus for bettors who recommend the Bet365 app to friends.

The company is known for its no-nonsense approach to sports betting, resulting in better lines but a limited number of extras.

It remains to be seen if its style will resonate with American bettors, but for now, the lack of a Bet365 loyalty program places it at a severe disadvantage competing against online sportsbooks with multi-faceted rewards programs for customer retention.

Bet365 Deposit Methods

Get Bonus

Get Bonus

Bet365 minimum and maximum deposit limits (per transaction):

| Deposit Method | Minimum / Maximum |

|---|---|

| Credit Card | $10 / $30,000 |

| Debit Card | $10 / $30,000 |

| Online Banking | $10 / $10,000 |

| PayPal | $10 / $10,000 |

| Bet365 Mastercard | $5 / $5,000 |

| PayNearMe | $10 / $500 |

| Cash at Hard Rock Casino | $1 / $30,000 |

| Skrill | $10 / $38,000 |

| Paysafecard | $10 / $1,000 |

Bet365 Withdrawal Options

Bet365 is generally good about expediting withdrawal requests, although it’s not implausible that it will delay a payout request for one reason or another.

Typically, customers can resolve such issues by providing financial documentation to Bet365 or speaking with one of its very helpful representatives.

Bet365 Sportsbook withdrawal methods and turnaround times are as follows:

- Online banking: 1-5 business days (usually on the lower end). Min: $10; Max: $10,000 per transaction.

- Bet365 Mastercard: Instant. Min: $5; Max: $5,000

- Credit/debit card: 1-5 business days. Min: $10; Max: $30,000

- PayPal: Within 24 hours. Min: $10; Max: $10,000

- Skrill: Within 24 hours. Min: $10; Max: $38,000

- Cash as the casino cage: Instant. Min $1; Max: $30,000

Currently, the only cash at the casino cage option is at Hard Rock Casino in Atlantic City.

Notice how flexible bet365 is with its withdrawal options, even allowing credit card payouts. That being said, bettors typically have to use a cashiering method for at least one successful deposit before using the same method to withdraw.

Bet365 Customer Service Options

Bet365 has an extensive FAQ that provides helpful answers to the most common customer queries. The help section is organized in logical categories including deposits, account verification, responsible gaming, and more.

For those looking to speak to a representative, there are a few viable options:

- Live chat: Speak with a representative via text. Available 24/7.

- Email: Send an email from your account. Response times are on the faster side, usually within one business day.

- Phone: Bettors can speak directly with a Bet365 rep. Phone lines are open 24/7.

- Web message: Send messages directly from your account inbox.

Bet365 clearly takes customer service seriously. If there is an issue with your account, representatives will take it upon themselves to schedule a call. Live chat agents are friendly and seem to have a deep knowledge of the product.

Bet365 Sports Betting Review

Bet365 may be one of the world’s largest betting operators globally, but it remains family-run to this day. This makes Bet365 an oddity in the increasingly corporate world of online sports betting characterized by boardrooms, stockholders, and billion-dollar mergers.

In all likelihood, the lack of stockholders is what has given Bet365 the flexibility to do things differently.

Bet365 has shown a remarkable degree of nimbleness compared to its competitors. For example, Bet365 was one of the first legal sportsbooks to offer esports betting.

Bet365 Sportsbook maintains a reputation for professional customer service and fair business practices.

Additionally, Bet365 tends to take larger wagers than most sportsbooks and is often the first to post odds for upcoming events. Its odds are often better than the competition, especially in smaller markets like tennis and for sports popular among European bettors, particularly soccer.

Thanks to its decades of industry experience, Bet365 doesn’t shy away from offering an extensive menu of props, derivatives, and alternative lines. Some of its props are so granular that it is difficult to find them offered anywhere else.

Bet365 Sportsbook also embraces new betting formats that have caught fire in the U.S., most notably Same Game Parlays.

On the other hand, Bet365 doesn’t award kickbacks to loyal bettors. Bet365 has improved its welcome bonus since launching and is starting to offer interesting promotions, but the lack of a VIP loyalty program and reliable recurring promotions is disappointing.

The Bet365 app is a mixed bag. The interface is dated and the layout is cumbersome and takes time to get used to. The upside is that it’s very responsive and doesn’t try to cram too much into one page.

In summary, Bet365 could benefit from adding a loyalty program and modernizing its app, but generous betting odds, extensive betting markets, and reputation for quality customer support make it worth considering.

The remainder of this Bet365 review will go into greater detail on its strong and weak points, the types of wagers it offers, and much more.

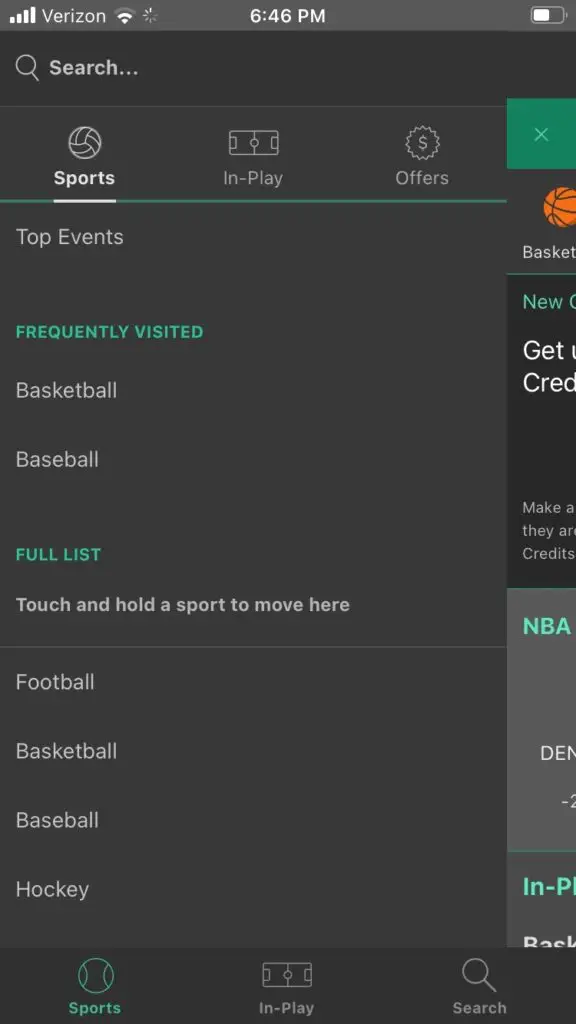

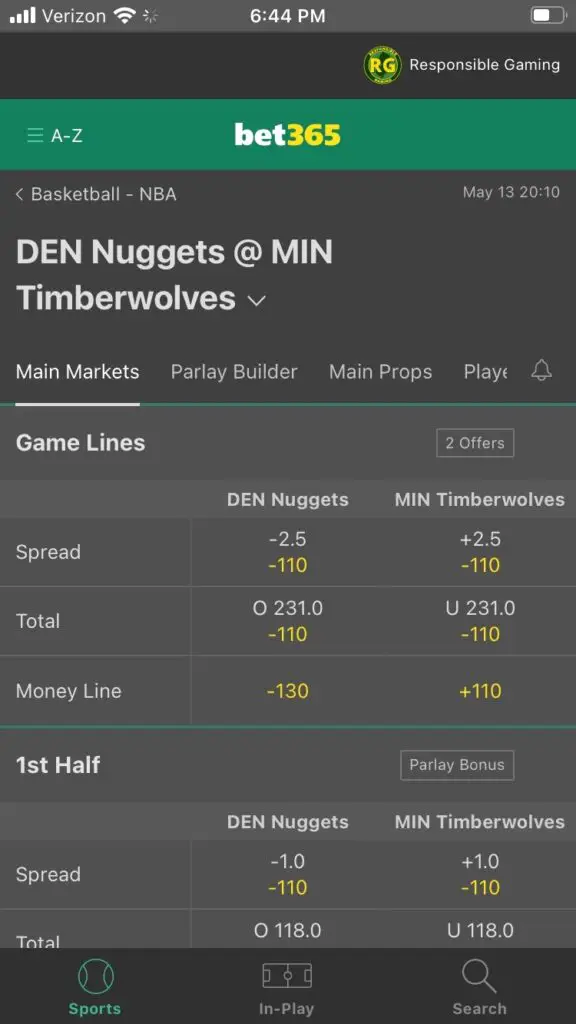

Bet365 Sports Betting App

Bettors can download the Bet365 mobile app for iOS and Android devices. On both versions, users have access to the same range of sports, features, and live streaming options offered by the full desktop website.

The first impression of the Bet365 Sportsbook app is that it’s antiquated, mostly text-based, with few visual cues to guide bettors.

On top of that, the overall aesthetic is borderline ugly. The interface is dominated by drab grey coloring interspersed with a tired-looking green, and the few graphical icons look anything but modern.

However, Bet365’s no-frills approach to bookmaking does have its benefits.

The Bet365 app facilitates quick responses to user input and constant odds updates during in-play betting. Users can freely tap any wager to instantly add it to the betting slip, where they can easily adjust bet amounts and create custom parlays.

The app home screen provides an overview of the day’s bigger events and popular wagers, plus a menu for quick navigation to specific sports, promotions, and in-play betting games.

However, featured games only list moneylines or point spreads, not a combination of totals, spreads, and moneylines like most online sportsbooks.

The enormous amount of betting markets and individual wagers may overwhelm new bettors. Bet365 does offer a few different ways of filtering these wagers, but some make more sense than others.

Bet365 Sportsbook excels when it comes to supplementary features.

For each game, it provides a slew of handy statistics, ranging from recent head-to-head results, average points scored, upcoming schedules to standings, and much more. These statistics won’t necessarily help bettors make more informed wagers, but it’s a nice touch.

Bet365 also goes above and beyond when it comes to immersion. Once a game starts, bettors can view an action-by-action cast of the event.

In addition, Bet365 provides a live streaming service across several major markets including soccer, tennis, basketball, and other sports.

Bet365 Mobile App Screenshots

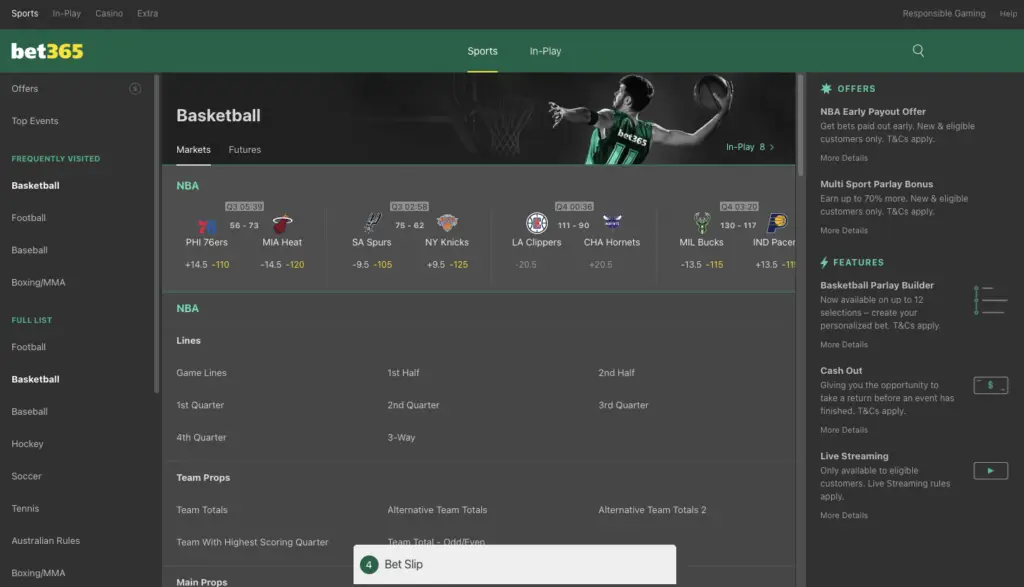

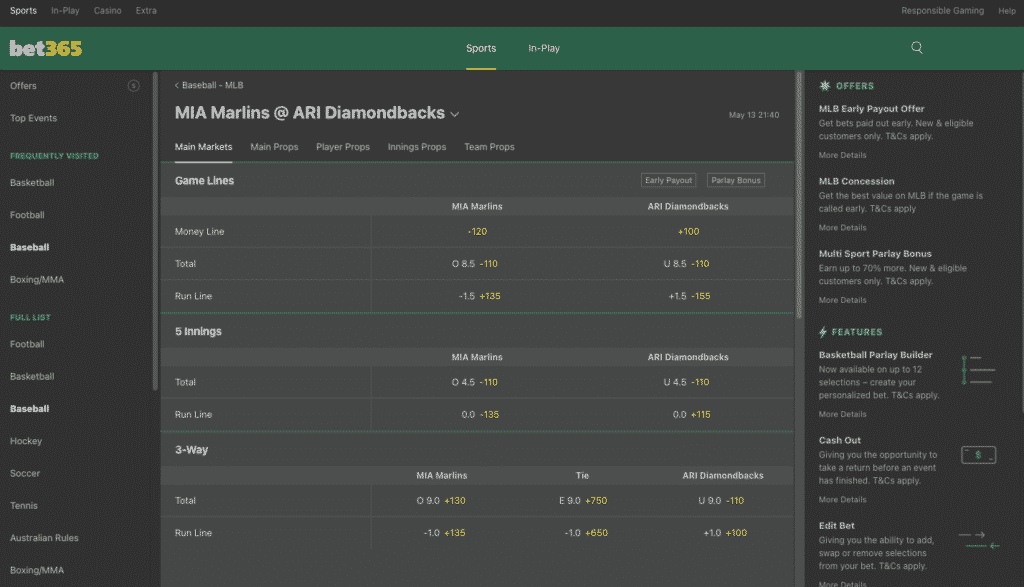

Bet365 Website and User Interface

The Bet365 interface has changed little since its U.S. launch. Bet365.com dedicates the left column to listing all sports, while the rest of the screen shows the day’s wagers for each sport.

The website looks simple at first, but customers can find many features hidden behind nondescript icons.

Finding basic wagers is easy, but there is a bit of a learning curve for certain features such as building round robins or figuring out how to view the in-play schedule.

Unlike other major sportsbooks, Bet365 software is entirely proprietary.

While other sports betting operators rely on third-party software and services from companies such as Kambi, Bet365 designs its software in-house.

As a result, there is no other online sportsbook quite like Bet365.

The design and styling look a bit dated by modern standards, but the website functions quickly and is feature-rich.

Bet365 Sportsbook is designed with the hardcore bettor in mind, who prefers responsive software and low-VIG wagers over fancy design and an abundance of promotions.

Bet365 Sportsbook Screenshots

Bet365 Betting Lines and Pricing

Like most sports betting apps, Bet365 offers -110 lines or their equivalent on major market totals and spreads.

Bet365 moneyline pricing varies by sport.

For NHL games and college sports, it’s middle of the road, but for the NBA, the VIG is noticeably lower compared to most of the competition.

Bet365 pregame lines on tennis, soccer, and some smaller markets are often exceptional.

Bet365 offers roughly -115 lines on pre-game props, which is in line with industry standards.

Bet365 futures pricing is also around average, maybe slightly above, but Bet365 does tend to take stronger opinions on futures than most. Savvy bettors should be able to find occasional value.

Bet365 prides itself on its in-play betting format. This confidence is reflected in Bet365’s in-play pricing, which is exceptional. It was difficult to find an instance where Bet365 didn’t offer the best in-play lines on international and niche markets.

The competition is a bit more rigid within major U.S. markets like football and basketball, but Bet365 still holds its own.

Overall, Bet365 offers better-than-average value nearly across the board and should be included in any bettor’s line shopping rotation, especially those who prefer in-play wagering.

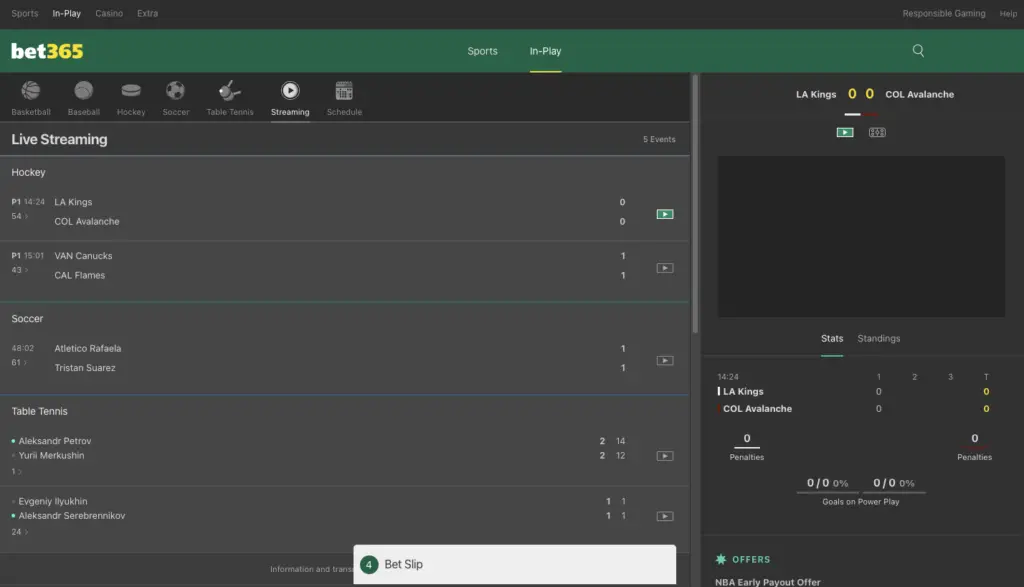

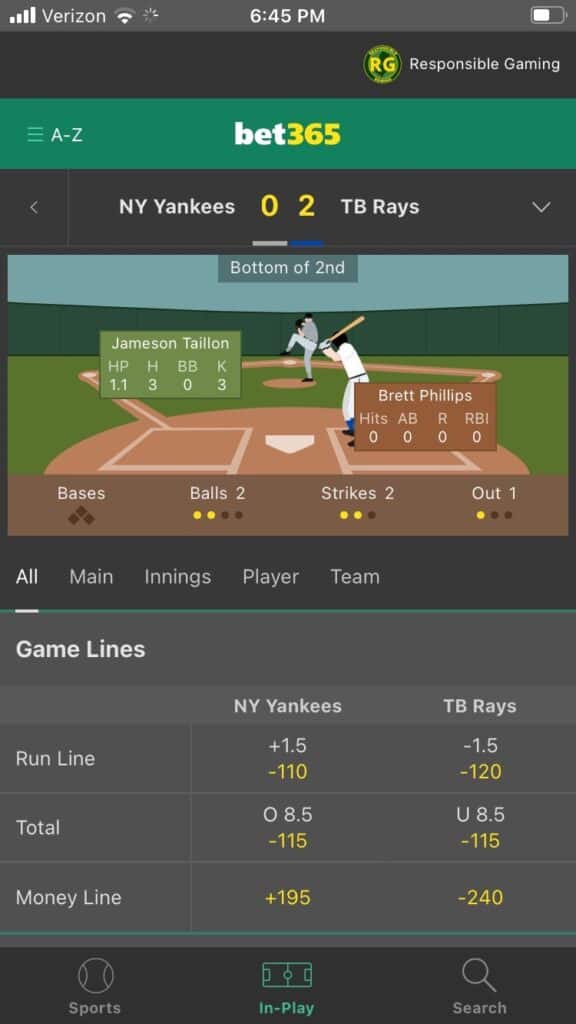

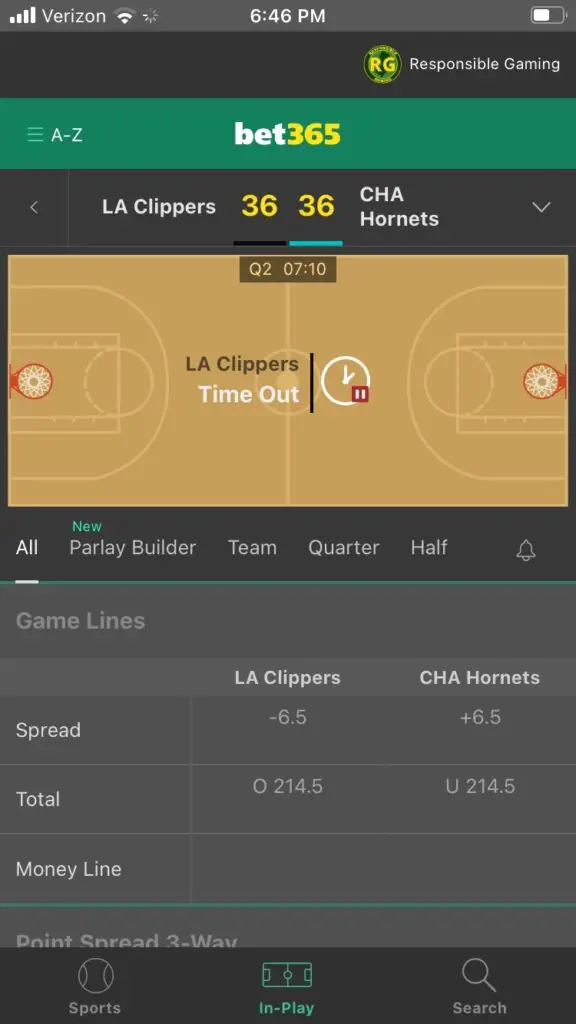

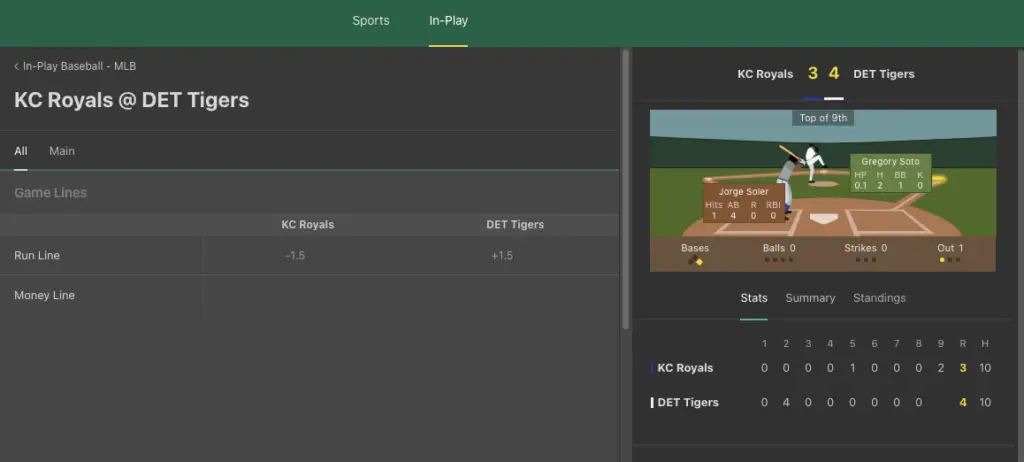

Bet365 In-Play Betting

In-play betting forms the core of Bet365’s business model, perhaps more so than almost any other online betting operator. In the past, Bet365 has stated in-play betting accounts for up to 80% of its sports betting revenues.

Bet365 did not invent in-play betting, but it was an early adopter. The Bet365 app was the first to launch in-play betting for mobile users, long before mobile betting became as popular as it is today.

Today, the bet365.com live betting menu is extensive.

Customers can find dozens of live betting events on weekdays and hundreds on the weekends. In-play betting coverage includes all major U.S. sports, some minor leagues, a vast array of international events, and some niche sports.

On average, Bet365 features more live betting options than most online sportsbooks, although the gap is closing.

Bettors can see which events are available for live betting by logging in to the Bet365 app or website and selecting the “In-Play” menu.

From there, users can view which games are live now or will be going live soon. Users can also select the “Schedule” menu item to view all scheduled in-play games for the next week.

The in-play betting interface provides live stats and animated game trackers to help users stay up to date from start to finish.

Using baseball as an example, Bet365 provides an animated catcher’s point-of-view game tracker that shows the current batter and pitcher, plus pitch speeds and placement, who’s on base, and more.

Users can also view live play-by-play feeds and each team’s standing in the league.

In addition, Bet365 live streams a decent portion of in-play events. The live streaming service is open to all customers with a non-zero account balance.

Bet365 In-Play Betting Screenshots

Bet365 Sports Betting Markets

Bet365 is known for taking wagers on sports leagues large and small from around the world. In addition, Bet365 usually accepts larger bets than other sportsbooks are willing to take.

The full Bet365 betting menu covers all the usual sports and leagues one would expect from a licensed sportsbook. Coverage includes the NFL, MLB, NBA, NHL, international soccer, rugby, tennis, mixed martial arts, and more.

The true depth of Bet365’s offerings becomes apparent when users select any particular sport to see the many leagues covered.

For example, Bet365’s baseball coverage extends far beyond the MLB to include in-play betting on Triple-A minor league games.

Similarly, its basketball coverage consists of the NBA and WNBA, plus international competitions such as the FIBA World Cup and international women’s games.

Bet365 is also one of the only sportsbooks with MMA betting that extends beyond the UFC to include other organizations, such as Bellator and Combate.

Below is a list of sports Bet365 covers throughout the year:

- Australian Rules

- Auto Racing

- Badminton

- Baseball

- Basketball

- Beach Volleyball

- Boxing

- Cricket

- Cycling

- Darts

- Esports

- Field Hockey

- Football

- Golf

- Handball

- Hockey

- Lacrosse

- MMA

- Other Sports

- Rugby League

- Rugby Union

- Snooker

- Soccer

- Softball

- Specials

- Table Tennis

- Bowling

- Tennis

- Track and Field

- Volleyball

- Water Polo

- Water Sports

- Winter Sports

The types of wagers Bet365 offers are similarly diverse:

- Moneylines, point spreads, and totals

- In-play betting

- Futures

- Team props, player props, and game props

- Parlays, round robins, teasers, banker bets, Yankee bets

- Same game parlays

- If bets, reverse if bets

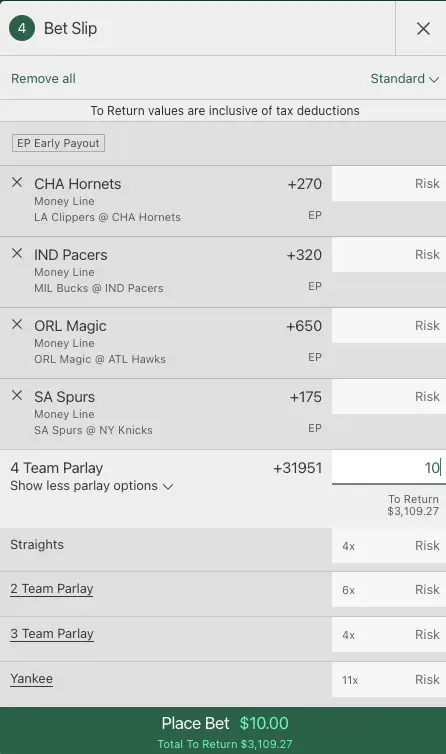

Bet365 is particularly strong in parlay wagers, with customizable standard parlays plus round robins, teasers, banker bets, and more.

Users can create custom parlays by adding two or more selections to the betting slip and tapping “more parlay options” to view the many options and parlay types available for those selections.

Bet365 Same Game Parlays

Bet365 supports a surprisingly robust same game parlay format, that’s at least on par, and in several key areas, better than what SGP pioneer FanDuel provides.

Bet365 same game parlays span a wide variety of sports, including basketball (both NBA and NCAAB), tennis, soccer, and others, depending on the season. Bet365 also allows bettors to combine selections from a single game with non-SGP selections.

For instance, NBA bettors can place multiple wagers from the Golden State Warriors vs. Memphis Grizzles game with a moneyline bet on the Toronto Raptors vs. New York Knicks game. The possibilities are expansive.

Bet365 permits up to 12 selections on SGP tickets and displays the odds of each individual leg of the SGP, which is information many other sportsbooks fail to provide.

\Bet365 also supports impressive SGP betting menus and isn’t afraid to post SGP lines earlier than most books.

Additionally, Bet365 supports same game parlay + wagers, which combine SGPs from multiple games into singular parlays with even higher payouts.

Bettors can either build SGP+ wagers manually by adding multiple SGPs to the betting slip one at a time or use Bet365’s SGP+ builder, which displays popular betting markets from two or more games so bettors can build SGP+ bets quickly.

The downside is that even though Bet365’s SGP lines are slightly above average, SGPs are high house hold wagers that can really cripple a player who goes on a bad run. Play single game parlays with caution.

Bet365 Live Streaming Video

Bet365 provides live streams for multiple sports and events daily.

Most major North American sports leagues are still missing, but Bet365 often broadcasts international events on its website and the mobile app.

Some of the sports for which Bet365 provides live video include NHL games, tennis matches, soccer games, table tennis matches, select WNBA games, and beach volleyball. Bet365 comes up a little short on its coverage of the major US sports outside of hockey, but its international coverage is comprehensive.

Users can watch live streams for no additional charge if they have a funded account or have placed a bet within the last 24 hours.

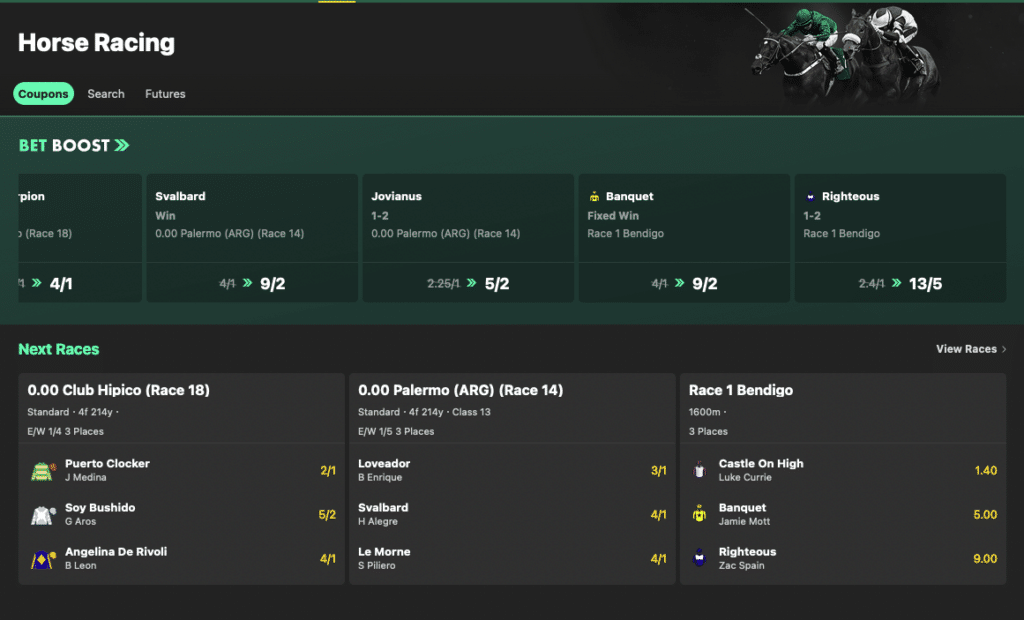

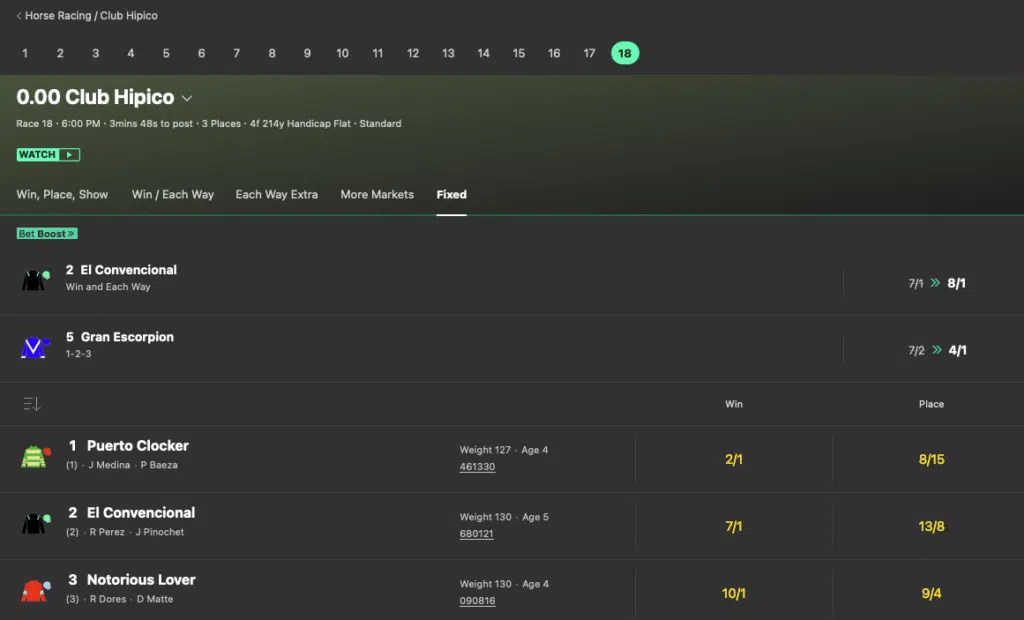

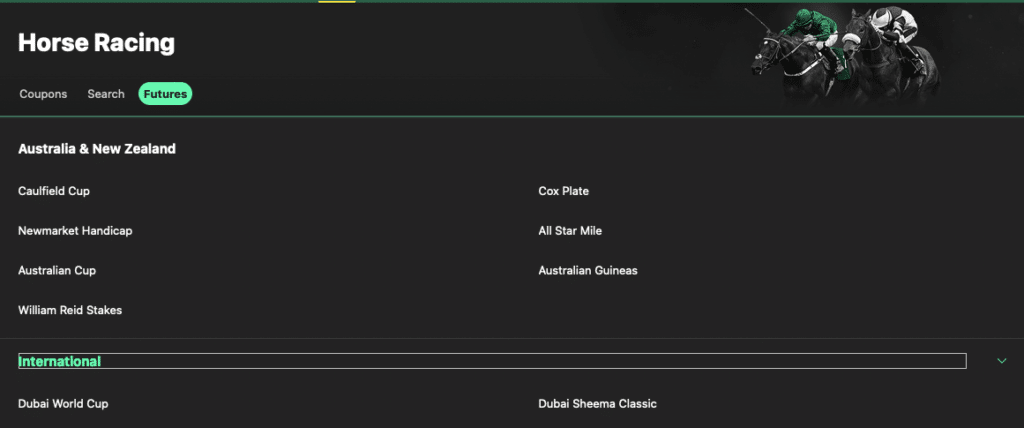

Bet365 Horse Racing Betting

Bet365 offers fixed-odds horse racing betting in Colorado and will soon expand that capability to New Jersey.

Notably, Bet365 offers horse racing and sports betting in a single app with one account.

In other states, fans must open accounts, verify their identities, and deposit funds with at least two separate betting sites to bet on horse races and sports.

The Bet365 horse racing & sportsbook app eliminates the trouble by offering customers both forms of wagering through a single account and a shared wallet.

The advantage of Bet365’s fixed-odds horse betting markets is that bettors lock in their odds when confirming their wagers. That’s in contrast to pari-mutuel wagering, in which bettors don/t know what the actual payout odds will be until the race gets underway.

Other positives include coverage of more than 140 tracks worldwide, free live-streaming video of any race where customers have wagered at least a dollar, a wide variety of bet types, and numerous horse racing bet boosts each day.

The biggest downside is Bet365’s track coverage consists primarily of international race tracks.

Bet365 reps have stated they’re working on deals with additional US tracks, but they haven’t revealed which tracks or when bettors can expect to see them on the app.

As a result, Bet365 doesn’t yet offer fixed-odds wagering on key US horse racing events like the Kentucky Derby and Belmont Stakes.

Bet365 Responsible Gambling Policies

Out of the many online sportsbooks BettingUSA has reviewed, Bet365 has displayed the most consistent and dedicated approach to responsible gambling.

Licensed US betting sites generally score well in the responsible gambling department because their licenses depend on it, but Bet365 goes further than its competitors.

Like most online sportsbooks, Bet365 offers various responsible gambling tools that allow customers to manage their spending. Bettors can log in to their accounts to set the following limits:

- Deposit Limits: Limit the amount of money you can deposit into your account during any single day, week, or month.

- Spending Limits: Limit the amount of money you can wager during any single day, week, or month.

- Session Limits: Limit the amount of time you can spend logged in to your account during any single day.

- Single Wager Limits: Limit the maximum amount you may bet on any single wager.

Once a customer sets a limit, it remains active indefinitely, and there is no way to rescind it until the current period has expired. Bettors may increase their limits at the end of a time period, but Bet365 enforces a mandatory 24-hour cooldown period between receiving the request and acting on it.

Bet365 customers who want to take a break from all gambling may also request time-out periods or outright self-exclusion:

- Time-Out Period: Disable all wagering on your account for 72 hours, 7 days, or 30 days. You can still log in and withdraw, but you may not place wagers or reactivate your account until the end of the selected period.

- Self-Exclusion: Disable all wagering on your account for 6 months, 1 year, 2 years, 5 years, or indefinitely. You can still log in and withdraw, but you may not place wagers or reactivate your account for any reason during the self-exclusion period. Bet365 will also remove you from its marketing database.

Bet365 also offers several tools customers can use to track, summarize, and visualize their activity:

- My Activity: Log in, open the account menu, and select “My Activity” for a dashboard and visual representation of your recent wagers and statistics over the past week, month, or year

- Online Account History: Open the account menu to view a complete history of your transactions, deposits, and withdrawals.

- Win/Loss History: See how much you’ve won relative to how much you’ve risked.

Bet365 pairs all of the above with a responsible gambling knowledge base that provides additional tools, tips, and questionnaires to assist customers with keeping their betting under control. Customers can also find local problem gambling resources and helplines in Bet365’s state-specific responsible gambling guides:

- Arizona: https://responsiblegaming.az.bet365.com/

- Colorado: https://responsiblegaming.co.bet365.com/

- Indiana: https://responsiblegaming.in.bet365.com/

- Iowa: https://responsiblegaming.ia.bet365.com/

- Kentucky: https://responsiblegaming.ky.bet365.com/

- Louisiana: https://responsiblegaming.la.bet365.com/

- New Jersey: https://responsiblegaming.nj.bet365.com/

- North Carolina: https://responsiblegaming.nc.bet365.com/

- Ohio: https://responsiblegaming.oh.bet365.com/

- Virginia: https://responsiblegaming.va.bet365.com/

Most legal betting sites offer self-limit tools and self-exclusion, but the detailed activity logs and state-specific problem gambling resources are standout features.

Additionally, Bet365 is more likely than most online sportsbooks to check in with anyone who may be displaying signs of problem gambling.

If there is one complaint, it’s that Bet365 may be too aggressive with responsible gambling checks. Even the slightest indication that a customer is gambling irresponsibly triggers an account suspension, which they must resolve over the phone.

That said, an overly cautious approach to problem gambling is certainly better than too little.

If the worst complaint one has regarding an online sportsbook’s responsible gambling policies is being too cautious, that’s a significant compliment in an industry where genuine regard for gamblers’ well-being is rarer than we’d like to see.

Bet365 Sportsbook FAQ

Bet365.com History

Bet365.com originates from Stoke-on-Trent in the UK and built an international business from its original center of operations. The Bet365 story dates to a chain of betting shops established in 1974 by Peter Coates. His daughter, Denise Coates, purchased the domain name bet365.com in 2000 and took the company online.

Bet365 Sports grew quickly from there. Today, bet365.com boasts 35 million customers from around the world and employs more than 3,500 people.

Bet365 has an interesting history for those interested in entrepreneurship. Unlike most sportsbooks whose histories are so convoluted with mergers and acquisitions that it’s hard to tell where one ends and the next begins, Bet365’s story is straightforward.

The international sports betting behemoth now known as bet365.com began as a chain of UK betting shops started by Peter Coates in 1974. He brought his daughter, Denise Coates, into the family business to work as a cashier at a young age. She later moved into the accounting side of the business and gained new skills that would serve her well later.

Eventually, her father gave her a small chain of underperforming betting shops to manage on her own while still in high school. She put everything she had learned to use and turned things around at the struggling betting outlets.

Denise took a risk in 2000 when she convinced her family to take out a large loan on the business to fund an expansion into online sports betting. Thus, bet365.com was born and headquartered in a Portakabin in a parking lot.

Bet365 was launched to the public in 2001 under the leadership of Denise Coates and quickly became a successful operation. The Coates family sold their brick-and-mortar sportsbooks to Coral for £40 million in 2005 and immediately paid off the loan initially obtained to start bet365.com. From that point on, it was uphill all the way for Bet365.

Bet365 came to the USA in August 2019 and has expanded rapidly since then. Today, Bet365 is one of the largest online betting operators in the world and remains privately owned.

Expert Opinion: Is Bet365 Legit?

Bet365 is not very well known in the U.S., but it is a powerhouse on the international scene and one of the UK’s largest private employers. Here in the USA, customers can rest assured they will receive fair treatment and prompt payouts when betting with Bet365.

The Bet365 app is lightweight and easy to use, but it lacks some of the flashy aesthetics and promotions other online sportsbooks provide.

However, its welcome bonus features exceptionally customer-friendly terms, making Bet365 worth a look for anyone building a bankroll. Bet365 is a legit sportsbook in our opinion, evidenced by experience with them going back two decades.