Is Indiana Considering Legalizing Online Casinos?

Don’t look now, but Indiana is suddenly a serious contender to become a legal online casino state. Indiana State Senator Jon Ford and the state legislature plans to take a “hard look” at online casino gambling in 2021.

That’s good news, as Indiana is a terrific candidate for legal online gambling (a state I have watched since 2014). Legalization would be a win for its residents looking for legal online gambling options, as well as the state and its existing gambling operators.

Potential Benefits of Indiana Online Casinos

Indiana online casinos can help the Hoosier State on multiple economic fronts. This aid is critical as the state attempts to recover from the economic damage wrought by COVID-19.

First, it will provide an immediate influx of cash to the state coffers through upfront licensing fees, followed by a steady stream of revenue in the form of gaming taxes.

Second, it provides existing gaming operators with a new, additive revenue channel and a way to future-proof their current business.

Third, online casino is synergistic with online sports betting. New Jersey offers a great example of how the sum of sports betting and online casino is greater than the parts. As the chart below shows, despite being nearly five years old, New Jersey’s online casino industry experienced a surge with the launch of online sports betting.

And finally, legal, state-regulated online gambling provides consumer protections, responsible gaming safeguards, and a much-needed alternative to offshore, black market sites.

The Indiana Online Casino Opportunity

The research firm Eilers & Krejcik Gaming recently estimated Indiana’s online casino opportunity at $358 million annually when fully matured.

The amount of gaming revenue flowing into the state’s coffers depends on how aggressively the legislature taxes the industry, and what type of upfront licensing fee it chooses to impose.

For comparison, sports betting licenses in Indiana cost $100,000 and has a 9.5% tax rate. However, that rate was determined pre-COVID and unlikely to be replicated in an online casino bill.

An Indiana online casino bill mirroring sports betting wouldn’t be much of an opportunity, netting the state about $1.3 million upfront and annual tax revenue of about $35 million.

Further, it will take quite a while for revenue to start rolling in, unless the state imposes hefty upfront licensing fees, as was the case in Pennsylvania, which charged operators $10 million for an online gambling license. The reason being, unlike Indiana’s sports betting industry, online casinos won’t launch a month after the passage of a law.

New Jersey’s online casino industry still holds the record, as it managed to go from legalization to launch in just nine months. Every other state has taken far longer, and even 12 months is seen as an accelerated timeline.

That dynamic is likely to skew Indiana towards a higher initial licensing fee and a low to moderate tax rate.

Option 1: High Licensing Fee and Moderate Tax

If each of Indiana’s 13 casino operators applied for a $5 million online casino license, the state would see a quick influx of $65 million. But that licensing burden would only be feasible if accompanied by a moderate tax rate, no more than 20%, resulting in roughly $70 million annually to the state.

Option 2: High Licensing Fee That Goes Towards Future Taxes Owed

Another option is an even heftier licensing fee, perhaps $10 million, with the stipulation that the payment would go towards future taxes owed. That would cause a further delay in ongoing tax collection but would provide more money in advance. Further, the state could impose a higher tax rate, perhaps instituting a tiered structure like its land-based casino industry.

That model would provide the state with a quick influx of $130 million, but little money during the first two years (12 months to set-up and another 12-months of pre-paid taxes). However, at maturity, the state could collect upwards of $100 million annually if the typical tax rate is around 30%.

The state could also opt to cap the amount of money an operator could use towards future taxes at $5 million and adjust the tax rate accordingly.

Bolstering the State’s Retail Casinos

Indiana has a robust retail casino industry, but the market hasn’t been immune to the pinch from the competition in neighboring states.

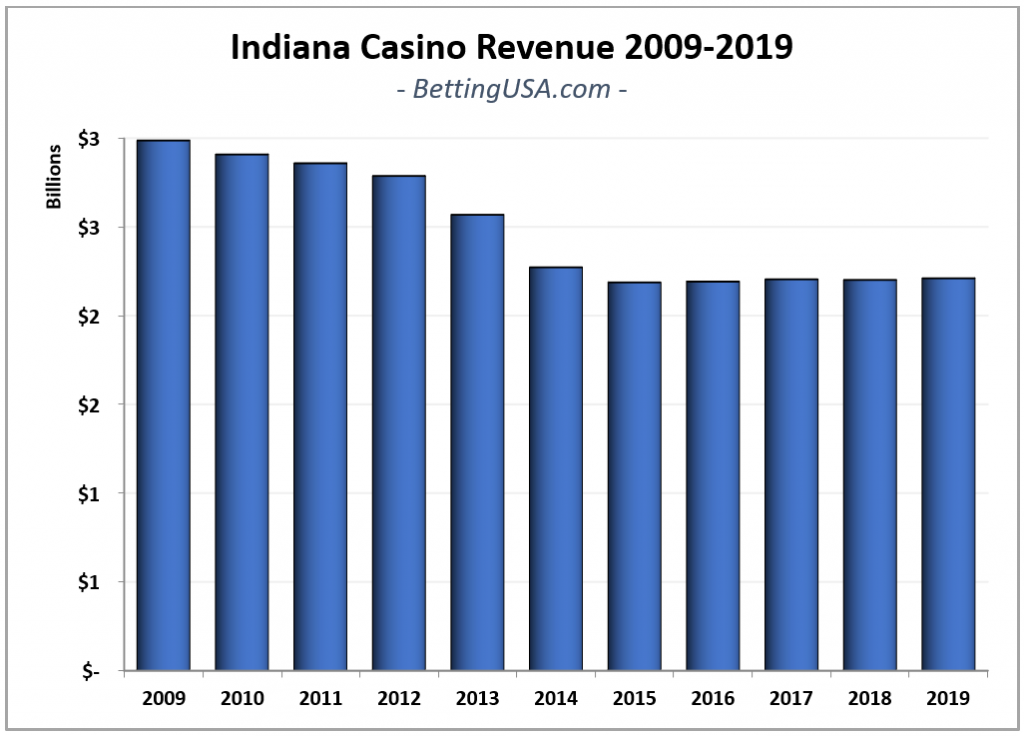

Indiana is one of the older gaming jurisdictions in the US, dating back to 1993. Gaming revenue peaked in the state in 2009 at $2.8 billion, but by 2015, Indiana casino revenue fell to $2.2 billion, and it has remained there ever since.

Because of COVID-19, the 2020 numbers will be far worse.

The legalization of online casinos in Indiana can help future-proof the state’s retail casinos with a proven product that brings in new, younger customers without cannibalizing existing gaming.

In an interview with Yaniv Sherman, head of commercial development at 888, told Betting USA what every US online gambling operator has intimated, Online gambling provides incremental revenue.

Indiana Is Already an Online Gambling State

As noted above, Indiana already has experience with online gambling. The state legalized retail and online sports betting on September 1, 2019. The state’s first sportsbooks launched soon after that, beginning with BetRivers and DraftKings on October 3. And so far, so good. Despite COVID-19 upending the summer sports schedule, Indiana’s experience with legal online sports betting has been a rousing success (more on this in a moment).

Its experience with online sports betting helps Indiana’s chances to add online casinos to the mix, as lawmakers and regulators are already comfortable with the notion of online gambling delivery channels and how they work.

Similar paths played out in West Virginia, where online sports betting led to online casino and online poker. And also in Michigan, where online lottery led to the legalization of online sports betting, casino, and poker.

Can Indiana Replicate its Sports Betting Success?

When operators talk about online gambling opportunities in the US, they often point to New Jersey, Pennsylvania, New York, California, Florida, and Illinois. But opportunities can quickly disappear due to legislative inaction, and at the end of the day, they’re only as good as the structure of the market.

Indiana is an excellent example of a state that saw an opportunity and ran with it. Indiana is a seemingly innocuous state that has turned into a sports betting success story, as it trails only New Jersey and Pennsylvania in terms of betting handle per resident.

Betting handle per resident in key states, July 2020:

- New Jersey = $35.48

- Pennsylvania = $12.87

- Indiana = $10.58

- West Virginia = $8.85

- Delaware = $8.14

- Iowa = $7.25

- Mississippi = $2.66

- Rhode Island = $1.92

Here’s how Indiana pulled it off, and how it can replicate it by legalizing online casino games in Indiana.

Indiana’s Existing and Created Advantages

The Indiana gambling market has several built-in advantages:

- An in-state population of 6.7 million (ranked 17th in the US)

- Access to out-of-state population bases (the border cities of Chicago, Cincinnati, and Louisville have a combined population of 3.6 million)

- Strong in-state and out-of-state sports fanbases

- A thriving, multi-faceted gaming industry

Further, unlike other states, the legislature didn’t saddle the industry with unnecessary restrictions.

As such, Indiana:

- Is an open, competitive market with reasonable operator burdens (licensing and taxation)

- Offers retail and online betting with minimal restrictions

- Uses a nimble regulatory approach that allows regulators to approve a wide range of betting options.

The combination of these elements has allowed Indiana to punch well above its weight. Expect similar results if the state takes a similar approach to legalizing online casinos.