Report Highlights Payment Processing Role For US Sports Bettors

A recent report published by Paysafe detailing the online sports betting industry within the United States has found that the industry grew nationally through 2020, with the report concluding even more growth in 2021.

That growth came despite numerous months of canceled games due to COVID-19, in part from markets like Michigan and Colorado joining the list of states with regulated online sports betting. However, states that had already launched sports betting industries also saw an increase in revenue.

Even with projected growth and a world of opportunity ahead, the US online sports betting industry faces plenty of challenges gaining new customers and even more when it comes to safely, securely, and quickly processing deposits and withdrawals.

The report was broken down into two parts, first discussing the landscape of US online sports betting in 2021 and then following it up with the role that sports betting payment processing plays across the industry. Information was based on a study of 2,000 sports bettors across eight states nationwide.

Here are some of the highlights.

2021: Online Sports Betting in the USA

Online sports betting revenue grew in 2020, even with several down months due to COVID-19. While it’s apparent COVID-19 isn’t completely going away anytime soon, it’s also not going to play as big of a role as it did last year.

We’ve collectively moved a lot of our lives online over the past year, and this trend looks to continue. It also bodes well for action, wagers, and revenue moving into 2021.

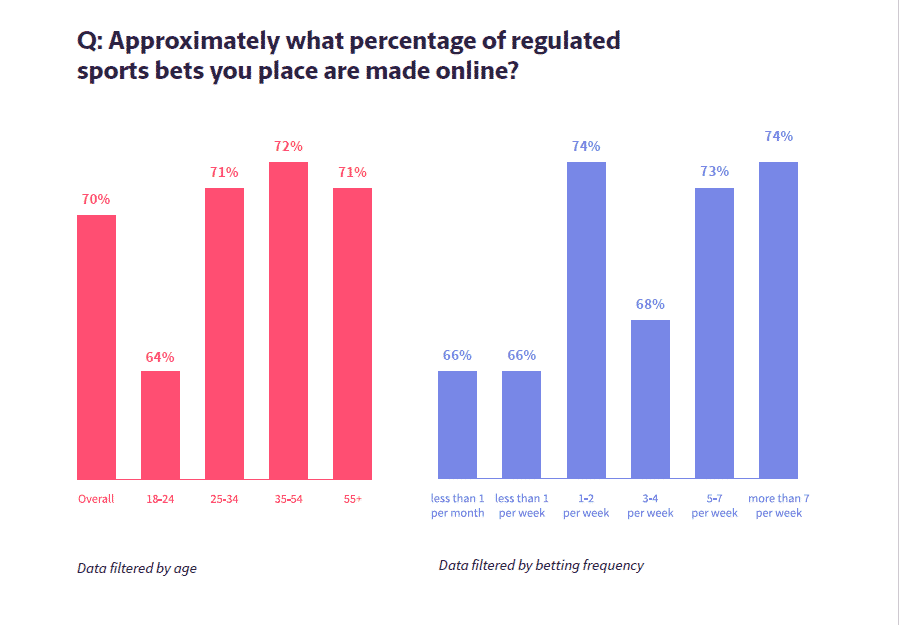

According to the study, players are currently placing 70% of their bets online, and that number could keep growing, as 61% of players in the survey stated that they are planning to bet online “much more frequently” in 2021. Furthermore, this applied for bettors of all frequencies, ranging from those who only bet once or twice a year up to those who make bets on a daily basis.

Higher volume players are also more likely to place more of their bets online. Those who bet less than once per week deposited $238 per month on average, a number more than quadrupled by players who made more than seven bets a week ($1,107).

High-volume bettors also deposit 4.6x per month more on average. They are also more likely to bet across multiple sportsbooks, making the role of payments even more important for them than the rest of the population, where it is already of tremendous significance.

The Role of Payments

Sports betting payment processing breaks down into two segments: deposits and withdrawals. Of course, anyone wishing to place bets online must deposit first, and if they are lucky enough to win, only then will they have the chance to cash out.

An Increase in Declined Sportsbook Deposits

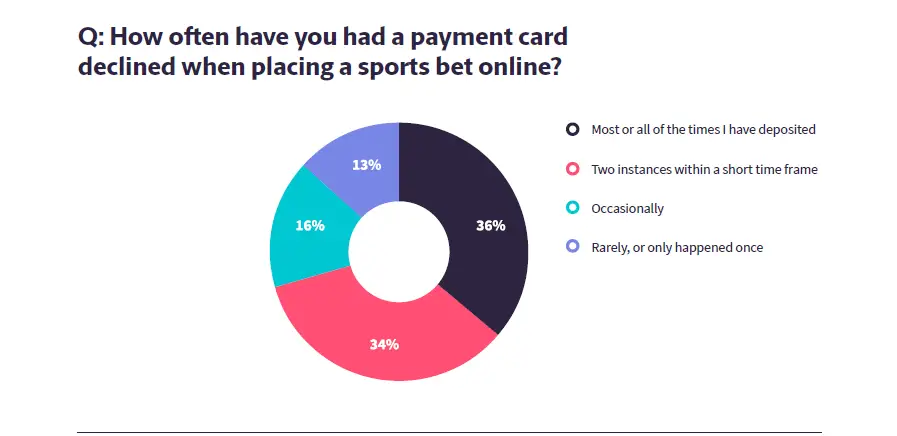

The number one issue regarding deposits at online sportsbooks is a high rate of declined bank cards. More concerning, the rate is on the rise. In 2018, 10% of players experienced consistent declines; that number has risen to 14% as of December 2020, with 40% of all players saying they have experienced a card being declined at some point in their sports betting career.

The outlook isn’t rosy, as Betting USA reported in December:

According to Jerry Rau, E&K’s Managing Director of Electronic Money Movement, beginning on January 1, 2021, Visa will treat certain payment processors and general-purpose reloadable cards as if they were online gaming operators. That change effectively prohibits online gamblers from funding these alternative payment methods with their Visa cards. According to Rau, the change could have a material impact on online gross gaming revenue.

Failed sportsbook deposits have implications, hurting the sportsbook’s long-term reputation and its relationship with the bettor. Nearly half of the players surveyed placed the blame on the sportsbook for a card decline. Many others have changed preferred sportsbooks and even found themselves dissuaded from betting more online as a whole due to declined transactions. In total, only 13% of players were largely unaffected by this issue.

There are other options for depositing in many cases, including E-wallets such as Skrill or NETELLER. These are the most popular among high-volume players as they allow for the easiest way to move funds across sites. Many others favor prepaid eCash cards as the most secure way to place bets online.

Sportsbook Withdrawal Speed Frustrates Players

Regarding withdrawals at online sportsbooks, the number one factor for choosing a sportsbook was the speed and efficiency of payouts. That was more important for players than any promotional offers or odds they received, and it even ranked higher than overall brand trust.

Faster sports betting payouts are always better, and a staggering two-thirds of players believe they should receive withdrawals within 24 hours. Nearly half of those players believe that payment should be instantaneous, and on the converse, only a meager 8% of players were comfortable waiting more than three days for their money.

Lastly, security is of concern. Many players still feel cash is king, but trust for online deposits is growing organically, which also bodes well for the industry. There is also no clear-cut leading online sportsbook, and a large amount of the existing sports betting population has no loyalty to one brand over another.

All of this leaves a playing field ripe with opportunity, both in existing markets and with existing customers along with new, prospective ones. At the end of the day, whichever companies can adapt best and meet their customers’ needs will be the ones to see the most success.