Kambi Is A Clear Winner In The US Sports Betting Space

The US sports betting industry has created many rising stars, but few companies have grabbed hold of the US opportunity quite like Kambi.

The Sweden-based company is the sports betting supplier to the stars, with a Kambi sportsbook client list that includes DraftKings, BetRivers, and Penn Entertainment.

Just how important the US has been to Kambi is evident in its Annual Report.

Kambi’s US Sports Betting Expansion

Kambi is now operational in 14 US states (up from nine in 2019). According to the report, the company completed 50 online and on-property partner launches in 2020, with 11 online and 28 on-property launches in the US alone.

Kambi sportsbook operations in the US market include the following assets:

- Retail sportsbooks in New York, Arkansas, and Missippi.

- Online sportsbooks in Virginia and Tennessee.

- A mix of retail and online sportsbooks in Colorado, Indiana, Illinois, Iowa, Michigan, West Virginia, Pennsylvania, New Jersey, and New Hampshire.

Kambi’s access to these markets comes via partnerships with:

- DraftKings

- Penn National

- Rush Street Interactive

- Churchill Downs (TwinSpires)

- Kindred (Unibet)

- BetParx

- 888

- Four Winds

- Seneca

Kambi is also partnered with Mohegan Sun in Connecticut, which is on the precipice of legalizing sports betting this year.

Quarterly Revenue and Operating Margins

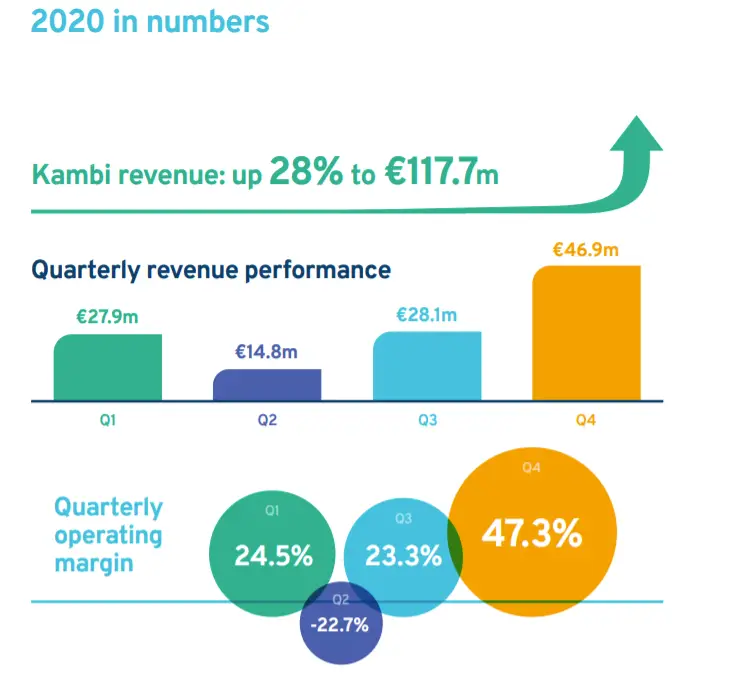

The annual report contains two very intriguing charts, showing its quarterly revenue and operating margins in 2020.

Minus the Q2 numbers (impacted by the loss of sports during the height of COVID-19 lockdowns), Kambi’s growth looks robust.

As CEO Kristian Nylén noted, “Our revenue growth in the second half of the year highlights the underlying health of the business, showing our ability to respond successfully not only to the lockdown situation, but also ensure resources were in place as major sports returned.”

Perhaps the most eye-catching part of Kambi’s financial numbers is shifting from a European-focused company to a global supplier in just two years.

In 2018, roughly 90% of Kambi’s GGR was generated in Europe. In 2020 the split was 51% Europe, 47% Americas, and 2% from the rest of the world.

As Nylén explained, the US is at the core of the company’s business strategy:

“The growth of the US market is a core driver for the business and remains a significant area of focus for commercial expansion. State-by-state regulatory efforts continue to gather pace, with increasing emphasis being placed on mobile and online in addition to on-property wagering. Our record of delivery in the US speaks for itself. We are now live in 14 states, having achieved market firsts with our partners in 10. We have a diverse group of partners with ambitious plans to capitalize on the ongoing spread of regulation, and we look forward to helping them to make the most of the opportunities this affords.”

Can New US Partners Offset the Loss of DraftKings

Kambi is the betting partner to more than 30 operators on six continents. In the US, the firm added Churchill Downs and Four Winds Casino in 2020. That’s in addition to the launch of the Barstool Sportsbook app in select states in 2020. Along with other partners, the Barstool sports betting app has launched or is expected to launch in several existing sports betting states throughout 2021.

But, there is a big loss coming, as DraftKings anticipates its migration to SBTech in September 2021 following the merger of the two companies.

The loss of the sports betting heavyweight later this year is something Kambi has planned for. As Max Meltzer, the chief commercial officer at Kambi, told Betting USA in August 2020, the loss of DraftKings is far from the be-all-end-all for the company:

“We’re very excited about the Barstool Sports launch planned for Q3. They’ve got a fantastic database, a very different database than others, and we think they’re developing interesting technology and hiring fantastic people. That’s going to be really exciting for Penn National.

“And we’re obviously delighted about Rush Street Interactive going public. They’re going to have a wealth of resources to acquire new customers, retain customers, and get market access.

“We also recently signed a deal with Four Winds in Michigan, adding another really strong tribal gaming operator following partnerships with Seneca and Mohegan Sun.

“Looking into the future, we expect to work with these multi-state and local market leaders. We’re doing very well now, but there’s plenty more to be done and a large number of markets to come.”