Cracking The Code: European Brands Struggling In The US Sports Betting Market

European sportsbooks and online gambling operators have the experience and proven technology to make a big splash in the US. But to date, those advantages haven’t translated into success in the market.

The missing piece of the puzzle is branding.

Well-known European betting sites like William Hill, Ladbrokes, Paddy Power, UniBet, 888, and Bet365 don’t resonate with US customers. And they certainly don’t identify these companies with gambling.

Furthermore, the country’s long history of online gambling and sports betting prohibitions has created a customer base with healthy doses of confusion, ignorance, and apathy. When they’re unfamiliar with the brand, the bulk of US online bettors and would-be bettors have difficulty separating legal, licensed operators from illegal offshore operators with similar-sounding names.

European Operators Have Made Inroads

European operators have had success working with US brands. European operators power most online gambling sites and sportsbooks in the US. It’s as a standalone product that they’ve struggled.

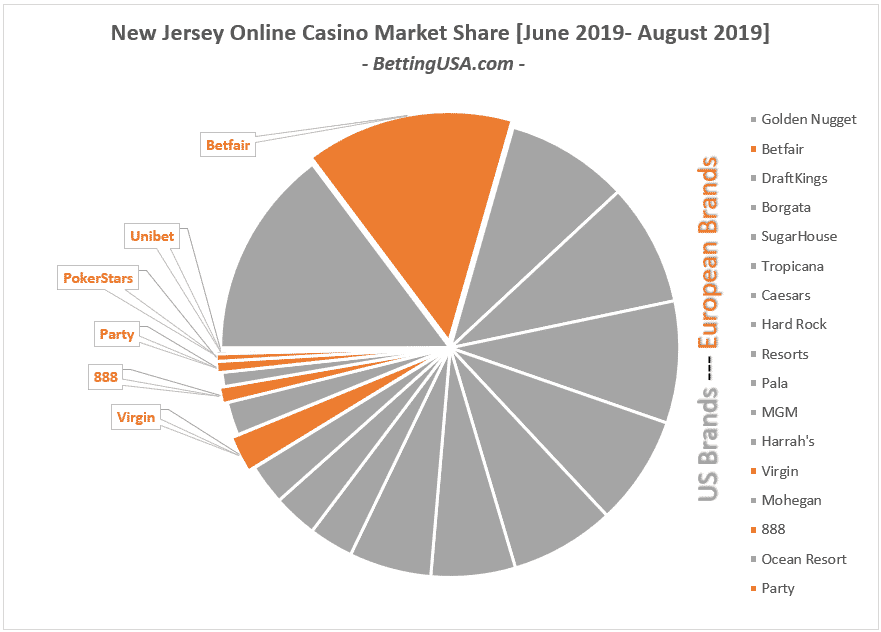

As the chart below shows (the data comes from the August 2019 Eilers & Krejcik Gaming’s US Online Casino Tracker), 11 of the top 12 brands are US-based brands.

Even though Party, 888, and Virgin Casino have been up and running in New Jersey for more than five years, only Betfair has managed to make any inroads.

And while Betfair has always been a positive outlier, its current ranking, as the second strongest brand in the market behind Golden Nugget, is largely due to its association with the FanDuel sportsbook. Without FanDuel, Betfair would be ranked somewhere in the 5-10 range.

It’s Unlikely Someone Can Replicate Betfair’s Success

What did Betfair do differently than other European online betting companies?

The first difference between Betfair and its peers was an aggressive pre-launch approach. Betfair was among the first online gambling sites to use billboards and commercial advertising in New Jersey.

Second, it didn’t hurt that Betfair’s first partner in the market, Trump Plaza, didn’t launch a branded online casino site. So, while other operators were marketing their branded online casinos to their land-based customers (with the scraps left for their European sub-brands), Betfair had full run of the Trump Plaza’s database of players.

Third, Betfair had quite a bit of experience in US markets, including New Jersey, thanks to its ADW horseracing products.

That convergence of events is unlikely to present itself again. And that leaves European online gambling operators eyeing the US with a difficult hill to climb.

What About the DFS Domination?

The success of FanDuel and DraftKings is easy to explain.

The DFS giants were de facto online gambling operators in the US for several years and in the process, built huge databases of customers.

Additionally, both companies became synonymous with wagering money on sporting events. Massive marketing campaigns and a scandal that turned out to be a blessing in disguise made FanDuel and DraftKings household names.

Should European Operators Settle for Silent Partnerships?

The partnerships between international online betting operators and suppliers is one of necessity. Most states require online gaming licenses run through land-based casino properties. And even in cases where multiple brands can operate under the same license, the land-based casino brand is the most prominent.

Fighting against an established local brand in a statewide market is folly. That is particularly true when that brand is offering an identical product (in a different wrapper) and controls land-based database access and on-property advertising.

One option European operators have is to limit their involvement and let the local casino or gaming brand be the forward-facing site. That will be a tough pill to swallow, but the uniqueness of the US markets, where operating licenses are tied to land-based gaming, might require some of the big European operators to take their medicine.

The Co-Brand

Another option is the William Hill method. William Hill has several sportsbooks with names like Monmouth Park Sportsbook by William Hill, and the William Hill Sportsbook at Tropicana AC.

Rather than trying to force-feed Americans their brand, the shared brand strategy allows William Hill time to build trust with the US customer and organically grow its brand in the US.

That seems like a good long-term strategy.

Going it Alone

The third option, force-feeding an unknown brand to a US audience, is the riskiest, but also presents the highest reward.

Here’s what it will take for this strategy to have any chance of success:

- An Easily Understandable Brand

- A willingness to spend ridiculous amounts of money on advertising

- A top-tier product

- A partnership strategy that focuses on smaller casino brands

I’ll touch on these points below, but bear in mind that each one could be a column on its own.

What’s in a Name

When you’re marketing your product to a new audience, it helps to have a brand name that is easily identifiable to the product. For instance, bet365 or Unibet will make a lot more sense to the US audience than Paddy Power or Ladbrokes.

Deep Pockets

If DraftKings and FanDuel taught us anything, it’s that spending money like it’s going out of style is a great way to build a brand. Of course, not every company (particularly the publicly traded ones) has an appetite for that type of spending.

Start with a Good Product

It should go without saying that if you want to make inroads in an industry, you need to be doing something different or better than your competitors. In online gambling you don’t have to be the best, but you do need to be a top-tier platform.

Finding the Right Dance Partner

The final piece of the puzzle is understanding the markets you’re entering. Partnering with a national casino operator is great for market access, but if your goal is to promote your brand, companies may want to target smaller, independent casinos; casinos that are willing to take a back seat when it comes to their online brand.

Is Anyone Doing These Things?

A good example of putting all of these things together is PointsBet. The Australian company has made some inroads in New Jersey and it ticks off most of the above boxes.

- It has an easily identifiable brand name.

- It isn’t spending like a drunken sailor, but PointsBet is being creative with its Good Karma Payouts marketing.

- It has a good product that has unique features.

- PointsBet has a couple of big partners in Meadowlands and Penn National, but it also has partnerships with smaller casinos in Iowa, Colorado, and a racetrack in Illinois.